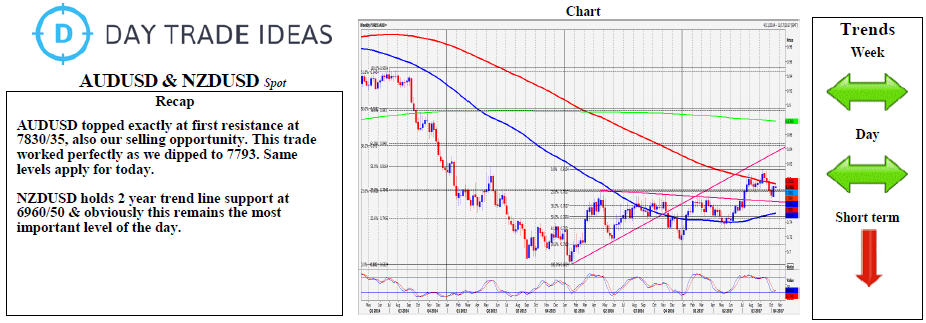

AUD/USD holding below at 7835/31 is a sell signal (we topped exactly here yesterday) targeting 7790 and 7770/65, perhaps as far as the 2 week low at 7735/30.

First resistance at 7830/35. Try shorts again, with stops above 7860. Next target and strong resistance at 7880/85. Try shorts with stops above 7900.

NZD/USD tests 2 year trend line support at 6960/50 as we over run to 6929. Obviously this is the most important level of the day with a slightly positive candle on Monday. Try longs use stops below 6910 as we become oversold. A break below 6910 is a sell signal however targeting 6885/80, 6860 and the 2017 low at 6820/16.

Holding 6950 allows a recovery to 6990/7000. We should struggle here initially but further gains eventually meet resistance at 7045/50 and a high for the day likely.