Here are four stocks with buy ranks and strong growth characteristics for investors to consider today, January 11th:

e.l.f. Beauty, Inc. (ELF): This seller of beauty cosmetic products, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings advancing 1.8% over the last 60 days.

e.l.f. Beauty has a PEG ratio 1.66, compared with 2.45 for the industry. The company possesses a Growth Score of A.

Beacon Roofing Supply, Inc. (BECN): This distributor of residential and non-residential roofing materials, which carries a Zacks Rank #1 (Strong Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 21.5% over the last 60 days.

Beacon Roofing Supply has a PEG ratio 1.34, compared with 1.41 for the industry. The company possesses a Growth Score of A.

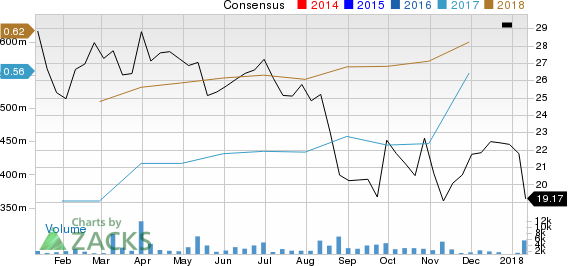

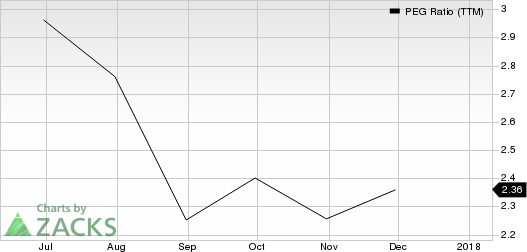

Oshkosh Corporation (OSK): This designer of specialty vehicles, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings advancing 0.4% over the last 60 days.

Oshkosh has a PEG ratio 1.21, compared with 1.50 for the industry. The company possesses a Growth Score of A.

Western Digital Corporation (NASDAQ:WDC) (WDC): This seller of data storage devices, which carries a Zacks Rank #1 (Strong Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 2% over the last 60 days.

Western Digital has a PEG ratio 0.24, compared with 1.07 for the industry. The company possesses a Growth Score of A.

See the full list of top ranked stocks here

Learn more about the Growth score and how it is calculated here.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Western Digital Corporation (WDC): Free Stock Analysis Report

Oshkosh Corporation (OSK): Free Stock Analysis Report

e.l.f. Beauty Inc. (ELF): Free Stock Analysis Report

Beacon Roofing Supply, Inc. (BECN): Free Stock Analysis Report

Original post