Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

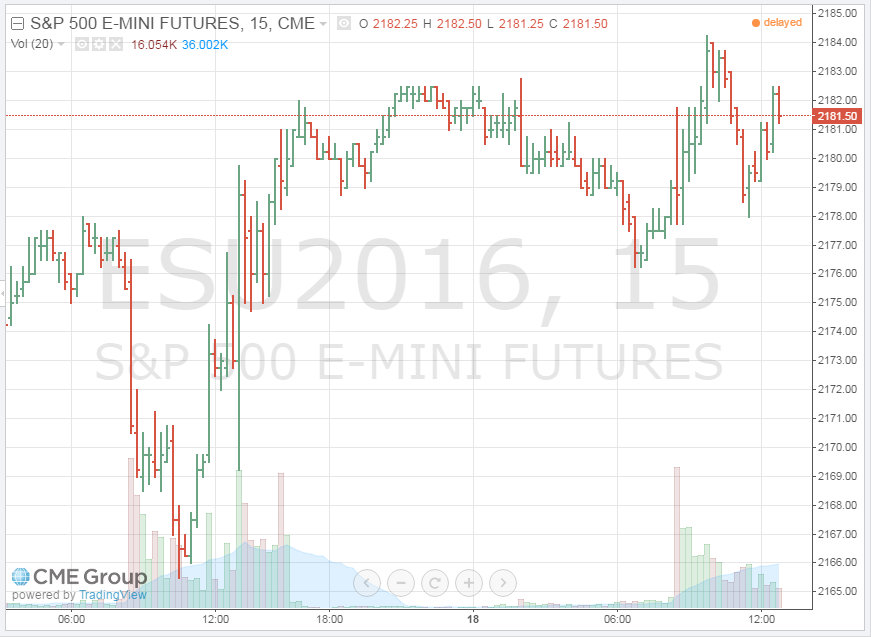

After turning the opening range after making early lows, the s&p did challenge the pre-market high of 2182.75, high 2182.50 in both pit / mini. Holding steady took one last attempt to find a stop price of 2185.00, but stopped short with a pit print 2183.50, board bid 2184.00 / mini high at 2184.25. A move to the early high of 2181.75 that led to the low, print 2182.00, moved one last time north. However, that failure to make new highs turned the 2181.75 early high on its way to a move under the opening range, low 2178.00 in pit and mini. Failing to make new lows did find legs to a last high of 2180.25, which in turn held the pivotal price 2180.50. I suspect it’s now or never to make new lows with the early call of 2176.00 short value price / daily pivot 2175.550 moving into the 2nd half of today.

The Nasdaq after failing to find its pre-market high of 4814.00 first attempt, high 4813.50 did return to a lower high which in turn found one last push that hit that pre-market high spot on that 4814.00 price. A push print down to the 4807.00 price, followed with a lower high as it triggered a move south. A move under its pivotal / opening tic triggered further erosion as it looked for the pre-market low of 4793.50 / daily pivot 4794.75 area making new lows in the process. Taking the average of the two, bid 4794.00, I hit the jackpot so to speak when this future found a low at 4792.75. The ensuing bounce looked for covers at 4798.50 and 4801.50, a price that was hit and filled, which in turn held that opening / pivotal price 4802.00. Decision time to say the least heading into the 2nd half of today. This future is the more honest of the two because it did make new lows with a turn of the opening print, while the s&p failed to do so. That bounce off that low was huge and it leaves the bias / direction for the remainder of the day in a snafu…..time will tell, but it makes me wonder if the s&p will carry the weight back to new highs.

Funny how the Nasdaq can’t make new pre-market highs while the s&p did and follow with new pre-market lows, while the s&p refused…..did somebody say trading the Dog Days of August was going to be easy.

Top Notch

Keep an eye on Tim’s support and resistance levels and share your feedback with us!

If you like what Tim has to say, then check out his daily technical analysis geared specifically toward the day trader!