Here are four stocks with buy ranks and strong growth characteristics for investors to consider today, May 19th:

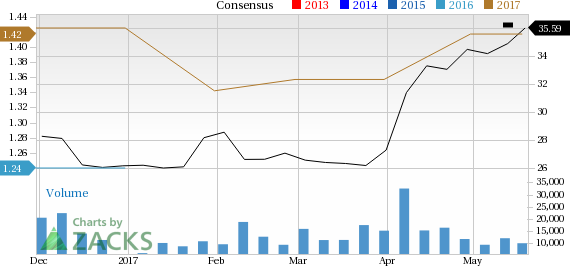

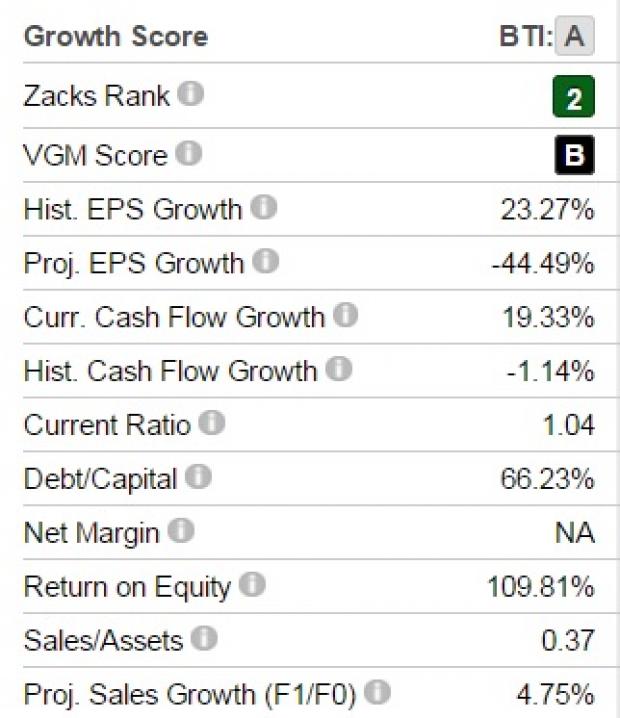

British American Tobacco (LON:BATS) p.l.c. (BTI): This tobacco company, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 2.5% over the last 60 days.

British American Tobacco has a PEG ratio 1.76, compared with 1.94 for the industry. The company possesses a Growth Score of A.

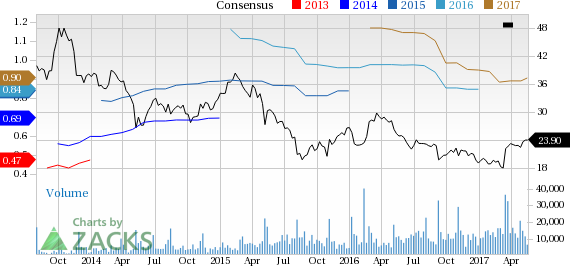

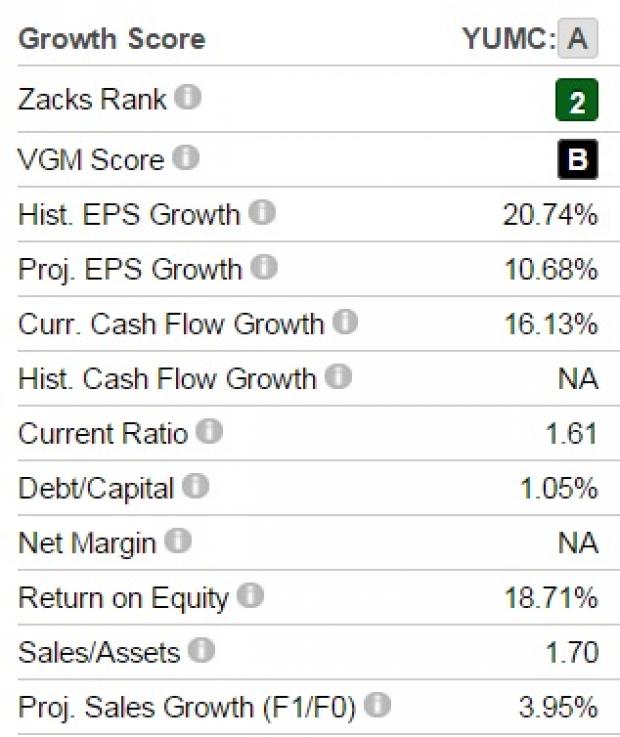

Yum China Holdings, Inc. (YUMC): This restaurant company, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings advancing 4.4% over the last 60 days.

Yum China Holdings has a PEG ratio 1.93, compared with 2.04 for the industry. The company possesses a Growth Score of A.

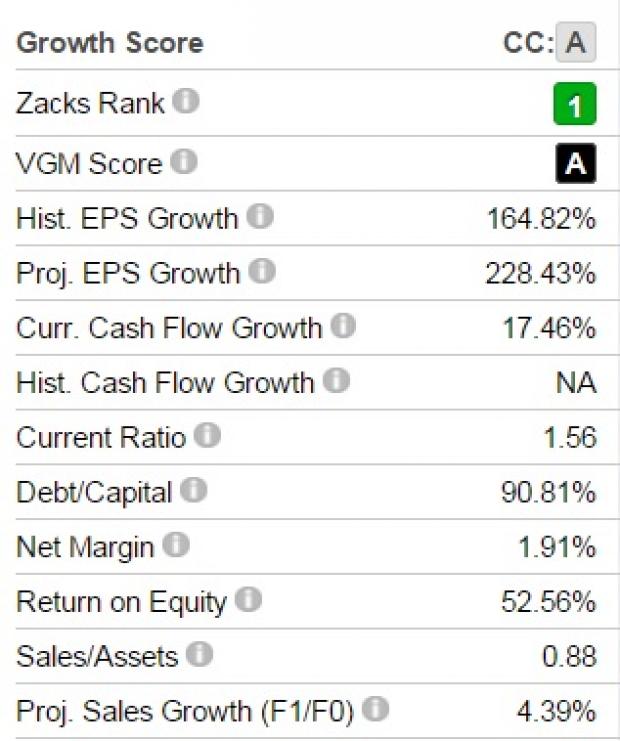

Chemours Company (CC): This chemical company, which carries a Zacks Rank #1 (Strong Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 37.9% over the last 60 days.

Chemours has a PEG ratio 0.82, compared with 1.51 for the industry. The company possesses a Growth Score of A.

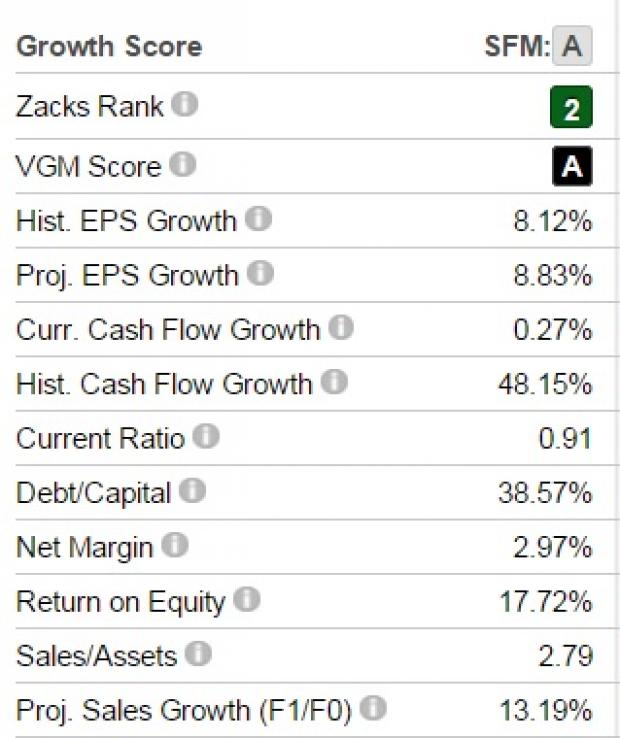

Sprouts Farmers Market, Inc. (SFM): This grocery store chain company, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings advancing 2.3% over the last 60 days.

Sprouts Farmers Market has a PEG ratio 2.26, compared with 2.82 for the industry. The company possesses a Growth Score of A.

See the full list of top ranked stocks here

Learn more about the Growth score and how it is calculated here

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

Yum China Holdings Inc. (YUMC): Free Stock Analysis Report

Sprouts Farmers Market, Inc. (SFM): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

British American Tobacco p.l.c. (BTI): Free Stock Analysis Report

Original post

Zacks Investment Research