I said two months ago that I didn’t think the Fed should ease, but they would anyway. And they did, by cutting overnight rates 50bps. Then last month I said:

“Getting rates back to neutral, around 4% or so, is not a bad idea as long as quantitative tightening continues. It isn’t the best idea, but it’s not a disaster. But this raises the stakes for the next FOMC meeting… I suspect 25bps is the only choice they can make which will make almost everybody equally unhappy. There’s more data to come before that meeting, but the FOMC’s path has narrowed considerably as inflation remains sticky.”

And the Fed, on cue, cut rates 25bps.

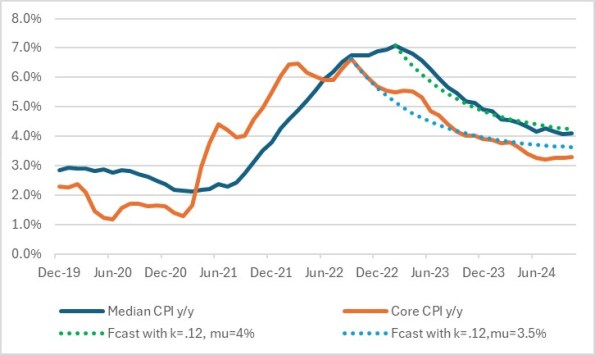

But the Fed is getting into an uncomfortable position now, because inflation looks like it has leveled off. As I have said for a while it likely would.

We will get to that. First let’s look at the number.

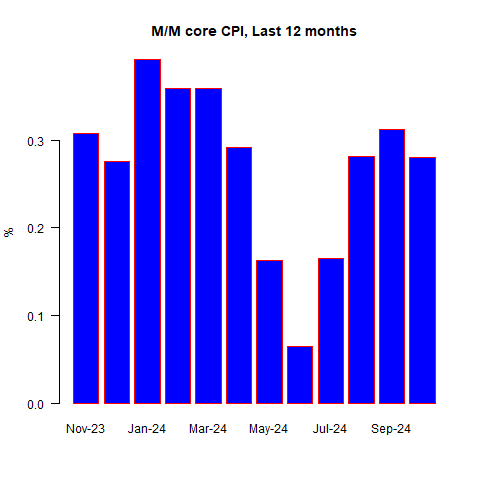

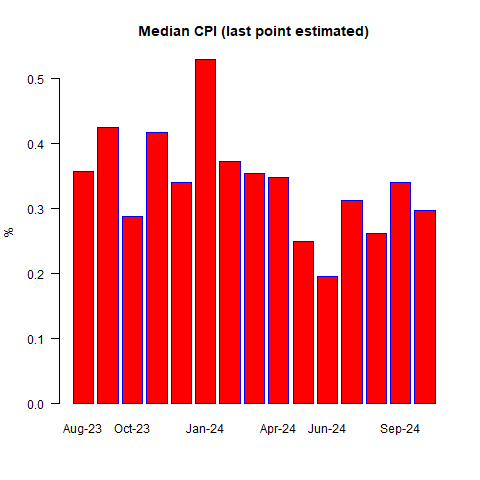

The economists’ consensus has been drifting higher in recent days, as data on used cars was suggesting that component would be an add in October. Consensus going in was for +0.21% headline (SA) and +0.28% on core. The actual numbers were +0.24%/+0.28%, so pretty close to the consensus with y/y headline inflation at 2.58% and y/y core at 3.30%. It doesn’t seem to me, though, that the chart of core CPI for the last year is particularly soothing. More and more it appears that May-June-July were the outliers, and we are hanging out around 0.3% per month on core inflation.

Also, my early estimate for median inflation is 0.296% m/m, leaving y/y basically unchanged at 4.09%.

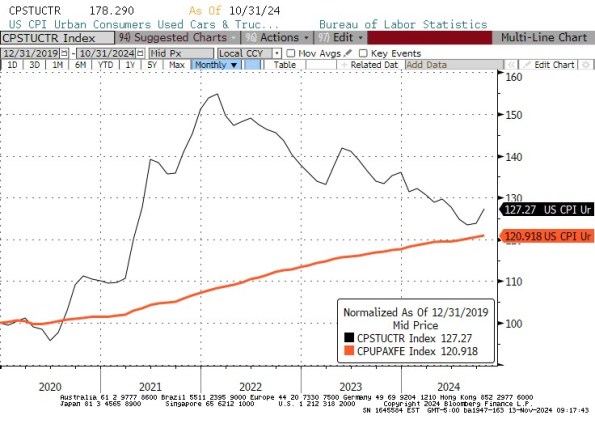

Used Cars was indeed high, at +2.7% m/m. But the real problem with Used Cars isn’t this month. The real problem is that for two and a half years Used Cars has provided steady disinflation as the COVID spike (caused because new cars were not being produced as quickly thanks to supply chain problems, but the deluge of money meant that people had lots to spend and wanted cars dammit) ebbed…but that game appears to be about over.

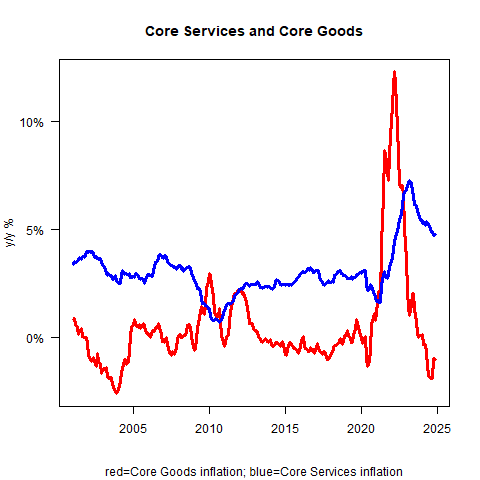

So if you want to get inflation lower from here, it’s going to be a challenge to get it from core goods, which was steady y/y at -1% this month but only because Apparel had a large decline. Core goods is likely to head back to small deflation or small inflation (with the dollar’s recent strength, small deflation is the better guess), but higher from here. We have known this for a while. The heavy lifting is going to have to come from shelter, or supercore, going forward.

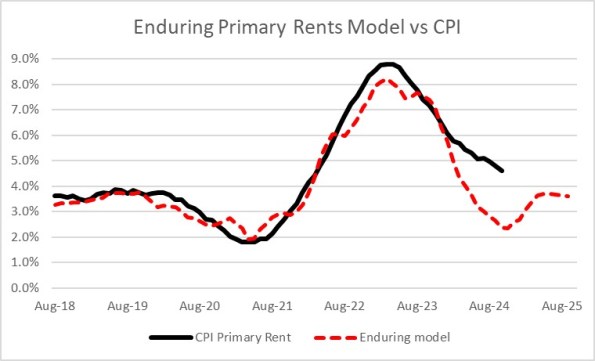

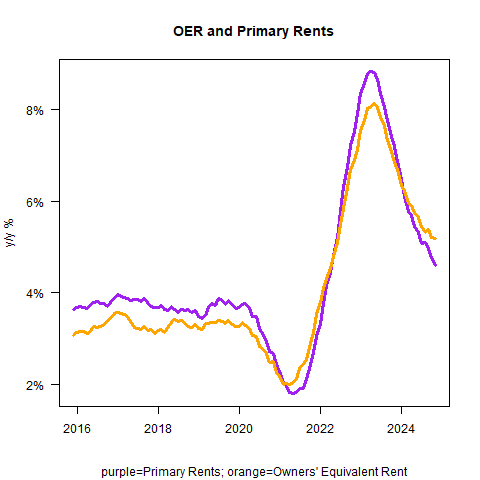

So as for shelter…OER was +0.33% m/m in September but +0.40% m/m in October. Primary Rents were +0.28% last month and +0.30% this month. The y/y disinflation is continuing, but still no sign of the hard deflation we were promised.

The good news here for 2025 is that if Trump’s plan for mass deportations happens, and if “mass” means millions, then some of the pressure on shelter that developed over the last few years as ten million additional heads needed roofs over them will abate. Then maybe we can get shelter inflation lower. There is a modest additional “if” part, though, and that is “if landlord costs can stop increasing.” Our bottom-up landlord-cost-driven model has primary rents eventually converging just south of 4%. Better, but still not great.

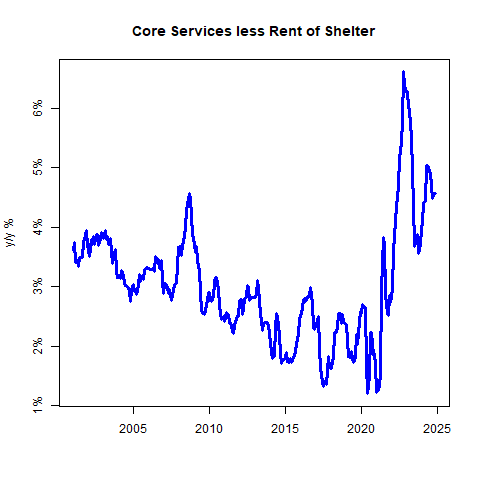

So that leaves supercore, which unfortunately ticked higher this month.

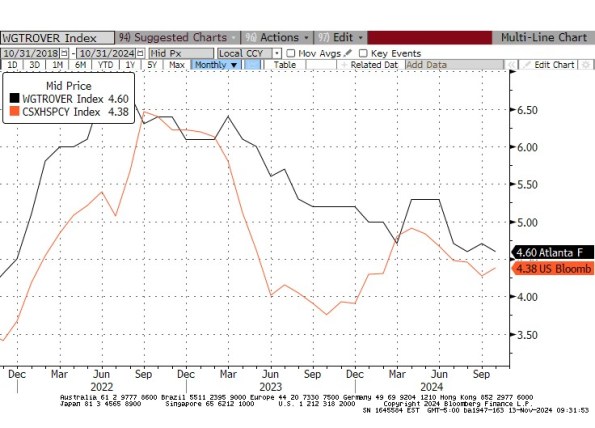

The problem there also remains the same. Stop me if you’ve heard this one, but wages are moving only slowly downward, and supercore is where the wage/price feedback is the strongest. The red line below is Bloomberg’s calculation of supercore and the other line is the Atlanta Fed wage growth tracker. And the problem is that median wages don’t tend to move drastically differently than median inflation, which as we have discussed is proving sticky.

If core goods is no longer declining, and shelter isn’t doing the heavy lifting of deflation, and if core-services-ex-shelter (supercore) is leveling off…then gosh, that looks a lot like high-3s-low-4s village.

As an aside: I have been saying ‘high 3s, low 4s’ would be where inflation settles in…and I’ve been saying that for a couple of years. Even I am a little amazed that I haven’t had to tweak that forecast much, other than to allow that we might briefly dip below that if housing followed the dip-and-bounce that our model had. I don’t want to put on false humility, because I was saying that inflation would stay sticky and too high long before anyone else was saying that, and I had the correct reasons and I think I’ve guided readers and clients well. But getting the landing spot right, that far in advance, also clearly involved some luck. I am saying that partly to keep the Fates on my side. But you should also know that someday, it might turn out that ‘high 3s, low 4s’ needs to be adjusted. And I’ll still consider this a pretty good call!

The Fed’s actions can clearly affect that eventual equilibrium level, but it doesn’t look like they are yet taking this seriously. The game isn’t over and there will be more CPI reports and more after that. But for now, this looks like a policy error – or worse, a blatant attempt to influence the election – and unless something unexpected happens with prices it looks like the Fed is going to have to choose between the right policy move (which means continuing tight policy) that appears to be political, or continuing to loosen policy so as to not appear to be political, and temporarily surrendering on inflation. I suspect that the FOMC will vote to keep rates steady at the next meeting.

By the way, if you care about the crypto space at all and haven’t read my column on stablecoins, you should, and you should be sure to circulate it. The column is here.