After a week when the NY/NJ area saw an earthquake, an eclipse, and a gorgeous 75-degree spring day, it is time to get back to work.

Yesterday’s CPI report was not expected to be particularly great. One of the biggest conundrums of market behavior recently has been the question of why investors seemed to remain very confident that the Fed will cut rates several times this year, even as forecasts for the path of inflation have backed off of what they were last year (when most forecasters had core CPI returning placidly and obediently to the neighborhood of 2% this year). The a priori consensus forecasts for yesterday’s CPI figure were +0.28% m/m on core and +0.33% m/m on headline. The Kalshi market was in line with that, although CPI swaps were a touch lower on headline at +0.29% (seasonally adjusted, but CPI swaps trade NSA CPI). That’s not wonderful: 0.28% on core would annualize to 3.4% y/y.

The assumption has been that even if in March we are annualizing to 3.4%, the coming deceleration in rents will push everything back down to where it needs to be. The problem with this has always been (a) the strongly-held belief that rents would slip into deflation this year were never based on good analysis, and more importantly (b) this assumed that nothing unforeseen would happen in the other direction. It is characteristic of inflationary periods, of course, that bad things happen on the upside. So this was always sort of assuming a can opener,[1] but at least forecasts for the current data were reflecting that these things had not happened yet. To be fair, the consensus on core has been low relative to the actual print for four months in a row, but at least folks are forecasting mid-3s, rather than 2.0.

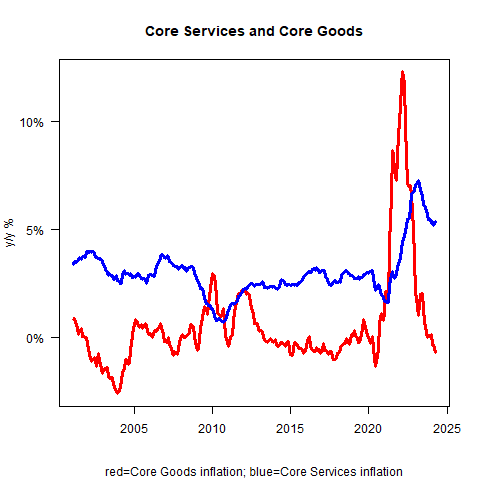

Now, let’s review one other thing before we look at some charts. The recent story boils down to this: sticky rents, sticky wages. While core goods has been pulling down core inflation, that game was running out of room. The next part of core deceleration relies on un-sticking the sticky rents, and sticky wages.

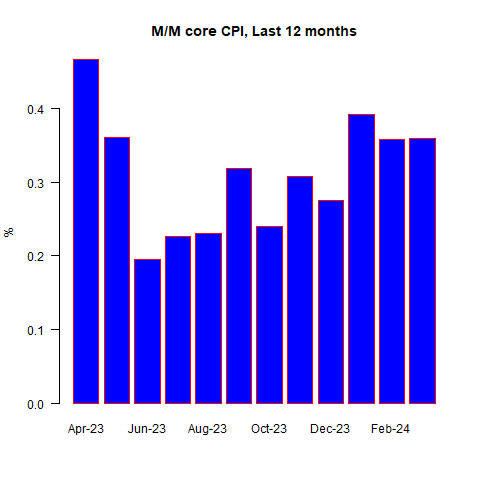

So here we are. Yesterday’s figure +0.36% on core CPI, +0.38% on headline (seasonally adjusted on both). This makes the last 3 core CPIs 0.39%, 0.36%, and 0.36%. The chart below of the m/m core CPI figures does not really give the impression of a decelerating trend.

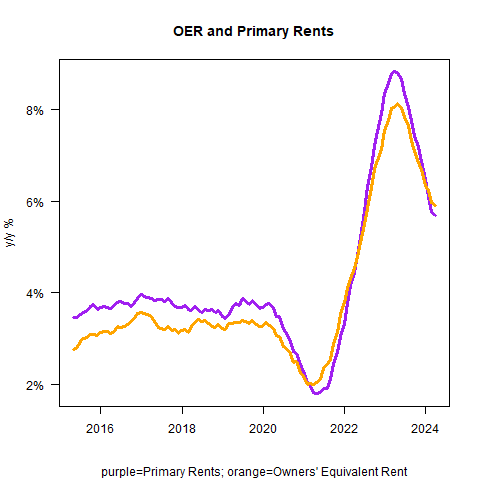

We always look these days first at rents, because that is so important to the disinflation story. Rent of Primary Residence was +0.41% m/m, down from 0.46% last month. Owners’ Equivalent Rent was steady, at +0.44%. Remember that there had been some alarm two months ago, when OER for January jumped to 0.56%, that this was due to a new survey method or coverage and it was going to be repeated going forward.

That was always pretty unlikely, but now we have had two months basically back at the old level and the January figure appears to be an outlier. 0.41% on Primary and 0.44% on OER is not hot, just sticky. It isn’t going up; it’s just not going down very fast.

Rents will continue to decline. But the failure of rents to slip into deflation is a source…maybe the source…of the big forecast error made by economists about 2024 CPI.

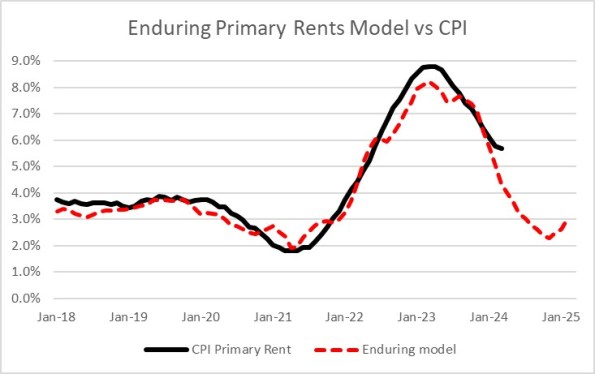

Our cost-based model for primary rents, which never got even vaguely close to deflation, has now definitively hooked higher with the low coming in November. Rents haven’t been decelerating as fast as our model had them, but if anything that’s a source for concern on the high side.

Outside of rents, core inflation ex-housing rose to 2.38% y/y. That sounds like “most of the economy is on target,” but that’s not how inflation works. There’s a distribution, and if the ‘rents’ part of the distribution is going to be higher than the target then everything else needs to average something below the target.

We aren’t there. And, as I noted above, we’ve squeezed out just about everything we can from core goods. Actually, y/y core goods dropped to -0.7% thanks partly to continued declines in Used Cars (-1.1% m/m) and some decline this month in New Cars (-0.2%). I think the latter might partially reflect discounts on the EV part of the fleet, where cars for sale have been piling up as manufacturers under political pressure have been producing far more of them than people want.

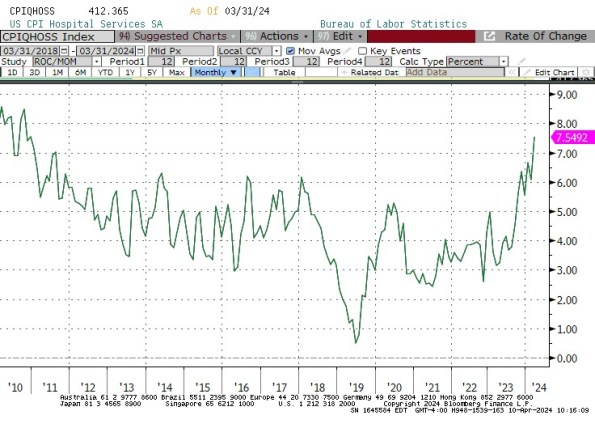

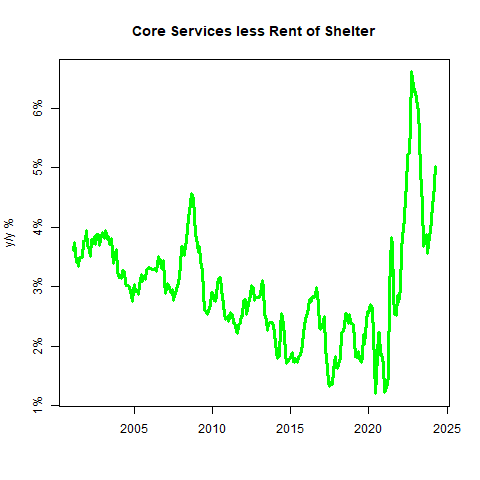

Note that core services, even with the decline in y/y rents, moved higher this month to 5.4% from 5.2% y/y. Some of that was medical care, which was +0.49% m/m driven by another jump (+0.98% m/m) in Hospital Services. The y/y rise in Hospital Services is now up to 7.55% – the highest since October 2010.

Partly driven by hospital services, the ‘super core’ (core services ex-rents) continues to re-accelerate.

Again, this is not what the Fed wanted to see; and it’s driven partly by the stickiness in wages. The Atlanta Fed’s Wage Growth Tracker has decelerated but is still at 5.0% y/y. That’s not the stuff that 2% core inflation is made of.

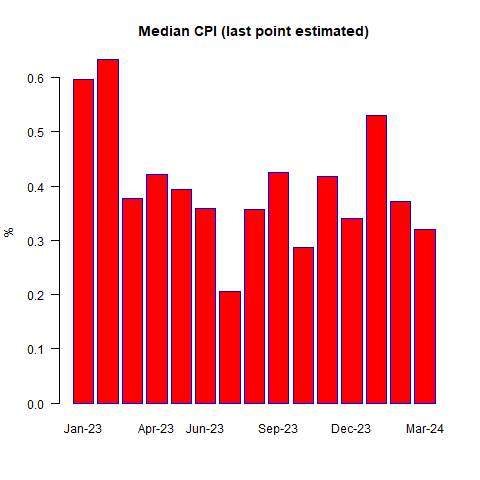

Let’s take one moment to look at a piece of good news from the report. My estimate of median CPI, which is my forecast variable because it is not subject to outliers like Core CPI, is +0.32% for this month. Because I have to estimate seasonals for the regional housing numbers, actual Median might be a teensy bit higher or lower but in any event the chart of Median CPI is much less alarming than the chart of Core CPI.

I should observe that the news there is not completely good, since a signature of inflationary environments is that tails are to the upside – that is, core is persistently above median. That was true during the upswing, but during the moderation core has gone back below median. But this bears watching, and if core starts to routinely print above median it will be a negative sign. For now, though, the Median CPI is good news. Relatively.

So let’s talk policy.

The Administration always seems to be confused about why, despite strong jobs numbers, consumers consistently report dissatisfaction with the economic situation. There really shouldn’t be any confusion. Consumers, especially those not in the upper classes, hate taxes. And in addition to a high direct take from the government in explicit taxes, consumers are also facing persistent inflation that the Administration says isn’t there. Inflation is a tax, and it sucks worse than direct taxation because you can’t rearrange your consumption very well to avoid it. (You can rearrange your investment portfolio, but a strikingly small number of people seem to have actually done that even three years into this inflation episode. If you’re curious about how, you really should visit Enduring Investments and ask.)

On the other question of policy, and that’s the Fed: I can’t see any rational argument for cutting rates in June. Actually, on the data we have in hand I can’t see an argument for cutting rates in 2024, except for the one the Fed doesn’t consider and that’s that interest rates don’t affect inflation. To cut the overnight rate, the Fed would have to rely on forecasts that inflation is going to get better. And to do that now, when forecasts have been persistently wrong (and not by just a little bit but about the whole trajectory) since 2020, would be incredibly cavalier. The FOMC still consists of human beings, so never say never. And the inflation data should improve as the year goes along and rents moderate. I just don’t see any sign that it’s going to moderate enough to say ‘we’ve reached price stability.’ Sticky in the high-3s, low-4s is still where I think we’re coming out of this.

[1] A physicist, an engineer, and an economist are stranded on the desert island with nothing but a crate of canned food. “How are we going to get the food that is inside of these cans?” asked one. The physicist says “well, we could heat the cans, carefully, in a crucible we make from ocean clays. Eventually the heat will cause the can to burst and we can get the food inside.” The engineer says “that will take too long. What we need to do is take some of these coconuts, raise them up to a great height with a series of ropes I will design, and allow them to smash down onto the cans, breaking them open.” The economist says “I have a solution that is far easier than what you fellows are doing. Here is how we do this. First, assume a can opener….”