Here are four stocks with buy rank and strong income characteristics for investors to consider today, December 27th:

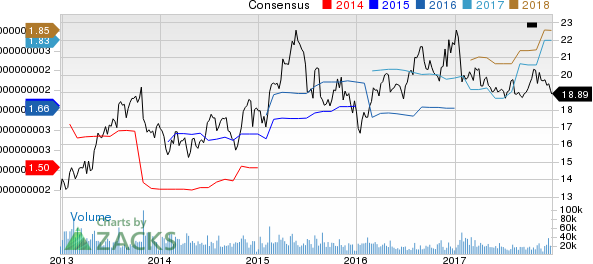

The Western Union Company (NYSE:WU) (WU): This money movement and payment services provider has witnessed the Zacks Consensus Estimate for its current year earnings advancing 5.2% over the last 60 days.

This Zacks Rank #2 (Buy) company has a dividend yield of 3.67%, compared with the industry average of 0.00%. Its five-year average dividend yield is 3.17%.

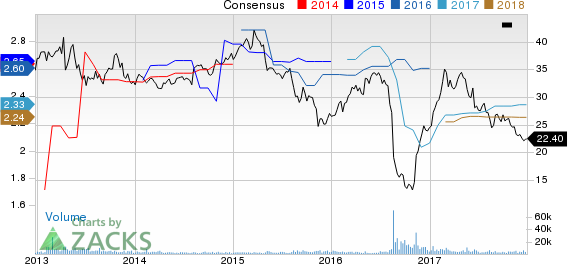

ARMOUR Residential REIT, Inc. (ARR): This REIT has witnessed the Zacks Consensus Estimate for its current year earnings increasing 1.1% over the last 60 days.

This Zacks Rank #2 (Buy) company has a dividend yield of 8.89%, compared with the industry average of 8.63%. Its five-year average dividend yield is 14.65%.

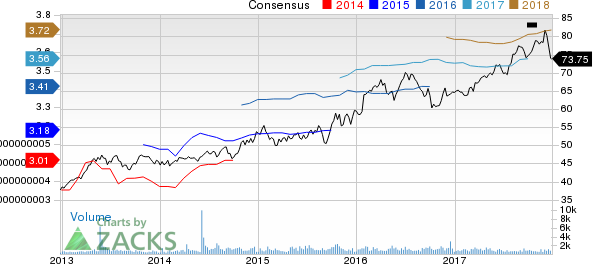

Spire Inc. (SR): This utility company has witnessed the Zacks Consensus Estimate for its current year earnings advancing 0.5% over the last 60 days.

This Zacks Rank #2 (Buy) company has a dividend yield of 3.05%, compared with the industry average of 2.77%. Its five-year average dividend yield is 3.44%.

CoreCivic, Inc. (CXW): This REIT has witnessed the Zacks Consensus Estimate for its current year earnings increasing 0.4% over the last 60 days.

This Zacks Rank #2 (Buy) company has a dividend yield of 7.51%, compared with the industry average of 3.97%. Its five-year average dividend yield is 2.80%.

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Western Union Company (The) (WU): Free Stock Analysis Report

Spire Inc. (SR): Free Stock Analysis Report

Corrections Corp. of America (CXW): Free Stock Analysis Report

ARMOUR Residential REIT, Inc. (ARR): Free Stock Analysis Report

Original post

Zacks Investment Research