Federal Reserve Attempts To Push Short Yields Higher

Source: Short Side of Long

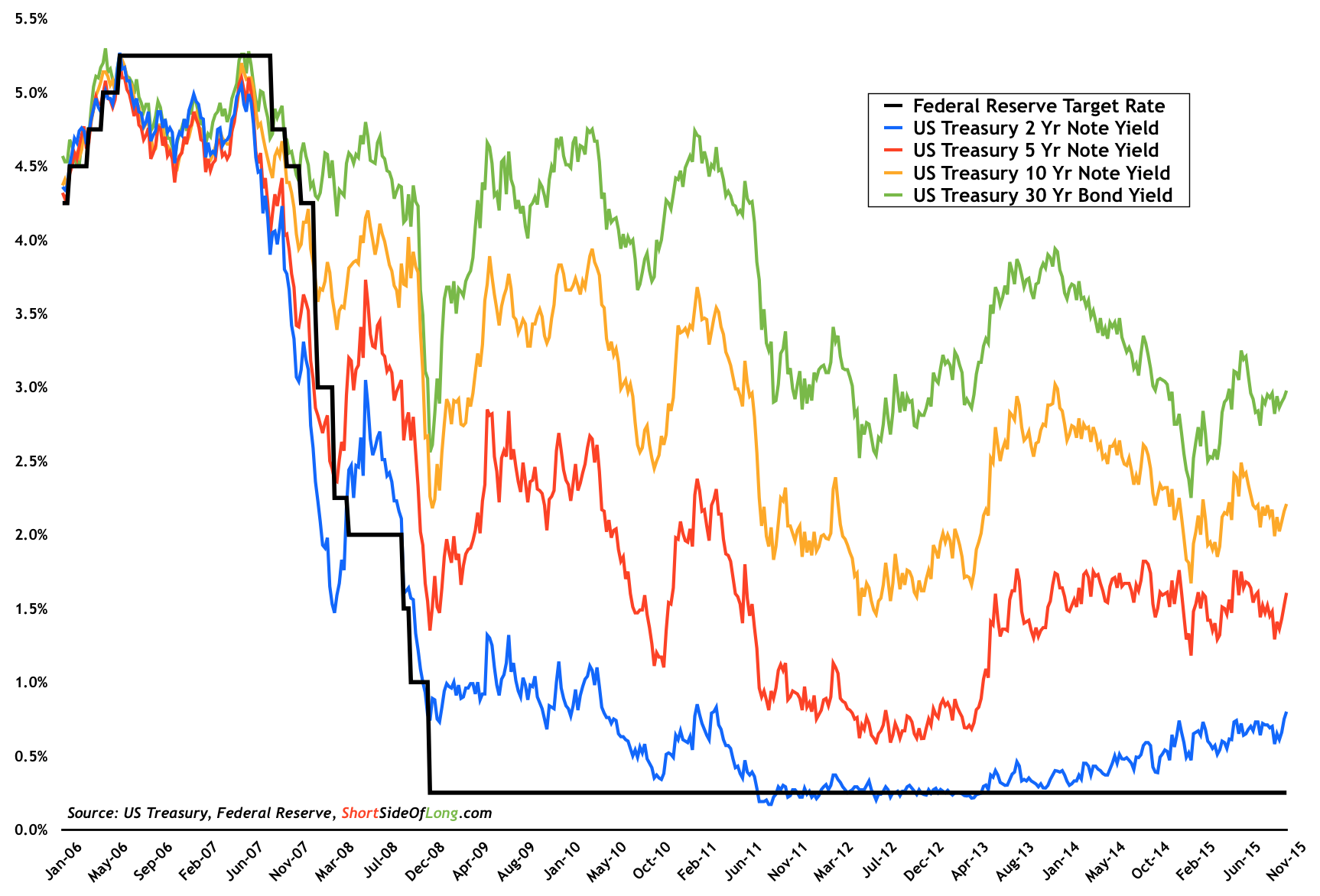

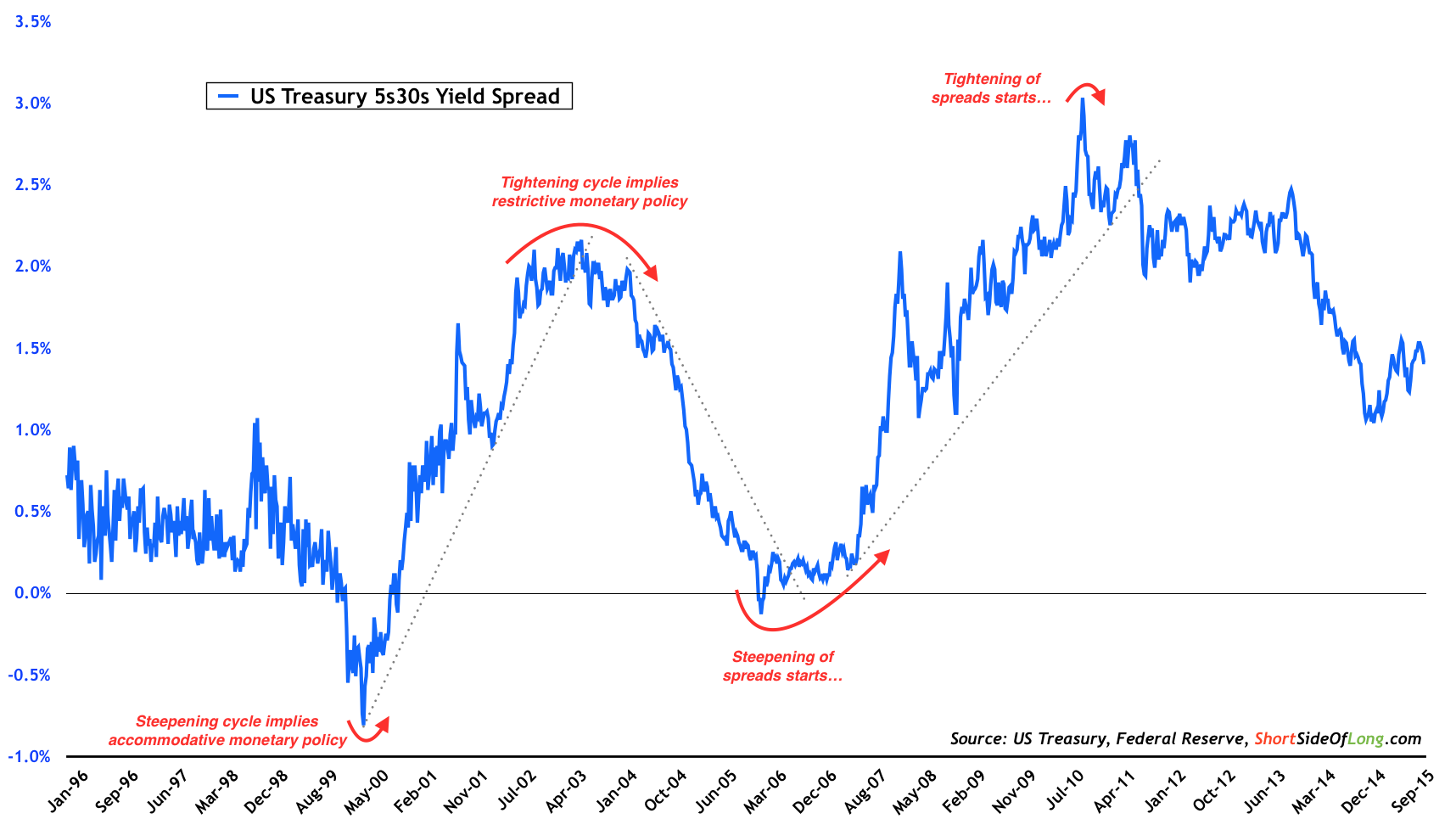

Federal Reserve is on a mission to push rates out from the zero and get out from the so called “emergency” monetary policy. Janet Yellen is speaking as I write, reiterating that the December FOMC meeting will be “live”. The current probability of at least a 25 basis-points increase in Federal Funds Rate has risen above 50%, while January 2016 meeting is approaching odds of 2 in 1. As we can see from the chart above, the 2-year Treasury yield has technically broken out of its prolonged range-bound consolidation zone and is now moving above 0.8%, while the 10-year note is currently yielding 2-and-a-quarter percent. This has also pushed the yield spread between the long bond (30 Year) and the middle maturity (5 Year) into a flattening trend once again.

30-Year, 5-Year Yield Spread Is Flattening

Source: Short Side of Long

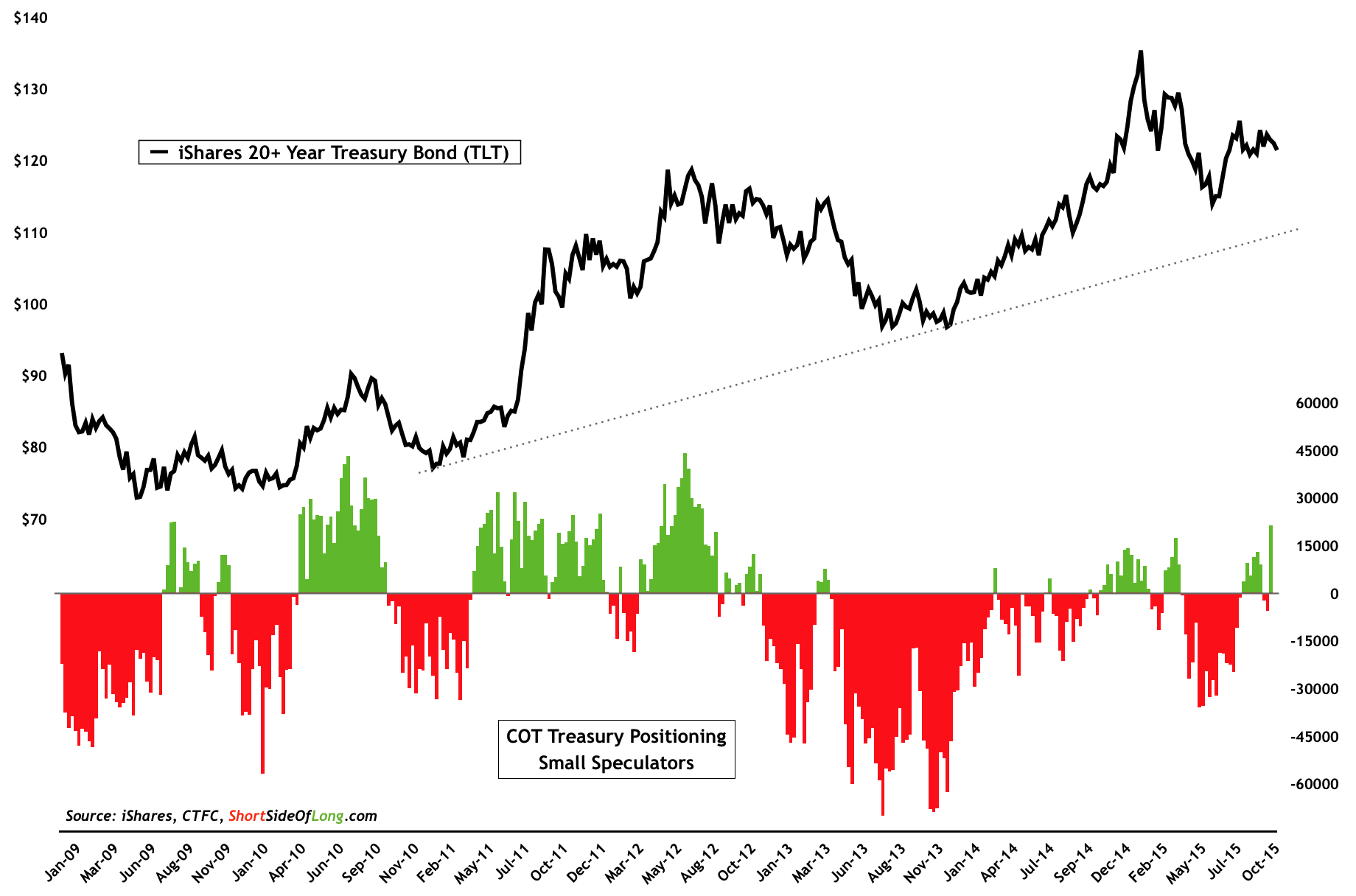

Interestingly, it seems that hedge funds and other speculators have not been positioned correctly, especially when one considers rising rate-hike probabilities in recent days. Latest Commitment of Traders report showed that Long Bond small speculator COT readings jumped to the highest net long position since middle of 2012, just as the Euro Debt Crisis was in full swing. Favoritism toward Treasuries most likely occurred as money-manager positioning turned defensive, with the recent volatility spike in the stock market.

Long Bonds: Funds Hold Big Net Long Positions

Source: Short Side of Long