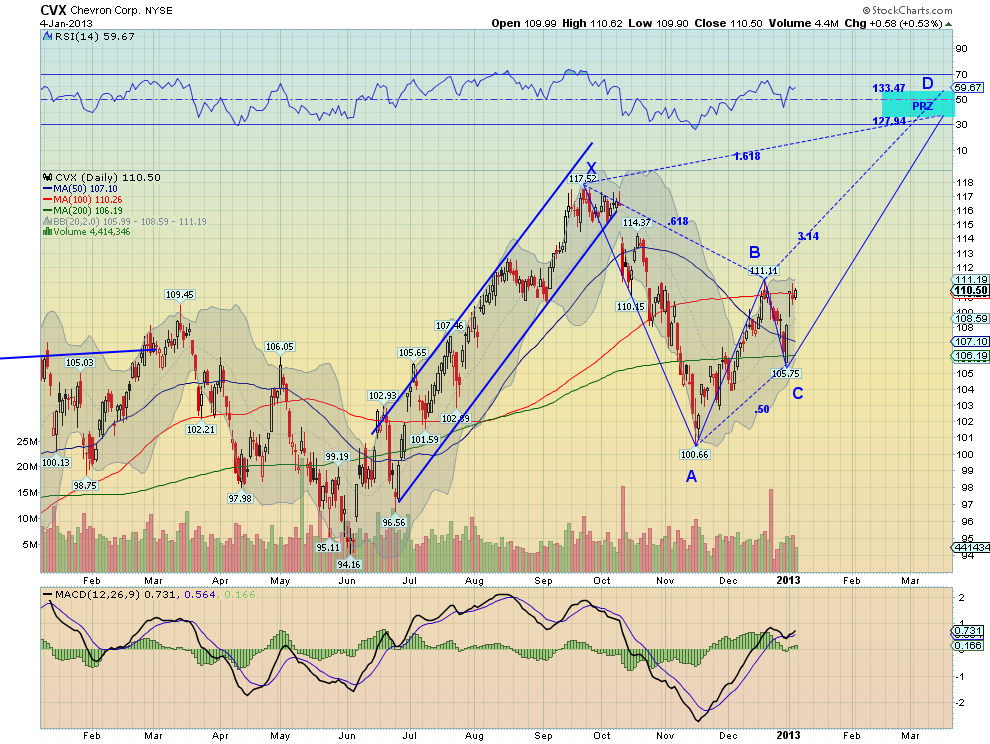

Chevron (CVX) is back testing resistance at 111 after a pullback to the 200-day Simple Moving Average (SMA). It has a bullish and rising Relative Strength Index (RSI) and a Moving Average Convergence Divergence indicator (MACD) that is positive and growing. Both support more upside. Resistance higher is found at 114.37 and 117.52 with support lower at 109.50 and 108.24 followed by 105.75. It is also exhibiting a Perfect Crab Pattern, which would give a Potential Reversal Zone (PRZ) between 127.94 and 133.47 in late March.

Trade Idea 1: Enter long on a move over 111.11 with a stop at 110.

Trade Idea 2: Buy the February 110 Calls (offered at $2.40 late Friday) on the same trigger.

Trade Idea 3: Sell the February 95 Puts (37 cents) on the same trigger.

Trade Idea 4: Buy the February 95/110 bullish Risk Reversal ($2.03) on the same trigger.

Trade Idea 5: Buy the March 100/115 bullish Risk Reversal (5 cents) on the same trigger.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Saturday which, as the financial markets get back to full strength, look for Gold to continue lower while Crude Oil continues higher. The US Dollar Index seems ready to continue higher while US Treasurys head lower, both with a chance that each may consolidate.

The Shanghai Composite and Emerging Markets are biased to the upside with the possibility that each may also rest. Volatility looks to remain low and may continue lower keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ, despite the big moves higher this week. Their charts all look higher as well with the IWM the strongest followed by the SPY and the QQQ pulling back or possibly consolidating. Use this information as you prepare for the coming week and trade’m well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post