Here are four stocks with buy rank and strong income characteristics for investors to consider today, December 26th:

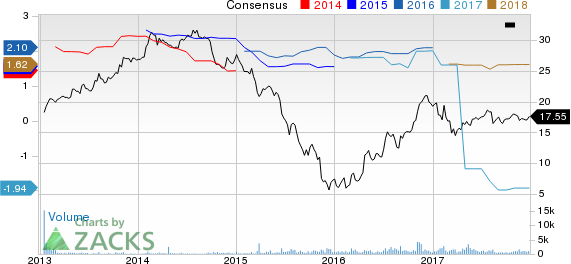

Flowers Foods, Inc. (FLO): This producer of bakery products has witnessed the Zacks Consensus Estimate for its current year earnings advancing 1.2% over the last 60 days.

This Zacks Rank #2 (Buy) company has a dividend yield of 3.46%, compared with the industry average of 0.00%. Its five-year average dividend yield is 2.74%.

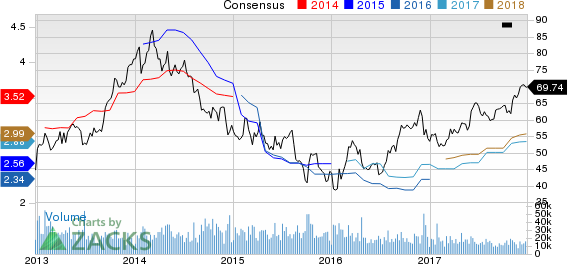

Las Vegas Sands Corp. (LVS): This operator of integrated resorts has witnessed the Zacks Consensus Estimate for its current year earnings increasing 1.1% over the last 60 days.

This Zacks Rank #2 (Buy) company has a dividend yield of 4.19%, compared with the industry average of 0.00%. Its five-year average dividend yield is 3.97%.

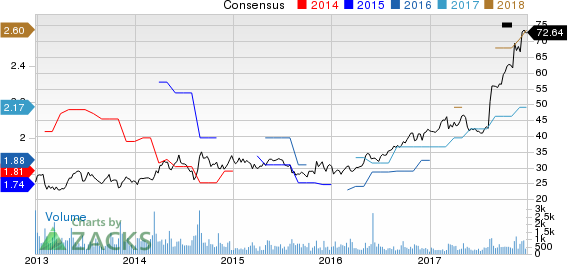

Medifast, Inc. (MED): This producer of weight loss and weight management products has witnessed the Zacks Consensus Estimate for its current year earnings advancing 2.4% over the last 60 days.

This Zacks Rank #2 (Buy) company has a dividend yield of 2.64%, compared with the industry average of 0.00%. Its five-year average dividend yield is 1.07%.

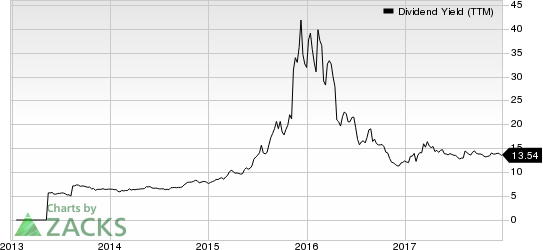

SunCoke Energy Partners, L.P. (SXCP): This master limited partnership firm has witnessed the Zacks Consensus Estimate for its current year earnings increasing 2.5% over the last 60 days.

This Zacks Rank #2 (Buy) company has a dividend yield of 13.54%, compared with the industry average of 0.00%. Its five-year average dividend yield is 12.52%.

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens.

Zacks Editor-in-Chief Goes "All In" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

SunCoke Energy Partners, L.P. (SXCP): Free Stock Analysis Report

MEDIFAST INC (MED): Free Stock Analysis Report

Las Vegas Sands Corp. (LVS): Free Stock Analysis Report

Flowers Foods, Inc. (FLO): Free Stock Analysis Report

Original post

Zacks Investment Research