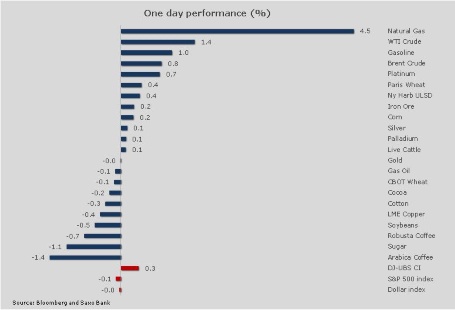

• Natural gas (NGG4) has surged to the highest price in two years as the sustained cold US winter continues to keep demand for heating at elevated levels.

• WTI Crude oil (CLH4) receiving a lift from the opening of the southern part of the Keystone pipeline, which will help to further reduce the bottleneck at Cushing, Oklahoma, the delivery point for WTI Crude.

• Gasoline higher despite the weekly inventory data, due Thursday at 16:00 GMT, is expected to show that inventory levels has risen to a one-year high.

• Platinum (XPTUSD) has resumed its rally as mines in South Africa brace for their biggest stoppage since 2012. Key resistance lurking above at 1,481 USD/oz.

• Soybeans (ZSH4) lower again today after yesterday's steep drop, which was triggered by a forecast for rain in Argentina after hot and dry weather raised the risk of reduced yield.

• Raw Sugar (SBH4) drops to the lowest level since June 2010 as ample global supplies combined with continued speculative selling presurise the price even further. A major forecaster sees a rebound later in the year after some additional weakness, with the market moving towards being better balanced as low prices lead to a cut in production.

• Arabica coffee drops as a high percentage of the 2013-14 crop remains unsold.