Pre-market update:

- Asian markets traded 0.1% lower.

- European markets are trading 0.2% higher.

- US futures are trading 0.1% higher ahead of the market open.

Economic reports due out (all times are eastern): MBA Purchase Applications (7), Durable Goods Orders (8:30), Jobless Claims (8:30), Chicago Fed National Activity INdex (8:30), Chicago PMI (9:45), Consumer Sentiment (9:55), Leading Indicators (10:30), EIA Petroleum Status Report (10:30), EIA Natural Gas Report (12)

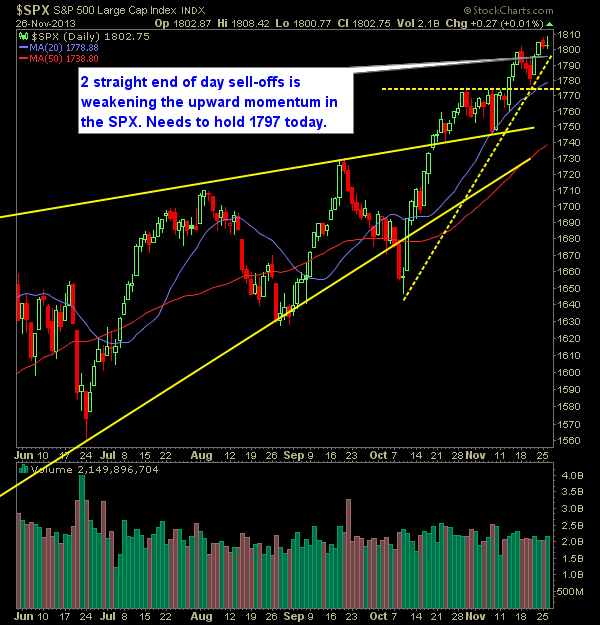

Technical Outlook (SPX):

- Another end of day, final hour sell-off leads the market to a 'scratch' of a day.

- Second straight day we are seeing heavy volume pour in at the day's close. Yesterday was extreme selling at the close. Futures saw 5x - 6x volume for what is typically considered routine in the final 20 minutes.

- It is a safe bet that as the day wears on, the volume will taper off. Friday, it will be non-existent.

- A move below 1800 could get traders rather uneasy. The key level for the bulls to hold sits at 1777. At that point the current rally would be over and a new lower-low would be in place.

- I am somewhat uneasy going into next week, however, I will not attempt to front-run any downward move. Instead I will lessen my risk to the upside where appropriate.

- In essence, I don't see any reason to be short yet in this market. Wait for the market to change directions first.

- Keep watch for a post that I will do later today detailing a nasty bearish wedge that has formed over the last two months on the S&P 500.

- The market can continue to rise higher if it so chooses and if so, you continue to trade long. However, bearish signs that arise should cause you to temper your expectations of a strong future upside move and manage the risk accordingly.

- SPX 30-minute chart is sporting a short-term double-top.

- The 10-day moving average has been an excellent guide for the health of this market during strong uptrends. No different here.

- VIX remains stagnant at 12.81.

- SPX has traded higher for seven weeks straight on the weekly chart. That is the most consecutive weeks there's been since the March '09 bottom.

- Markets don't care about the economy nor earnings. That is not what is driving them. The markets only care about what the Fed is doing to keep equities propped up.

My Opinions & Trades:

- Added on new long position yesterday: JAH

- Closed out LUK at 28.73 for a 0.9% loss.

- At most I will add only one position. We are getting into extremely light volume levels here.

- Current Longs: GT at 21.71, ETFC at 17.63, KKR at 23.18, AAPL at 524.09, JAH at 56.50.

- Long 50% / Cash 50%

Chart for SPX:

Original post