Here are four stocks with buy ranks and strong growth characteristics for investors to consider today, July 20th:

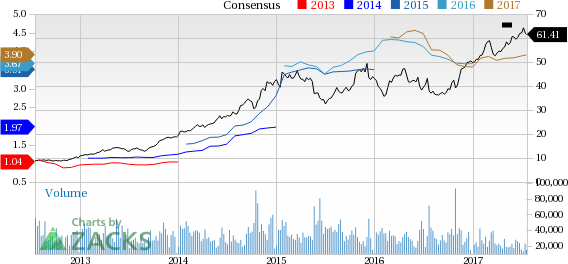

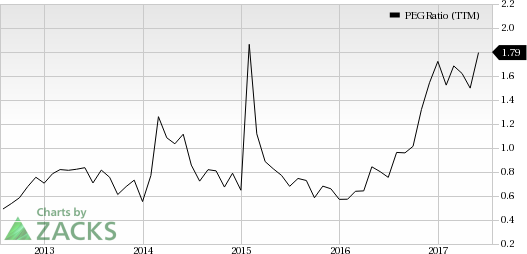

Southwest Airlines Co. (LUV): This passenger airline provider, which carries a Zacks Rank #1 (Strong Buy), has witnessed the Zacks Consensus Estimate for its current year earnings advancing 2.1% over the last 60 days.

Southwest Airlines has a PEG ratio 1.54, compared with 1.93 for the industry. The company possesses a Growth Score of A.

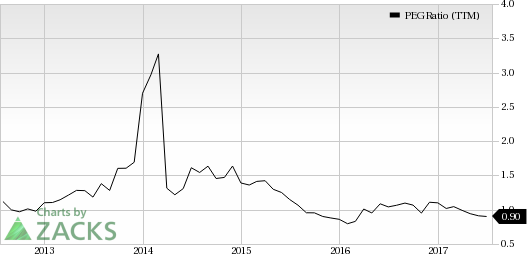

Big Lots (NYSE:BIG), Inc. (BIG): This discount retailer, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 3.7% over the last 60 days.

Big Lots has a PEG ratio 0.85, compared with 1.25 for the industry. The company possesses a Growth Score of A.

Chemours Company (CC): This chemical company, which carries a Zacks Rank #1 (Strong Buy), has witnessed the Zacks Consensus Estimate for its current year earnings advancing 4.5% over the last 60 days.

Chemours has a PEG ratio 0.83, compared with 1.72 for the industry. The company possesses a Growth Score of A.

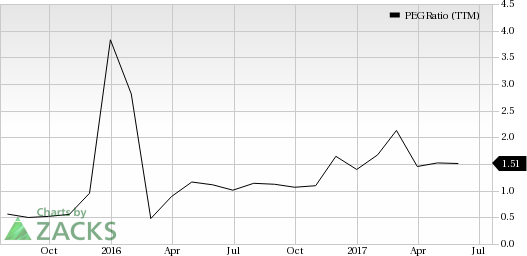

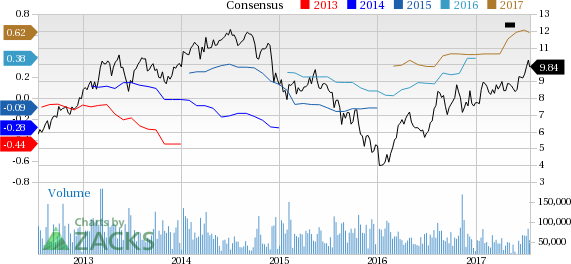

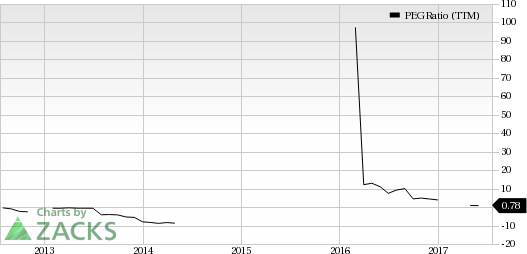

CEMEX, S.A.B. de C.V. (CX): This cement company, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 1.6% over the last 60 days.

CEMEX has a PEG ratio 0.85, compared with 1.46 for the industry. The company possesses a Growth Score of A.

See the full list of top ranked stocks here

Learn more about the Growth score and how it is calculated here.

Want to see all of today's Zacks Strong Buys?

Today's 5 additions are just the appetizer. You are welcome to download the full, up-to-the-minute list of 220 Zacks Rank #1 stocks free of charge. There is no better place to start your own stock search. Plus you can also access the full list of must-avoid Zacks Strong Sells and other private research.See the stocks free >>

Southwest Airlines Company (LUV): Free Stock Analysis Report

Cemex S.A.B. de C.V. (CX): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Big Lots, Inc. (BIG): Free Stock Analysis Report

Original post

Zacks Investment Research