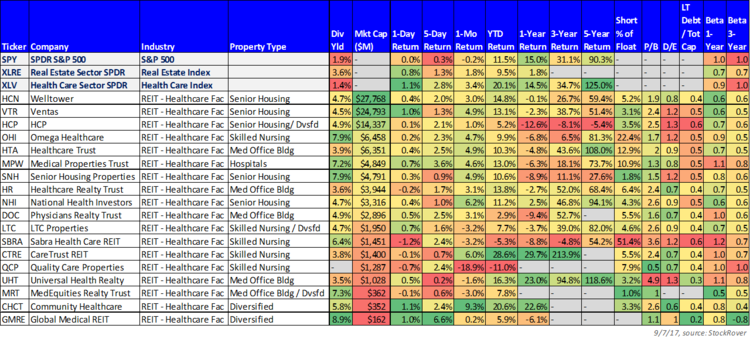

Health Care (NYSE:XLV) have gained 14.5% over the last year, thereby keeping pace with the overall market as measured by the SPY (NYSE:SPY) which gained 15.0% over the same time period. However, there are a variety of reasons why healthcare REITs have significantly underperformed, many of them delivering negative returns, as shown in the following table.

One reason investors have spurned healthcare REITs has to do with uncertainty surrounding many of their troubled operator tenants dealing with intense medical expense reimbursement pressures basically putting them in dire straits in some cases (for example, publicly traded operator tenants like Brookdale (NYSE:BKD) and Genesis (NYSE:GEN) have experience dramatic stock price declines and consistent negative net income, while other operator tenants are filing for bankruptcy such as Adeptus (OTC:ADPTQ).

Another reason healthcare REITs have underperformed is because they are REITs, a sector that has been out of favor since the post-election “Trump Rally,” and as fears of rising interest rate expectations are presumed to soon wreak increasing havoc on REITs because they rely heavily on borrowing to fund growth (as interest rates increase, the cost of borrowing increases).

With that backdrop in mind, and considering we are contrarian income-focused investors, we decided to highlight a few healthcare REIT opportunities that may be worth considering within the constructs of a diversified investment portfolio.

5. Medical Properties Trust (MPW), Yield: 7.2%

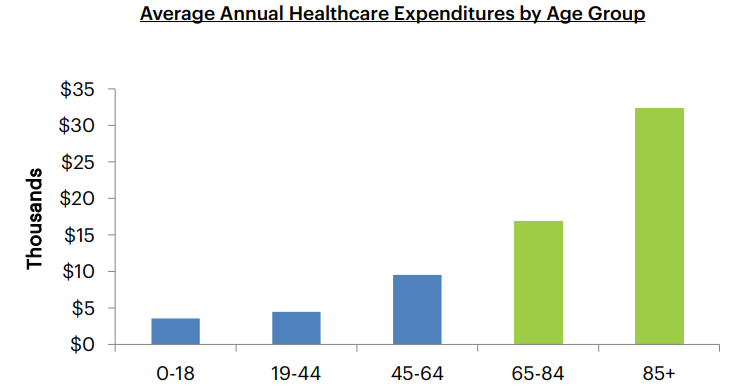

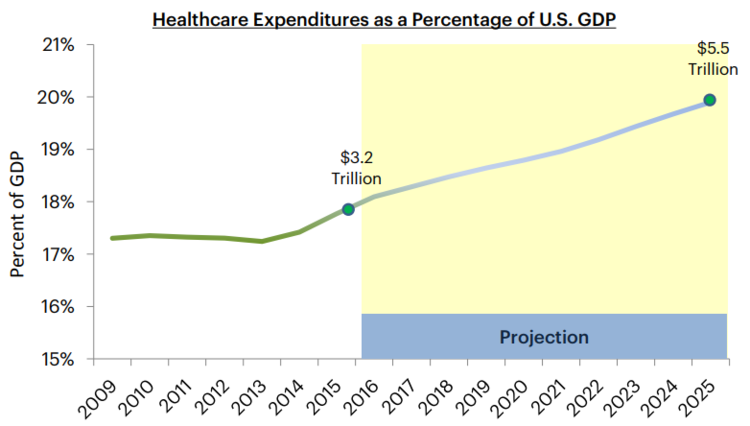

Medical Properties Trust Inc (NYSE:MPW) provides capital to hospitals and other acute care facilities. It has basically carved a unique niche for itself in the healthcare REIT space by allowing hospitals to tap into the value of their real estate so they can focus on what they do best (providing healthcare). MPW essentially bridges the gap between the growing demand for high-quality healthcare (this is a positive demographic theme we’ll cover more later) and the need to deliver it in an increasingly efficient and cost-effective manner (this is another theme we cover, the increasing pressure on healthcare reimbursement rates).

If you are a contrarian income-focused investor, there is lots to like about Medical Properties Trust. For starters, it offers an attractive 7.2% dividend yield, and its share price has declined (contrarians like this). Also, the dividend is well covered and the company’s valuation is very low considering the stock trades at only 9.9 times its 2017 Normalized Funds from Operations (“FFO”) guidance of $1.29 to $1.31 per share. Regarding dividend safety, the payout ratio is only 71.5% ($0.96/$1.30). The company is also attractive because of the growing demographic need for healthcare that we mentioned above (and we’ll cover in more detail later). And as MPW’s CEO (Ed Aldag) put it during their most recent earnings conference call:

As many of you have heard me say many times, you cannot imagine in our lifetime any developed country without hospitals. We are confident that we have some of the world's very best operators.

Basically, MPW has a high degree of confidence in the business it is in.

However, MPW faces a variety of risks that investors should consider. For starters, healthcare laws are subject to change, and this could negatively impact MPW. During the most recent earnings conference call, CEO Ed Aldag explained:

We have all watched in frustration, the inability of Congress to bring certainly the healthcare issues, our basic investment thesis at MPT has not changed. There are three things that we're absolutely sure of. Reimbursement will change and reimbursement in some form will always be here and hospitals are not going away.

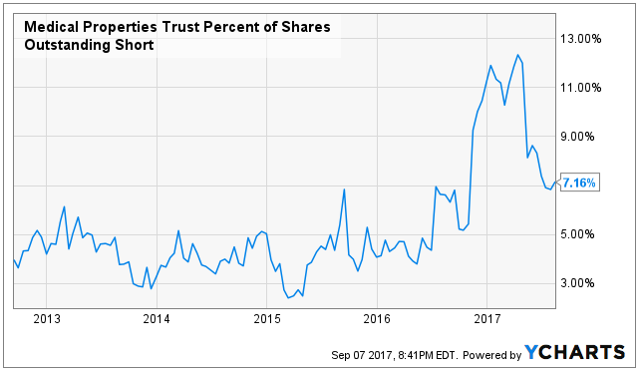

The possibility of healthcare law changes is a big risk factor facing MPW, and it’s part of the reason the current short interest on this stock is 7.16%.

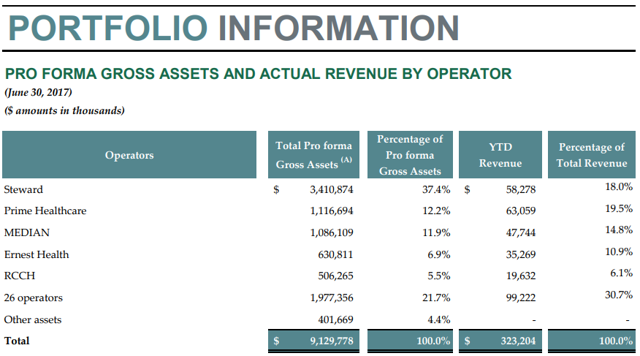

Another risk facing MPW is its operators. Not only are MPW’s operators concentrated as shown in the following table, but they are also at risk.

MPW’s operators are at risk because of challenging financial conditions. For example, Adeptus (which represents just under 7% of MPW's rent) has filed for bankruptcy. For the time being, all of the Adeptus properties continue to make rent payments, however approximately 13 facilities will later be severed from the master leases and MPW will either sell or release them to other operators. This is a significant risk. And this risk is not just related to Adeptus. Other operators are facing challenges.

Steward and Prime (see our portfolio table above) are also facing risks. For example, Steward, which is owned by Cerberus Capital Management, plans to merge with IASIS Healthcare to become the US's largest private for-profit hospital operator. These types of transactions can create challenges. Also Prime (another large tenant) has experienced lower than expected cash collections, primarily at six hospitals, and this will result in undesirable write-offs of 6% to 7% of revenues.

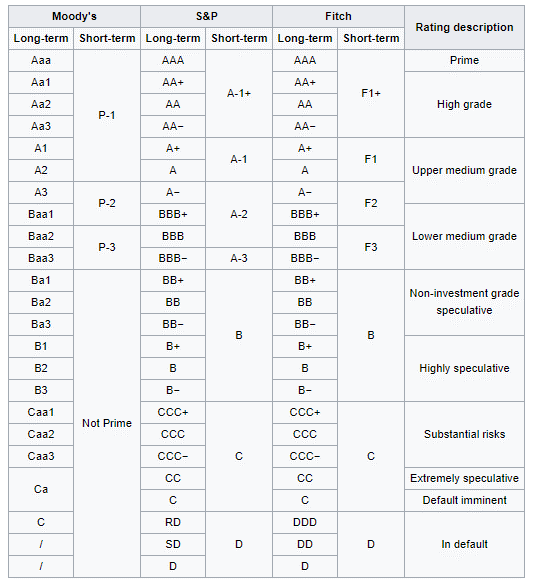

Another way to gauge MPW’s risks is its S&P BB+, non-investment-grade, credit rating. This is the highest non-investment-grade credit rating, and it is also the lowest credit rating of our top 5 healthcare REITs included in this report. This rating gives readers an indication of MPW’s relative risks.

Overall, if you are an income-focused investor, and you can get comfortable with the risks (i.e. if you believe MPW’s hospitals will continue to be in demand like CEO Ed Aldag believes) then this REIT is worth considering, especially considering its near dirt-cheap valuation, and it’s attractive well-covered dividend yield.

4. Welltower (HCN), Yield: 4.7%

Welltower Inc (NYSE:HCN) is an attractive, highly-conservative, blue-chip healthcare REIT that focuses mainly on Senior Housing. There is a lot to like about this company including its attractive dividend coverage ratio, its healthy price to FFO ratio, its investment grade credit rating, its performance over the last year (assuming you are a contrarian), the huge demographic tailwinds on its side, and of course its big 4.7% dividend yield. For your reference, we recently wrote in detail about Welltower in this report: Welltower Report (Yield: 4.7%).

And if you’re looking for safe dividend yield from a healthcare REIT, Welltower is absolutely worth considering.

3. Ventas (VTR), Yield: 4.5%

Very similar to Welltower, Ventas Inc (NYSE:VTR) is another attractive, conservative, blue-chip healthcare REIT focusing on Senior Housing. We like Ventas for many of the same reasons as Welltower (e.g. powerful demographics, safe dividend yield, price appreciation potential), but we also list 10 specific reasons why we like Ventas even more than Welltower in this report:

We don’t currently own shares of Ventas (we own a different healthcare REIT, more on this later), but we’re not opposed to owning shares. Ventas is currently high on our watch list, and we can understand why a lot of conservative income-focused investors currently do own shares.

2. HCP Inc (HCP), Yield: 4.9%

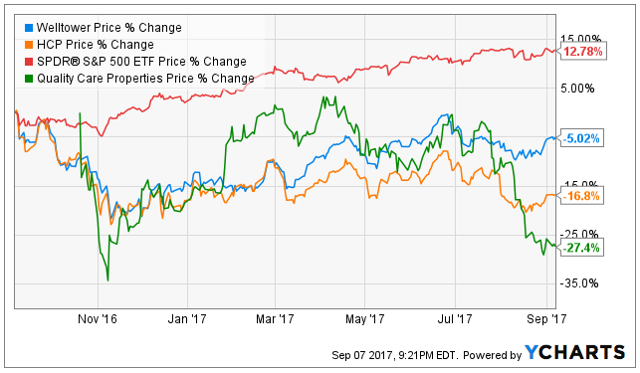

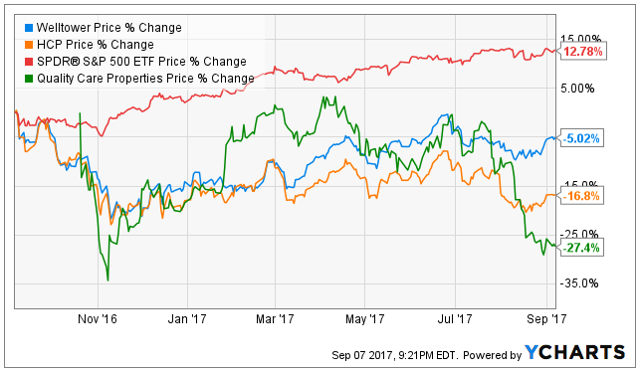

Too many investors continue to hate HCP Inc (NYSE:HCP) following its relatively recent troubled history with HCR ManorCare (the HCR ManorCare business has since been spun-off into a separate healthcare REIT (QCP) focusing entirely on skilled nursing facilities). And the fact that so many investors hate HCP is a big part of the reason we like it. As the following chart shows, HCP’s performance recently has been “lackluster” since the QCP spin-off last year.

However, contrary to the performance, there are a lot of reasons to like HCP. For example:

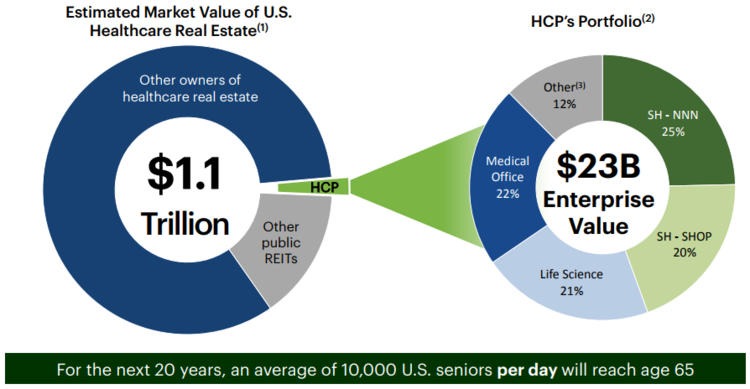

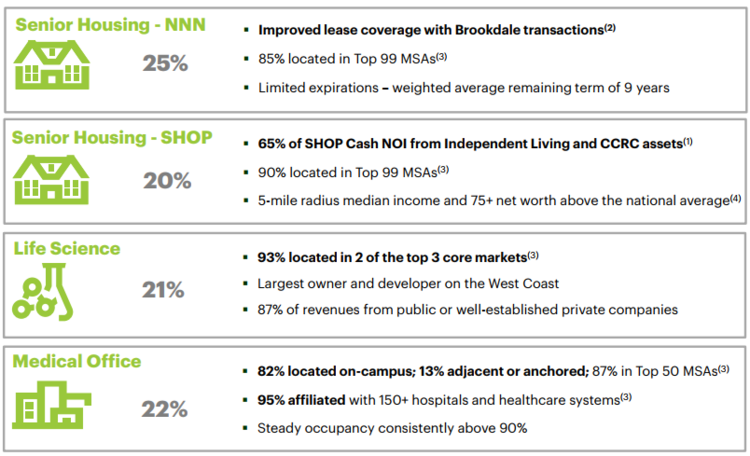

Property-Type Diversification: Aside from the fact that we like that HCP has no skilled nursing exposure (because they spun it off to QCP) we also like that HCP has better diversification than Welltower and Ventas in terms of property types.

Similar to Ventas and Welltower, HCP has significant exposure to Senior Housing, but it is less significant (only around 45% as shown in the graph above). This allows HCP to reduce risk by diversifying into other attractive property types. For example, we especially like HCP’s exposure to Life Sciences. Specifically, Life Sciences industry funding is led by pharmaceutical companies looking to invest via M&A, research funding, collaborations, and licensing to help backfill lost revenue as major drugs come off patent.

HCP’s strategy is to own real estate in locations where the funding is flowing, and we believe there could be big gain opportunities hear (and the market may not be appreciating the size of these opportunities for HCP).

One caveat for HCP investors, however, is the concentration of top tenants at 27% versus only 9% Ventas and 8% Welltower. This is a risk factor that investors should be aware of. Overall though, we like the opportunities presented by HCP’s attractive property-type diversification.

Brookdale Reduction: Regarding tenant concentration, we like that HCP has reduced its exposure to Brookdale Senior Living. Specifically, HCP recently sold 64 triple-net assets leased to Brookdale for $1.125 billion. This not only reduces HCP’s tenant concentration (a good thing), it also reduces its exposure to an increasingly challenged tenant (Brookdale has been struggleing with reimbursement pressures causing its stock price to decline sharply and its net income to be consistently negative. We view this reduced exposure as a positive for HCP.

Investment Grade Credit Rating: We also like that HCP has an investment grade credit rating. The current ratings are Baa2 from Moody’s and BBB from S&P. These investment grade ratings are one one step the larger blue-chips (Ventas and Welltower), and this rating is two steps above the non-investment grade credit rating of MPW as described earlier.

Attractive Entry Point: HCP has been one of the worst performing healthcare REITs over the last year. And as contrarians, this is attractive to us (we’d rather buy now that the price is lower).

And we especially like the lower price considering the many positive things HCP has going for it (as described above, and below).

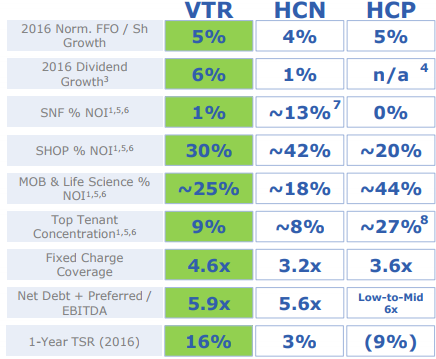

Competitive fixed charge coverage ratio: We also like HCP's fixed charge coverage ratio of 3.6x versus 4.6x for Ventas and only 3.2x for Welltower. This is an indication of safety and financial conservatism, which are especially attractive considering HCP’s big dividend.

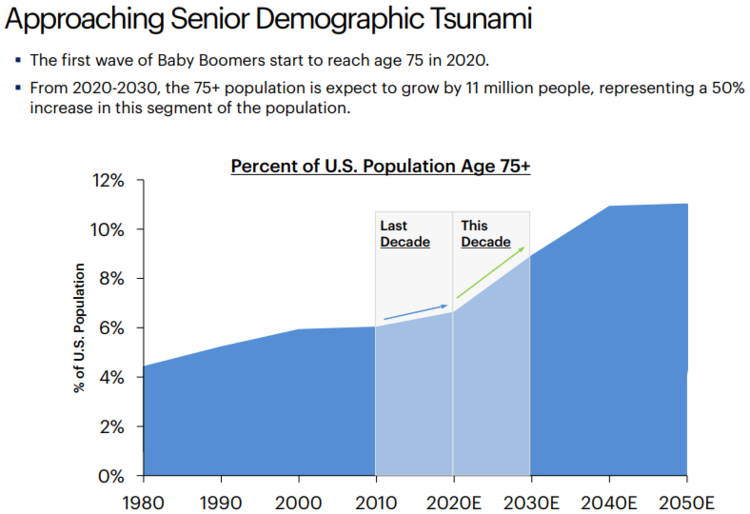

The Huge Demographic Wave: HCP, and Healthcare REITs in general, are all expected to benefit from a huge demographic trend. Specifically, the population is expected to age, and this will drive demand.

This large demographic shift is expected to benefit HCP, Ventas, Welltower, and other healthcare REITs.

Smaller Base from Which to Grow: We also like that HCP is smaller than Ventas and Welltower. For example HCP’s market cap is only around $14 billion, whereas Ventas is around $25 billion and Welltower $28 billion. This means HCP has to generate less absolute growth to achieve higher per share growth than Welltower and Ventas. It also means HCP can be more selective in its growth opportunities than Welltower and Ventas which have constant pressure to find larger scale opportunities.

Valuation: From a valuation standpoint, HCP trades at around only 15.4 times expected 2017 adjusted FFO (guidance is for $1.89 to $1.95 per share). And from a dividend payout ratio, HCP has some cushion. Specifically, the annual dividend per share is currently $1.48, which equates to a relatively safe 77% payout ratio. This means even if HCP experiences reduced payments from some operators, it has extra wherewithal to keep paying the dividend. And worth noting, 95% of HCP’s revenues are from private pay sources, versus only 93% for Ventas and Welltower. Private pay is generally considered safer because it does not have the same exposure to some of the regulatory uncertainties faced by public pay. This adds to the safety of the valuation and the dividend, in our view.

1. Omega Healthcare Investors (OHI), Yield: 7.9%

Omega (NYSE:OHI) is more risky than Welltower and Ventas, but it is also a different type of healthcare REIT, and it offers a better risk versus reward opportunity, in our view. Specifically, Omega is a skilled nursing facilities healthcare REIT, and this sub-sector is particularly exposed to potential regulatory changes to reimbursement rates (e.g. possible future changes to Medicaid Expansion under the Affordable Care Act, for example).

In the recent past, we have attempted to give a balanced view of Omega (instead of the usual one-sided cheerleading articles) in this detailed OHI write-up, and in our recent idea of the month video:

We do currently own shares of Omega as part of our broadly diversified investment portfolio. Many investors consider adding to their position in Omega if/when the share price falls below $30. We are not opposed to that idea.

Our main thesis on Omega, however, is simply that the fear is overblown, and the shares are attractive if you’re comfortable adding its specific risks within the constructs of your diversified investment portfolio.

Conclusion:

If you are an income-focused investor, healthcare REITs are attractive, some more so than others, if you are comfortable with the risks. We believe all five of the healthcare REITs described in this article have attractive qualities, and may be worth considering for an allocation within your diversified investment portfolio (especially if you are a contrarian). In fact, we have ranked several of these healthcare REITs highly (e.g Ventas is ranked #6, and Omega is ranked #3) on our more wide-ranging members-only article: Top 8 High-Yield REITs. Overall, we believe the market has been overly fearful regarding healthcare REITs, and fearful corners of the market are often where some of the best investment opportunities exist.