With energy prices on the mend, and the euro up 7.3% against the USD over the past one month, Europe seems to have a solid path ahead. Europe now seems to have a bullish story.

Economic Status of Europe

The European Commission has now upgraded Eurozone economic growth to 1.5% for 2015, from 1.3% guided three months earlier. The Commission now expects inflation of 0.1% in 2015 versus 0.1% of decline projected earlier. However, the forecast for 2016 is reiterated at 1.9%. The year 2016 is likely to see inflation of 1.5%, slightly up from 1.3% expected previously.

The Commission upgraded the job growth outlook. For 2015 and 2016, joblessness in the Eurozone is expected to be 11% and 10.5% respectively, down from previous projection of 11.2% and 10.6%.

ETFs for Europe

To invest in Europe without the fluctuations of the euro, two ETFs stand out – NYSE:HEDJ, NYSE:DBEU.

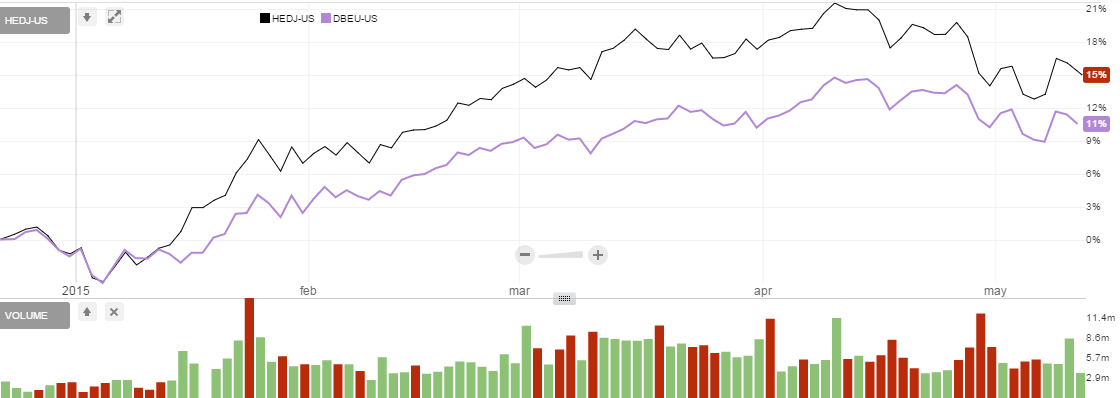

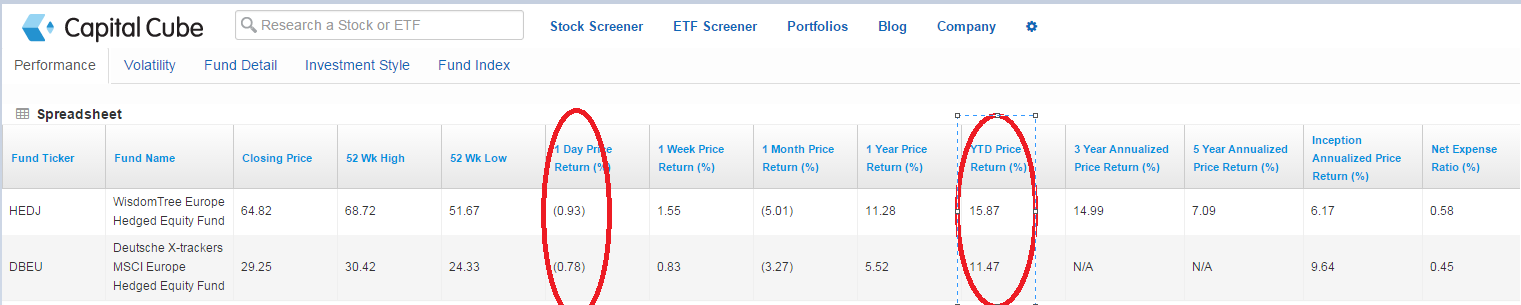

Both of the ETFs have been on a steady increase from the start of the year, and have been moving in the same direction. Analysing these ETFs on price return, HEDJ has given a better price performance as compared to DBEU. Even though the one day price return is down, it might be a good entry point, given the fact that the US 10 year yields are going up, signaling inflation and interest increase in the US.

On volatility comparison, HEDJ is slightly more volatile.

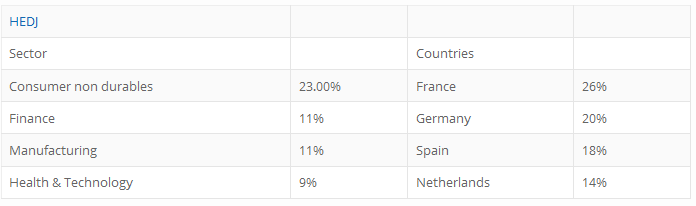

With HEDJ attracting higher average fund flows, HEDJ is a Consumer non-durables focused ETF with investments in France and Germany.

DBEU focuses on the finance sector with investments in UK and Switzerland primarily.

European ETFs with a currency hedge would be a good investment when Europe's fiscal initiatives are working.