Here are four stocks with buy rank and strong income characteristics for investors to consider today, July 14th:

Ashford Hospitality Prime, Inc. (AHP): This real estate investment trusthas witnessed the Zacks Consensus Estimate for its current year earnings increasing 0.6% over the last 60 days.

This Zacks Rank #2 (Buy) company has a dividend yield of 6.24%, compared with the industry average of 4.18%. Its five-year average dividend yield is 2.64%.

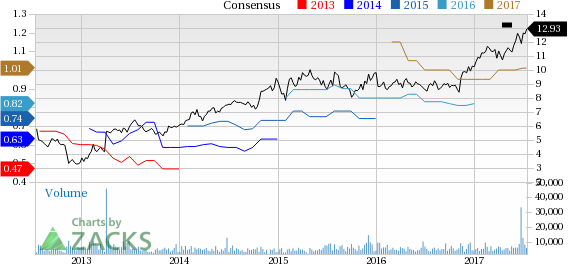

BGC Partners, Inc. (BGCP): This brokerage companyhas witnessed the Zacks Consensus Estimate for its current year earnings rising 1% over the last 60 days.

This Zacks Rank #2 (Buy) company has a dividend yield of 5.61%, compared with the industry average of 0.00%. Its five-year average dividend yield is 7.64%.

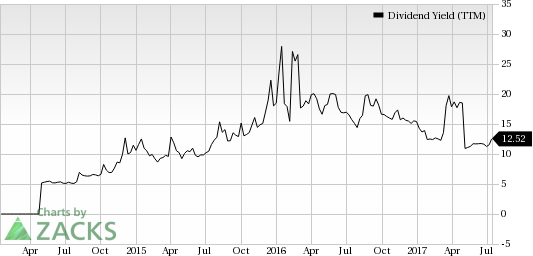

Cypress Energy Partners, L.P. (CELP): This pipeline inspection and environmental services provider has witnessed the Zacks Consensus Estimate for its current year earnings increasing 10.8% over the last 60 days.

This Zacks Rank #2 (Buy) company has a dividend yield of 11.81%, compared with the industry average of 5.26%. Its five-year average dividend yield is 12.03%.

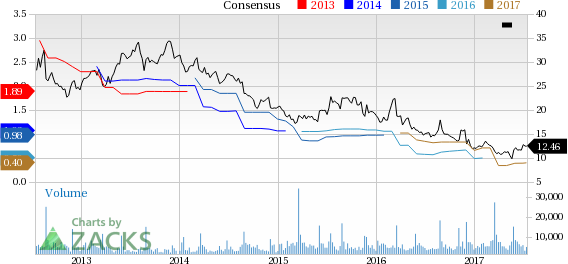

Guess', Inc. (GES): This apparel company has witnessed the Zacks Consensus Estimate for its current year earnings rising 17.6% over the last 60 days.

This Zacks Rank #1 (Strong Buy) company has a dividend yield of 7.68%, compared with the industry average of 0.00%. Its five-year average dividend yield is 4.36%.

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens.

Long-Term Buys You Won't See in the News

New Zacks Rank #1 Strong Buys are likely to be far outpace the broader market for the next 60-90 days. If you prefer investing for maximum long-term profits, you’ll want to see which stocks Zacks experts are sharing with our private members. These moves have double and triple-digit profit potential and are rarely available to the public. Starting now, you can look inside our stocks under $10, home run and value stock portfolios, plus more. Want a peek at this private information? Click here >>

Guess?, Inc. (GES): Free Stock Analysis Report

Cypress Energy Partners, L.P. (CELP): Free Stock Analysis Report

BGC Partners, Inc. (BGCP): Free Stock Analysis Report

Ashford Hospitality Prime, Inc. (AHP): Free Stock Analysis Report

Original post