Here are four stocks with buy ranks and strong growth characteristics for investors to consider today, September 11th:

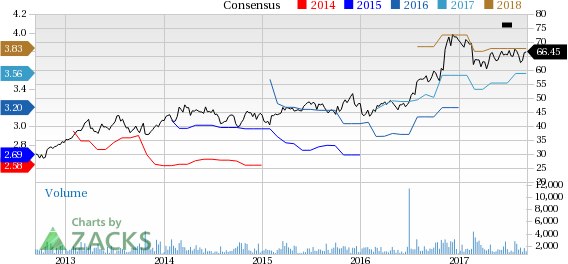

EMCOR Group, Inc. (EME): This electrical and mechanical construction services provider, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 2.9% over the last 60 days.

EMCOR Group has a PEG ratio 1.24, compared with 1.63 for the industry. The company possesses a Growth Score of A.

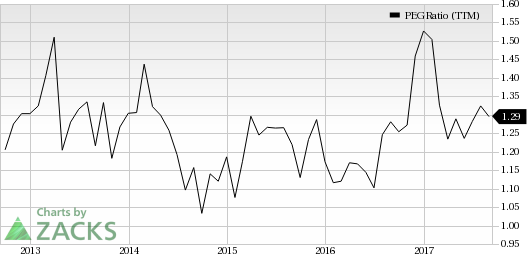

Amedisys, Inc. (AMED): This healthcare services provider, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings advancing 5.7% over the last 60 days.

Amedisys has a PEG ratio 1.29, compared with 1.40 for the industry. The company possesses a Growth Score of A.

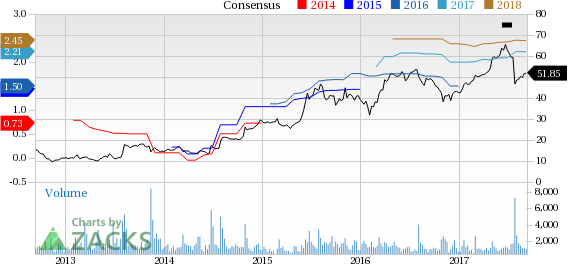

Nutrisystem, Inc. (NTRI): This weight management services provider, which carries a Zacks Rank #1 (Strong Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 12.4% over the last 60 days.

Nutrisystem has a PEG ratio 1.49, compared with 1.52 for the industry. The company possesses a Growth Score of A.

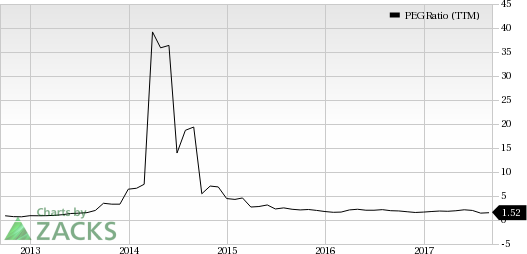

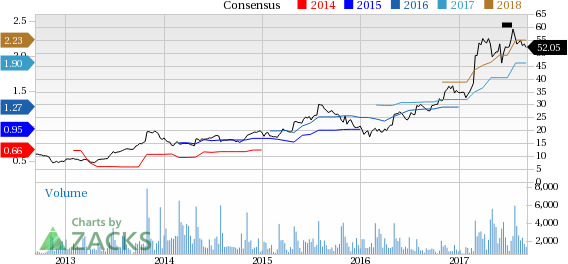

Chemours Company (CC): This chemical company, which carries a Zacks Rank #1 (Strong Buy), has witnessed the Zacks Consensus Estimate for its current year earnings advancing 3.7% over the last 60 days.

Chemours has a PEG ratio 0.88, compared with 1.62 for the industry. The company possesses a Growth Score of A.

See the full list of top ranked stocks here

Learn more about the Growth score and how it is calculated here.

4 Surprising Tech Stocks to Keep an Eye On

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really take off.

NutriSystem Inc (NTRI): Free Stock Analysis Report

EMCOR Group, Inc. (EME): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Amedisys Inc (AMED): Free Stock Analysis Report

Original post

Zacks Investment Research