Loonie bulls have been letting out a sigh of relief recently as the pair appears to be making a substantial recovery. However, the Loonie’s recent bullish stint may be ready to come to a screeching halt as a result of a developing chart pattern. Moreover, Parabolic SAR and the Commitment of Traders report could be signalling that this recovery might be more temporary than it might at first appear.

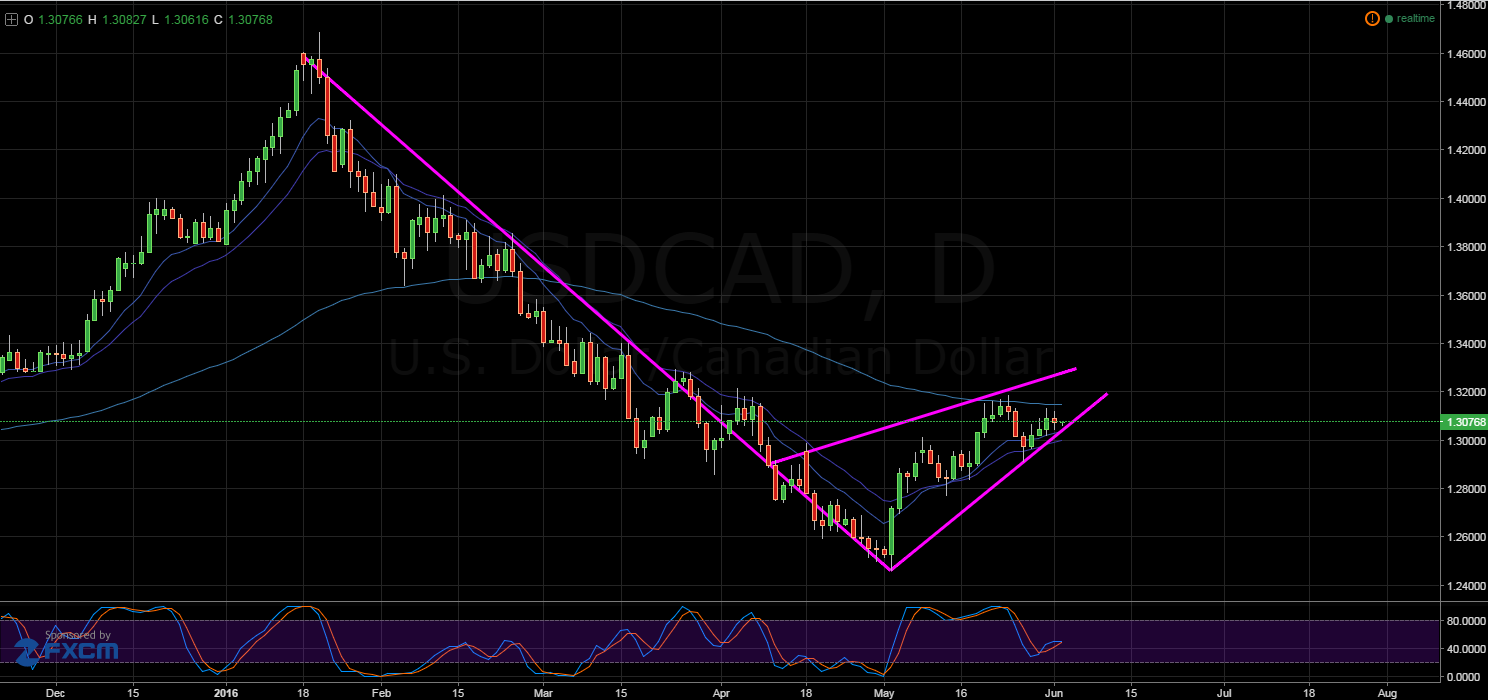

Taking a look at the daily chart, a rising wedge pattern is taking place which could send the pair plunging upon completion. This imminent dip could be closer than one would think given the narrowing of Bollinger® bands in recent sessions. Specifically, on the H4 chart, the bands are on the verge of a potential breakout which could mean this wedge completes in the very near future.

Additionally, the 100 day EMA is presently providing some strong dynamic resistance which should limit how high this wedge formation can carry the Loonie. Whilst this EMA could eventually allow the pair to travel higher, it remains unlikely that the USDCAD would be able to breach the long-term zone of resistance at 1.3302.

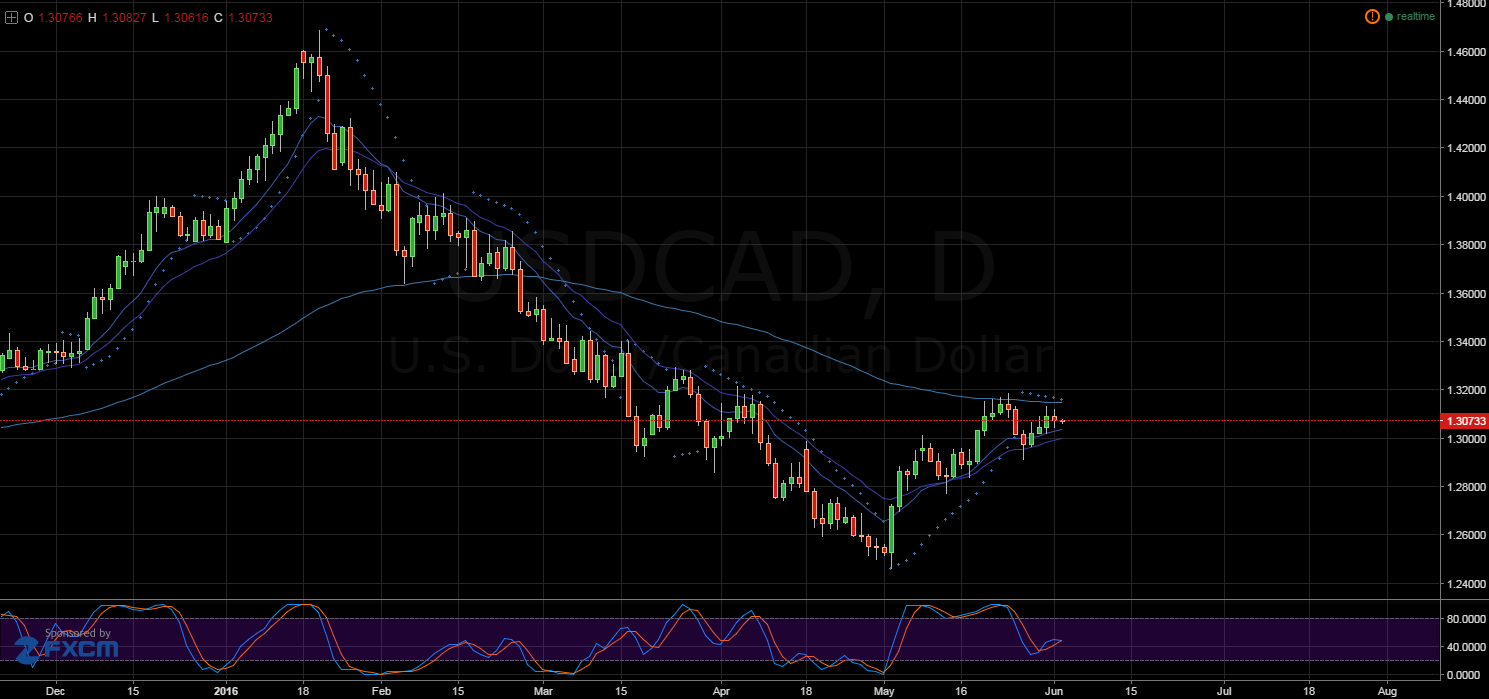

Aside from the EMAs and Bollinger bands, the Parabolic SAR indicator is also signalling that the Loonie is rapidly running out of upwards momentum. As shown below, the indicator is signalling that the recent bullish trend may have reversed. Consequently, a breakout to the downside could be in the cards in the immediate future.

Furthermore, the most recent Commitment of Traders report shows that, despite recent performance, bias is beginning to shift towards long positions on the CAD. Consequently, the Loonie seems to be edging towards a cliff which could undo much of its recent progress.

Ultimately, there are significant grounds to doubt the long-term viability of the Loonie’s recent recovery. The combination of a rising wedge formation, EMA activity, Bollinger bands, Parabolic SAR, and the COT report give some compelling evidence as to why the downside may be the safer bet. However, keep watch this Friday as I’m sure there will be jawboning and volatility in the wake of Governor Poloz’s announcement.