Here are four stocks with buy ranks and strong growth characteristics for investors to consider today, December 27th:

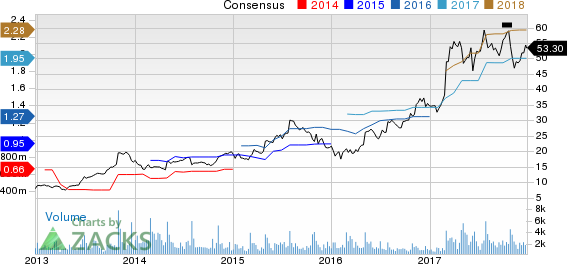

Nutrisystem, Inc. (NTRI): This weight management services provider, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 0.5% over the last 60 days.

Nutrisystem has a PEG ratio 1.52, compared with 1.69 for the industry. The company possesses a Growth Score of A.

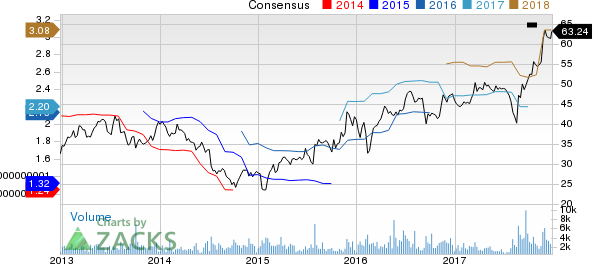

Beacon Roofing Supply, Inc. (BECN): This distributor of residential and non-residential roofing materials, which carries a Zacks Rank #1 (Strong Buy), has witnessed the Zacks Consensus Estimate for its current year earnings rising 16.7% over the last 60 days.

Beacon Roofing Supply has a PEG ratio 0.80, compared with 0.98 for the industry. The company possesses a Growth Score of A.

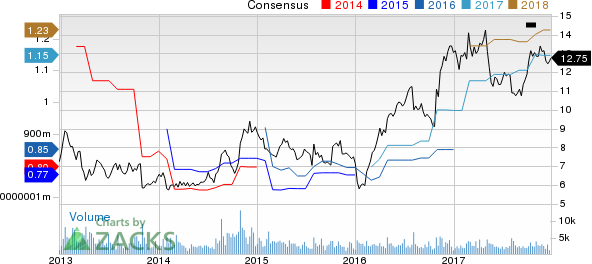

ACCO Brands Corporation (ACCO): This designer of office products and academic supplies, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 4.6% over the last 60 days.

ACCO Brands has a PEG ratio 1.10, compared with 2.01 for the industry. The company possesses a Growth Score of A.

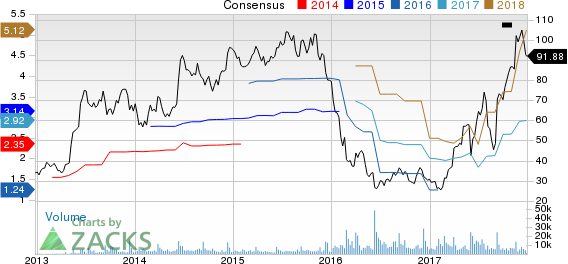

RH (RH): This retailer in the home furnishings market, which carries a Zacks Rank #1 (Strong Buy), has witnessed the Zacks Consensus Estimate for its current year earnings rising 12.3% over the last 60 days.

RH has a PEG ratio 0.92, compared with 1.75 for the industry. The company possesses a Growth Score of A.

See the full list of top ranked stocks here

Learn more about the Growth score and how it is calculated here.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Restoration Hardware Holdings Inc. (RH): Free Stock Analysis Report

NutriSystem Inc (NTRI): Free Stock Analysis Report

Beacon Roofing Supply, Inc. (BECN): Free Stock Analysis Report

Acco Brands Corporation (ACCO): Free Stock Analysis Report

Original post