Here are three stocks with buy ranks and strong growth characteristics for investors to consider today, March 13th:

United Continental Holdings, Inc. (UAL): This air transportation services provider, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 6.9% over the last 60 days.

United Continental Holdings, Inc. Price and Consensus

United Continental 10.67 has a PEG ratio of 0.35, compared with 0.86 for the industry. The company possesses a Growth Scoreof B.

United Continental Holdings, Inc. PEG Ratio (TTM)

Canadian Solar Inc. (CSIQ): This manufacturer and marketer of solar power products, which carries a Zacks Rank #1 (Strong Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 6.8% over the last 60 days.

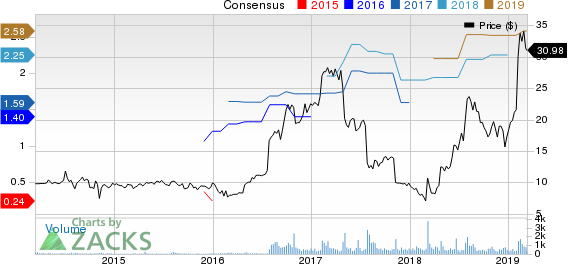

Canadian Solar Inc. Price and Consensus

Canadian Solar has a PEG ratio of 0.33, compared with 1.49 for the industry. The company possesses a Growth Score of B.

Canadian Solar Inc. PEG Ratio (TTM)

PCM, Inc. (PCMI): This technology products and solutions provider, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 1.6% over the last 60 days.

PCM, Inc. Price and Consensus

PCM has a PEG ratio of 0.60, compared with 0.85 for the industry. The company possesses a Growth Score of B.

PCM, Inc. PEG Ratio (TTM)

See the full list of top ranked stocks here

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, wouldn't you like to know about our 10 finest buy-and-holds for the year?

From more than 4,000 companies covered by the Zacks Rank, these 10 were picked by a process that consistently beats the market. Even during 2018 while the market dropped -5.2%, our Top 10s were up well into double-digits. And during bullish 2012 – 2017, they soared far above the market's +126.3%, reaching +181.9%.

This year, the portfolio features a player that thrives on volatility, an AI comer, and a dynamic tech company that helps doctors deliver better patient outcomes at lower costs.

United Continental Holdings, Inc. (UAL): Free Stock Analysis Report

PCM, Inc. (PCMI): Free Stock Analysis Report

Canadian Solar Inc. (CSIQ): Free Stock Analysis Report

Original post

Zacks Investment Research