In this article we look at how global property price trends influence financial sector stocks, and perhaps more interestingly - what the outlook is.

The chart comes from a broader discussion on global property price trends in the latest edition of the Weekly Macro Themes report.

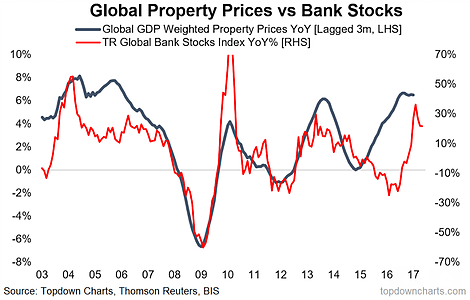

The chart below shows a monthly view of global GDP weighted property price growth (year-over-year) vs the Thomson Reuters global bank stock index. There is a clear link, and some important reasons why they generally move in unison.

There is a fairly intuitive or logical economic rationale for this kind of relationship and the rule of thumb is that property price gains are good for banks (improves asset quality and is consistent with credit growth), and that falling property prices are bad (headwind to credit growth and presents risks on the credit quality front).

Thus, last year when we saw the big rebound in bank stocks, it was actually more about the upturn in global property prices. The other thing I've discussed previously is that rising global property prices is supportive for global growth, and given the impact on growth and inflation - tends to put upward pressure on bond yields... which banks also tend to benefit from.

At present, property prices are still rising at a global level, so this presents tailwinds to growth, inflation, bond yields, and bank stocks.

So while it pays to keep track of yield curves, and bond yields, and equity beta more broadly, to get the outlook for banking stocks, pay attention also to the trends in property prices.