The ongoing trade dispute between the US and China has held the world’s attention for well over a year now.

This political battle of world powers has major implications on the global economy, but the US is already feeling market pressures. Back and forth retaliatory tariff hikes continue to put dents in US export figures - especially those of the agricultural industry.

From 1995 to 2017, US agricultural exports grew from $56.2 billion to $140.5 billion - a healthy 150% increase. As output outpaced domestic demand, US farmers and agricultural businesses leaned on export markets to maintain growth. However, in mid-2018, after China hit US agricultural products with a 25% duty - exports began to plunge.

US agricultural exports grew a meager 1% from 2017 to 2018 - driven by a 53% year-over-year decline in exports to China.

Despite recent trade talks and tariff exemption lists, the path forward is still somewhat hazy. Current policies are driving uncertainty around the US’s ability to consistently deliver as an exporter - leading importers to diversify their crop/food sources as a safeguard.

And US suppliers are dealing with the consequences.

Exports to China have declined dramatically

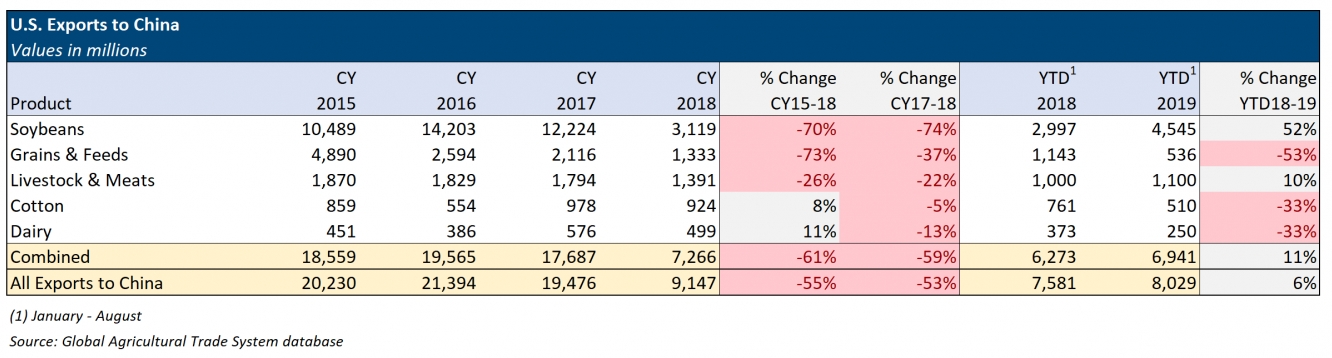

No export to China took more of a hit than Soybeans in 2018, as exports declined 74% year-over-year from $12.2 billion in 2017 to $3.1 billion in 2018. The story is similar for several other key export products - like Grains & Feeds, Livestock & Meats, Cotton, and Dairy. If it’s any consolation, for the current calendar year (through August), exports to China are up 6% over the prior-year period - driven by a small Soybean resurgence. However, the results are still way down from previous years. The US’s total agricultural export value for 2019 is trending towards the first year-over-year decline since 2015.

The overall health of the agriculture industry now and going forward

This is directly correlated to the longevity of the current trade dispute. The US’s benefit of a long-lasting trade relationship - and established infrastructure - will fade with time. Should the trade war continue, other countries’ suppliers can continue to gain footholds.

Moves are already being made to fill the gap. For example, Russia has begun exporting poultry, wheat, and soy to China. The concern is the threat of losing market share - which the US may never get back. It also puts American commodity producers at risk. In other words, the longer these trade wars draw out - the harsher the ramifications for US suppliers.

How long can the US agricultural supply chain sustain? Market-low prices threaten to drive many growers out of business - which impacts the entire US agricultural supply chain.

Even if the dispute is eventually settled, the US agriculture business is still susceptible to future retaliation should relations wear down again.

China isn’t the only problem

Tensions with China aren’t the only problem. The US’s trade relationships with its border countries - Canada and Mexico - face uncertainty as well. Congress hasn’t ratified the United States-Mexico-Canada Agreement - which was formally agreed upon just over a year ago. In the interim period, the US has used tariff hikes as a constant threat towards two of its biggest trade partners.

In May 2018, the US announced tariffs of 25% and 10% on steel and aluminum, respectively. In response, Canada and Mexico issued tariffs on US goods. Although these were all eventually removed, the US’s push for more favorable trade agreements has strained these diplomatic relationships - which the US cannot afford to do.

The upcoming 2020 election will have strong implications on the direction of the US’s agriculture industry and its role in export markets.