AUD/USD we wrote: The long tails on the daily candles could signal a recovery is on the cards but we need to beat resistance at 7780/90 for a buy signal.

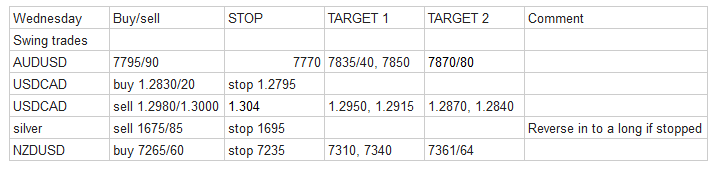

We have the buy signal and reached 7842, but have dipped to retest support at 7795/90.

NZD/USD we wrote: break above minor resistance at 7240/45 is a short term buy signal. Jump in to longs to target resistance at 7275/80. This is the main challenge for bulls today but shorts are risky. A break higher is another buy signal....

I hope you jumped in on the break above 7240 as we rocketed to 7311.

USD/CAD topped exactly at longer term moving average resistance at 1.2975/85 and did take a tumble (well done if you did try the short). We bottomed exactly at the target of 1.2860/50, seeing a good bounce to minor resistance at 1.2945/55. Gains are likely to be limited but if we continue higher try shorts at 1.2980/1.3000 with stops above 1.3040.

USD/JPY we wrote: manages a small bounce but I see no buy signal.

USDJPY had trouble recovering as expected and has collapsed again below 105.84/88 to the next target of 105.55/50 as I write. A break below 105.20 targets 104.90/80, 104.64/60 & 104.35/32.

EUR/JPY selling opportunity at 131.20/30 did not work as we unexpectedly reached 132.01, but then collapsed back below 131.20/30.

GBP/JPY hit important Fibonacci and 200 day moving average resistance at 147.70/80 for a selling opportunity with stops above 148.10.

A perfect trade as we topped at 148.00 and collapsed to first support at 146.55/45 and bottomed exactly here. An easy 115 pips.

A short term burst for DAX bulls took us to the next target of 12260/270 but we topped exactly here. Looks like they have lost control again in the bear trend.

FTSE higher as predicted with a good run to within 7 ticks of very strong resistance at 7195/7205.

Unfortunately we did not quite make it to our selling opportunity here but I hope you managed to exit longs at least.