Here are some of the standout economic and markets charts on my radar. I aim to pick a good mix of charts covering key global macro trends, and ones which highlight risks and opportunities across asset classes.

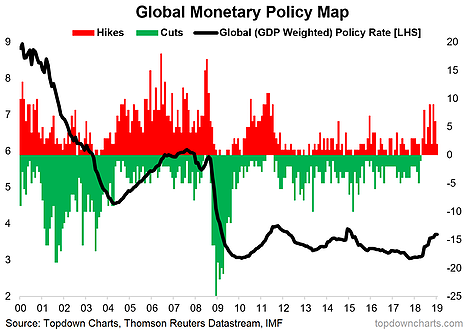

1. Global Deflatometer: This is going to be one of those charts I keep referring back to as the year progresses. Key point: while the global equity route has begun to abate, the deterioration in activity data remains a concern.

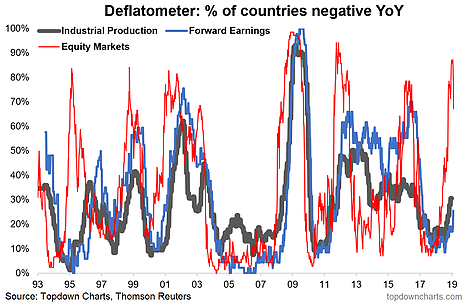

2. Global Shipping Indicators: Similar theme - global freight indexes have been on the soft side, and in particular the Baltic Dry Index has crashed over the past couple weeks (though I would note the China Containerized Freight Index has been just muddling along, likewise shipping sector equity relative performance). The thing to watch for with this chart is a synchronized movement in the indicators (not really yet), but the move in the Baltic dry itself is interesting, particularly in the, as yet, the absence of any real material stimulus out of China or visible progress on a comprehensive trade agreement.

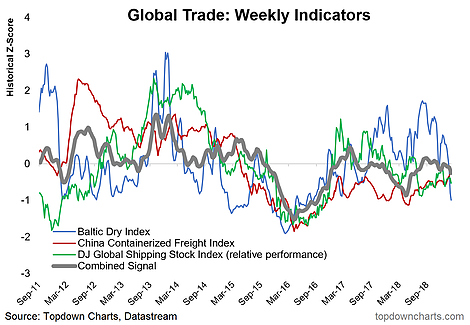

3. Bear Market Warning Indicator: One very interesting and useful dataset out this week was the Fed Senior Loan Officer Opinion Survey, which tracks: banks' willingness to lend, loan pricing, and loan demand. From this dataset has come this little bear market warning indicator. It worked well in the 2000 peak and even forewarned of the 2008 turmoil. But in fairness, it also produced basically false signals a handful of times during the period shown. In that respect, it is currently flashing an orange light - whereas a red light would be flashing were it to deteriorate further and at a sharper pace (i.e. if the banks were to aggressively tighten up lending standards).

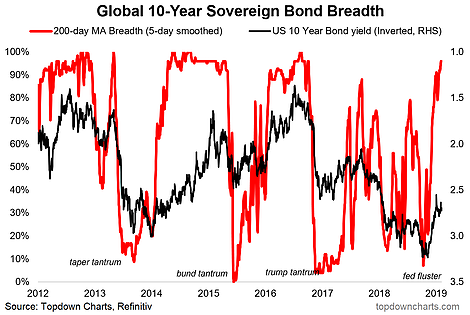

4. Global Sovereign Bond Market Breadth: With the surge in bond market breadth, it's fair to say that fixed income folks are getting excited about the signs of an economic slowdown. This chart, which featured in the latest Global Cross Asset Market Monitor, basically shows broad-based strength across DM sovereign bond markets (and usually these markets do well when the growth and/or inflation outlook deteriorates). The cautionary for bond bulls is that it could also be said to be a sign the bond market is overbought.

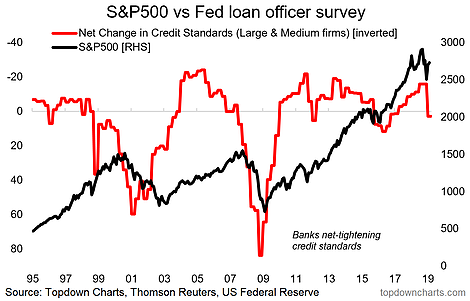

5. Global Monetary Policy Map: This chart remains very important chart for 2019. In essence, one could look at this chart and the first chart in this email and say that central banks have tightened policy too much, and are collectively on the verge of making a policy mistake. As I noted in last week's macro themes report, 2018 was incredibly rare in that for a full 8 months there were exclusively rate hikes and no cuts. In a world of rising leverage, we may already have an answer to the question/concern about rising interest rate sensitivity.

At this point, it looks like a global policy u-turn is required. If central banks act fast enough it should only need to be a temporary u-turn.