With no U.S. data on the calendar this morning, we want to take the opportunity to discuss our 3 favorite currencies and trades for 2014. If you have read our outlooks you may know that we are very bullish on the New Zealand dollar, U.S. dollar and British pound but our positive outlook on the greenback makes buying NZD/USD or GBP/USD difficult which is why it is important to look beyond the majors for trading opportunities. For the most part, the pace of tapering by the Federal Reserve will determine the direction for the dollar and many of the most actively traded currency pairs but as we saw in 2013, the strongest trends could be in the crosses.

New Zealand Dollar - Hottest Currency for 2014

Of all the major currencies our favorite is the New Zealand dollar because in addition to talking about raising interest rates this year, the Reserve Bank also laid out a plan to bring rates from the record low of 2.5% to 4.75% by the first quarter of 2016. No other major central bank is as hawkish as the RBNZ and with a high and growing yield, the New Zealand dollar should attract a significant amount of investment this year. What makes NZD even more attractive is that demand will be supported by growth. Unlike Australia who fuels China's thirst for energy and raw materials, New Zealand supplies China with soft commodities such as milk powder. As China's middle class grows, so will its demand for dairy and protein. As long as there isn't another milk contamination scare, New Zealand will be a major beneficiary of the sweeping reforms announced at China's Third Plenum with milk powder potentially doing for New Zealand what iron ore did for Australia.

For our full NZD/USD Outlook, read our 2014 NZD Preview

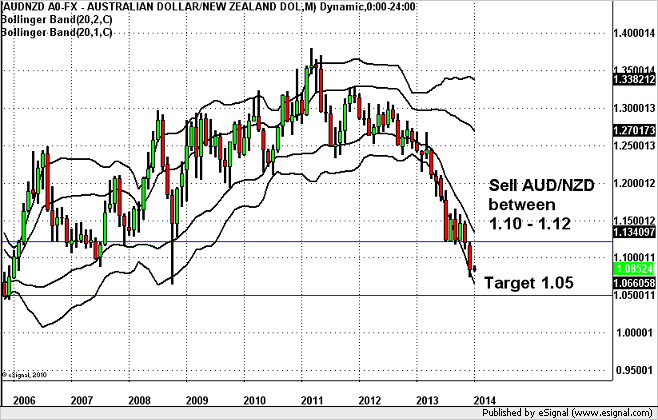

Potential Trade - AUD/NZD to 1.05

With the Fed tapering this year, we prefer to buy NZD against the AUD and EUR. Unlike the Reserve Bank of New Zealand, the central banks of Australia and the Eurozone are still considering another round of easing. The slowdown in China this year will weigh heavily on Australian growth while the high level of unemployment in the Eurozone will leave the region lagging behind its peers. As a result, we look at the recent rally in AUD/NZD towards 1.10 as an opportunity to sell at a higher level with a high probability move down to 1.05 and a potential for parity if the RBA eases and the RBNZ tightens. The major risk for AUD/NZD is a short squeeze in the Australian dollar but even if that were to occur, the shakeout of short positions will not alter the outlook for Australia.

For our full AUD outlook, read our 2014 AUD Preview.  AUD/NZD" title="AUD/NZD" width="706" height="452" align="bottom">

AUD/NZD" title="AUD/NZD" width="706" height="452" align="bottom">

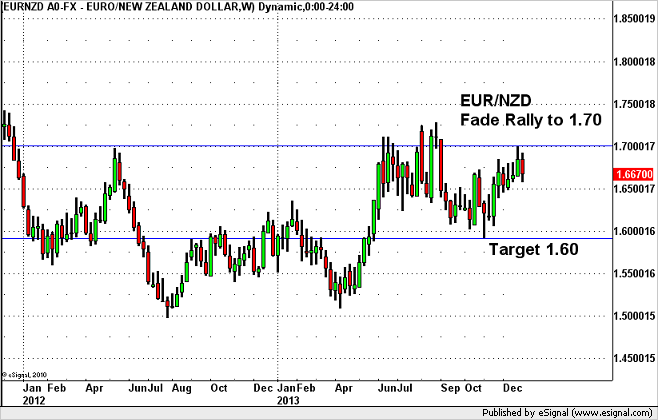

Potential Trades - EUR/NZD to 1.60

We see 1.65 to 1.70 as good points to sell EUR/NZD for a potential move down to 1.60.

For our full EUR outlook, read our 2014 EUR Preview.  EUR/NZD" title="EUR/NZD" width="706" height="452" align="bottom">2014 - The Year to Buy Dollars

EUR/NZD" title="EUR/NZD" width="706" height="452" align="bottom">2014 - The Year to Buy Dollars

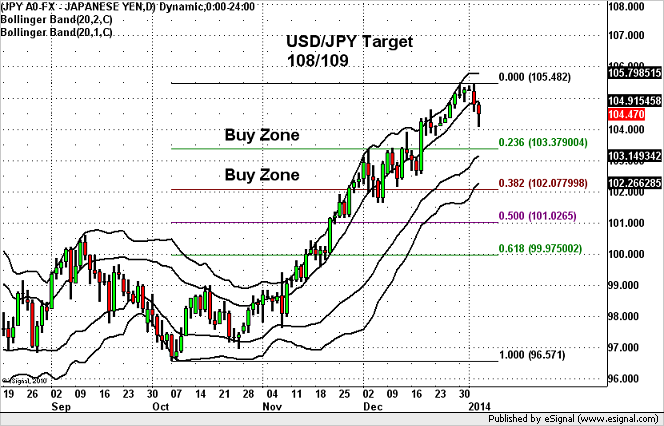

With the end of Quantitative Easing in sight and U.S. rates expected to head higher 2014 will be the year to buy dollars and the greenback should perform best against currencies of countries whose central banks are willing to loosen monetary policy such as the EUR, JPY and AUD. Of these 3 countries, the chance of easing is the greatest for the Bank of Japan because of the risks posed by the consumption tax hike in April. The last time a politician in Japan dared to raise taxes was in April 1997 and it plunged the economy into recession. In order to avoid the same fate, we expect the Bank of Japan to act quickly and aggressively on the first sign of sustained weakness. When they do, it will drive the Japanese Yen lower and USD/JPY higher. Even before the BoJ reacts, USD/JPY could rise ahead of the consumption tax. In the months leading up to the 1997 tax increase Japan's economy grew rapidly with 1996 Q4 GDP reaching 6.1%. Growth remained strong in the first quarter of Q1, with GDP rising 3%. During this time, USD/JPY rose 10% after rising 4.5% in Q4. While history never repeats itself exactly, we expect USD/JPY to break 105 again in the coming weeks and aim for 109.

For our full USD outlook, read our 2014 USD Preview

For our full JPY outlook, read our 2014 JPY Preview.

Potential Trade - USD/JPY to 108/109

We will look to buy USD/JPY from here down to 102. Below that level, the next opportunity to buy should be closer to 100. We don't see USD/JPY dropping that low unless the new Fed Chairman lowers the unemployment rate threshold and/or hits the brakes on tapering. USD/JPY" title="USD/JPY" width="706" height="452" align="bottom">British Pound - Solid Growth in 2014

USD/JPY" title="USD/JPY" width="706" height="452" align="bottom">British Pound - Solid Growth in 2014

The turnaround in the U.K. economy in 2013 was the envy of the world. The year before, Britain experienced virtually no growth and started 2013 softly but activity began to turn around quickly in the second quarter thanks to the government's responsive fiscal and monetary policies. In the New Year, we expect the U.K. economy to gain momentum thanks to the stronger global economy and pickup in housing and baking sectors. Last year, the U.K. government did a fantastic job of propping up the housing market with the Funding for Lending Scheme and the Help to Buy program. Their pledge to keep interest rates low will keep mortgage rates cheap, driving property prices higher and attracting foreign investment in 2014. The U.K. government understands that reflating the housing market is the key to keeping the economy supporting and consumers feeling optimistic. After writing off significant amounts of bad debt, the banking sector is also expected to report stronger earnings and dividends in the coming year. A stronger global environment will solidify the recovery and help the U.K. economy reach the Bank of England's 2.8% growth target for 2014, which is significantly higher than the 1.6% growth expected for 2013. The BoE also has a difficult decision to make next year. The unemployment rate has fallen much faster than they anticipated and when they release their Quarterly Inflation Report in February, they will need to decide whether they should acknowledge the improvements in the economy and accelerate their expectations for tightening or lower the unemployment rate threshold and maintain their extremely accommodative stance. The key lies in the wage growth. Right now wage growth is lagging behind inflation but if it starts to accelerate, the Bank of England will feel more pressure to raise interest rates. The fact that timing a rate hike is even on the minds of the BoE is bullish for the British pound. While interest rates are not expected to be increased in the U.K. this year, the BoE will most likely be the second major central bank to raise rates and this prospect should lend support to sterling this coming year.

For our full GBP outlook, read our 2014 GBP Preview.

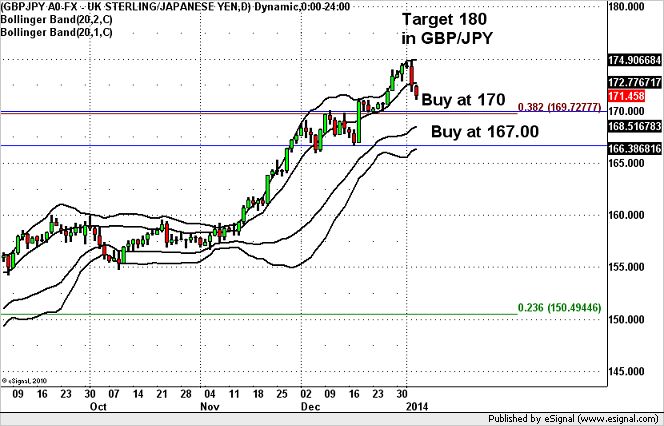

Potential Trade - GBP/JPY to 180

GBP/JPY is one of our favorite 2014 trades because it reflects our view for a stronger U.S. and global recovery. The currency pair has recently pulled back and we see 2 opportunities to buy - right above 170, the 38.2% Fibonacci retracement of the 2008 and 2009 crash and then at 167 for a potential move up to 180 if U.S. rates continue to rise and the U.K. economy continues to improve. If GBP/JPY breaks below 170, it is better to wait for a further decline to the 167 handle before stepping in. GBP/JPY" hspace="5" vspace="5" width="706" height="452" name="143585b6d2bd0ed9_ACCOUNT.IMAGE.143">

GBP/JPY" hspace="5" vspace="5" width="706" height="452" name="143585b6d2bd0ed9_ACCOUNT.IMAGE.143">

By Kathy Lien, Managing Director of FX Strategy

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Top 3 Currencies For 2014

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.