Here are four stocks with buy rank and strong momentum characteristics for investors to consider today, August 30th:

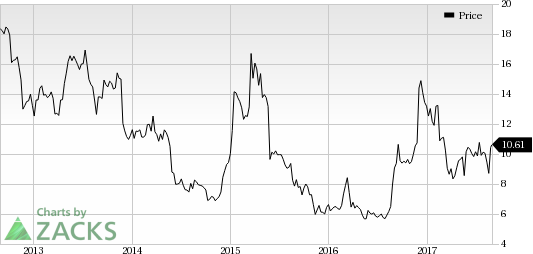

Tilly's, Inc. (TLYS): This apparel and footwear retailer has a Zacks Rank #2 (Buy) and witnessed the Zacks Consensus Estimate for its current year earnings rising 17.8% over the last 60 days.

Tilly's shares gained 4.8% over the last one month in contrast to S&P 500’s loss of 1%. The company possesses a Momentum Score of A.

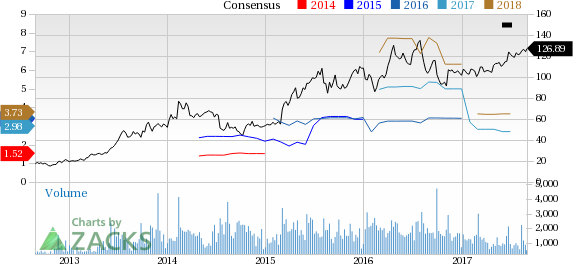

Ligand Pharmaceuticals Incorporated (LGND): This biopharmaceutical companyhas a Zacks Rank #1 (Strong Buy) and witnessed the Zacks Consensus Estimate for its current year earnings increasing 10.4% over the last 60 days.

Ligand Pharmaceuticals' shares gained 4.6% over the last one month. The company possesses a Momentum Score of A.

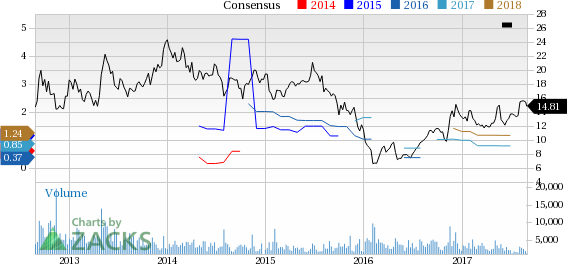

Stamps.com Inc. (STMP): This internet-based mailing solutions provider has a Zacks Rank #1 (Strong Buy) and witnessed the Zacks Consensus Estimate for its current year earnings rising 10% over the last 60 days.

Stamps.com's shares gained 28.7% over the last one month. The company possesses a Momentum Score of A.

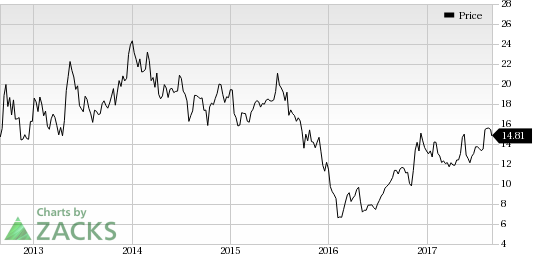

Beazer Homes USA, Inc. (BZH): This homebuilding companyas a Zacks Rank #2 (Buy) and witnessed the Zacks Consensus Estimate for its current year earnings increasing 7.6% over the last 60 days.

Beazer Homes USA' shares gained 9.8% over the last one month. The company possesses a Momentum Score of A.

See the full list of top ranked stocks here

Learn more about the Momentum score and how it is calculated here.

4 Surprising Tech Stocks to Keep an Eye on

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really take off. See Stocks Now>>

Tilly's, Inc. (TLYS): Free Stock Analysis Report

Stamps.com Inc. (STMP): Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND): Free Stock Analysis Report

Beazer Homes USA, Inc. (BZH): Free Stock Analysis Report

Original post

Zacks Investment Research