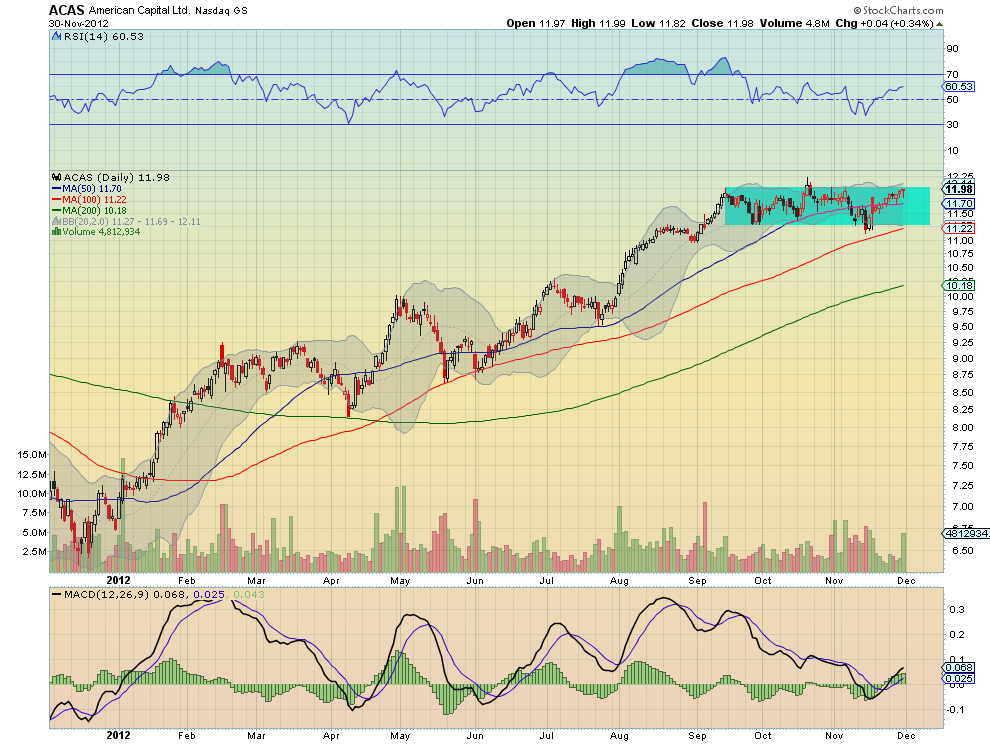

American Capital (ACAS) has been trading in the blue box for two-and-a-half months between 11.30 and 12. Now approaching the top of the zone it has a bullish and rising Relative Strength Index (RSI) and a moving Average Convergence Divergence indicator (MACD) that is positive and increasing to support a push higher. Friday’s Hanging Man candle though cautions against entering early.

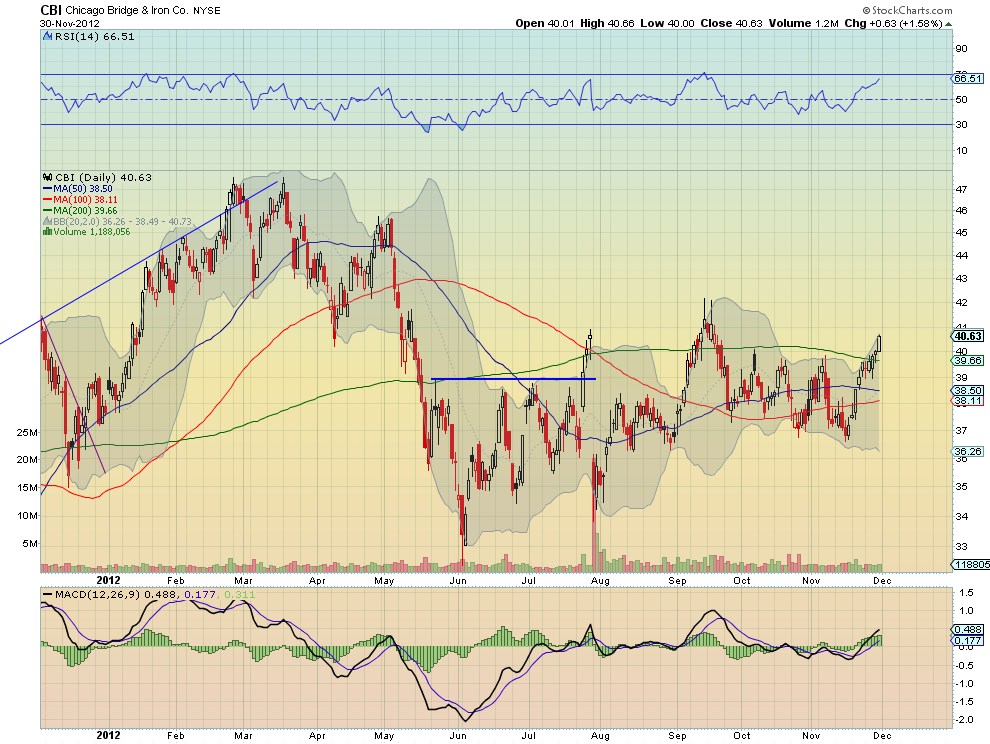

Chicago Bridge & Iron (CBI)

Chicago Bridge & Iron (CBI) broke above resistance at 40 and the 200-day Simple Moving Average (SMA) last week. It has a rising and bullish RSI and a MACD that is positive and increasing to support continued upside.

Cabot Oil & Gas (COG)

Cabot Oil & Gas (COG) printed a Hanging Man candle a week ago Friday and has been moving lower ever since. Now on support at 47, it has a falling RSI and a MACD that is negative and growing to support more downside action. Short interest is also low at only 3%.

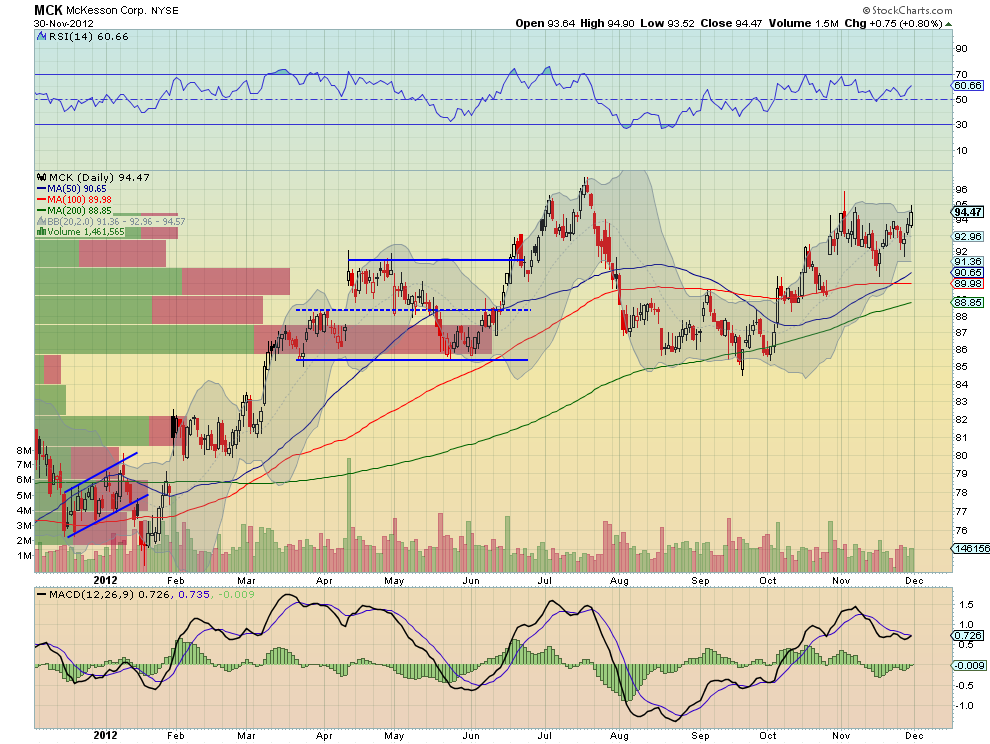

McKesson (MCK)

Mckesson (MCK) stair stepped higher out of a base between 86 and 89 reaching a top at 96 early in November. After a pullback it is testing that top again and with a move over has a Measured Move higher to 98. The rising and bullish RSI and MACD about to cross to positive support the upside case.

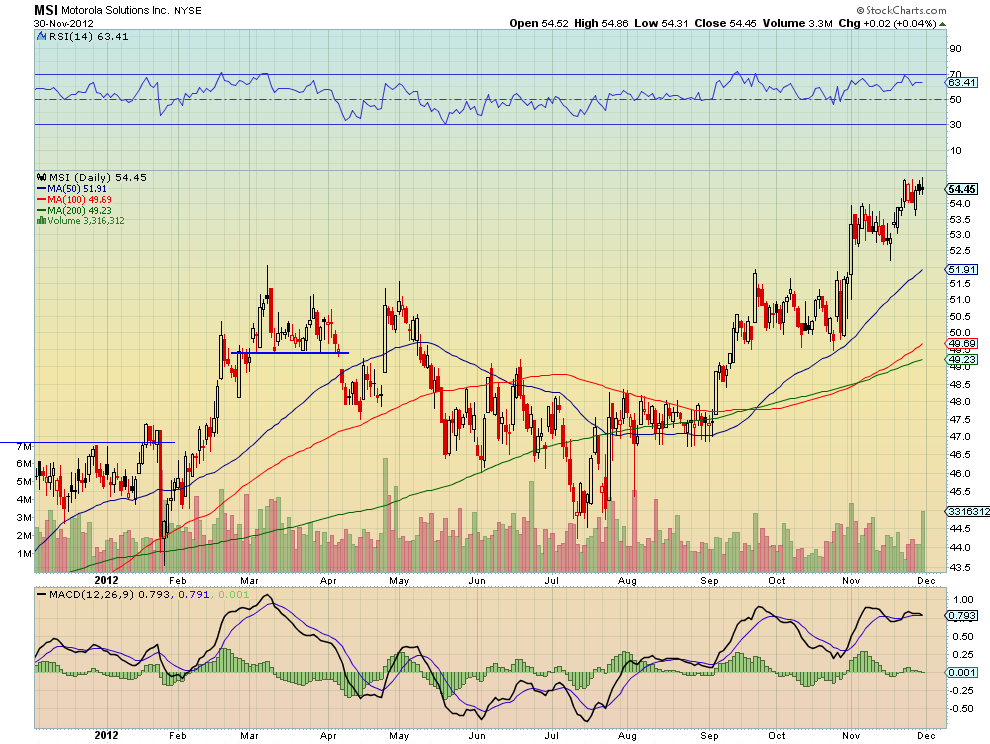

Motorola Solutions (MSI)

Motorola Solutions (MSI) is consolidating at 55 after moving higher out of a bull flag. It has a bullish RSI to support more upside and a flat MACD. A break over 55 carries a Measured Move higher to 57.75.

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Saturday which, heading into December sees the markets are biased higher but cautiously so.

Gold looks headed lower in its long-term channel while Crude Oil heads higher. The US Dollar Index seems content to move lower while US Treasurys are biased lower but may continue to consolidate. The Shanghai Composite is marching lower while Emerging Markets stagnate in their consolidation zone. Volatility looks to remain low keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts are starting to show signs of being tired though, so caution is warranted on the long side in the near-term. Use this information as you prepare for the coming week and trade’m well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post