Here are four stocks with buy rank and strong income characteristics for investors to consider today, February 12th:

Virtu Financial, Inc. (VIRT): This market making and liquidity services provider has witnessed the Zacks Consensus Estimate for its current year earnings increasing 1.8% over the last 60 days.

This Zacks Rank #1 (Strong Buy) company has a dividend yield of 3.68%, compared with the industry average of 0.00%. Its five-year average dividend yield is 4.3%.

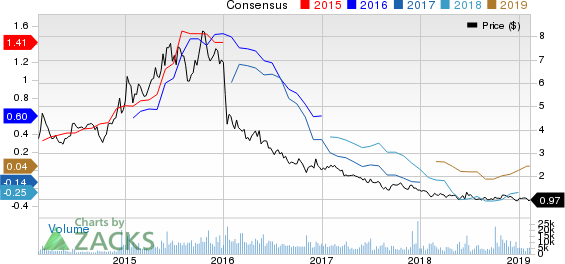

TESSCO Technologies Incorporated (TESS): This products and value chain solutions provider to support wireless systems has witnessed the Zacks Consensus Estimate for its current year earnings increasing 22.6% over the last 60 days.

This Zacks Rank #1 company has a dividend yield of 5.22%, compared with the industry average of 0.00%. Its five-year average dividend yield is 4.46%.

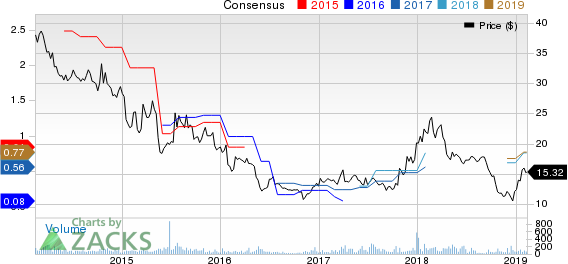

Teekay Tankers Ltd. (TNK): This marine transportation services providerwitnessed the Zacks Consensus Estimate for its current year earnings increasing 4% over the last 60 days.

This Zacks Rank #1 company has a dividend yield of 3.08%, compared with the industry average of 0.00%. Its five-year average dividend yield is 5.98%.

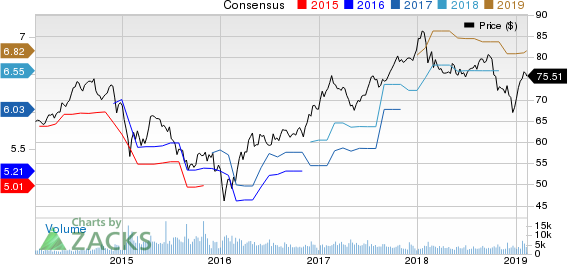

Royal Bank of Canada (RY): This diversified financial service company has witnessed the Zacks Consensus Estimate for its current year earnings increasing 0.6% over the last 60 days.

This Zacks Rank #1 company has a dividend yield of 3.81%, compared with the industry average of 3.17%. Its five-year average dividend yield is 3.9%.

See the full list of top ranked stocks here

Find more top income stocks with some of our great premium screens.

Zacks' Best Stock-Picking Strategy

It's hard to believe, even for us at Zacks. But from 2000-2018, while the market gained +4.8% per year, our top stock-picking strategy averaged +54.3% per year.

How has that screen done lately? From 2017-2018, it sextupled the market's +15.8% gain with a soaring +98.3% return.

Free – See the Stocks It Turned Up for Today >>

Virtu Financial, Inc. (VIRT): Free Stock Analysis Report

Teekay Tankers Ltd. (TNK): Get Free Report

TESSCO Technologies Incorporated (TESS): Free Stock Analysis Report

Royal Bank Of Canada (RY): Free Stock Analysis Report

Original post