Over the last several months I’ve been writing about the bond market throwing us a possible curveball. Meaning, instead of ongoing rising interest rates we may see rates falling.

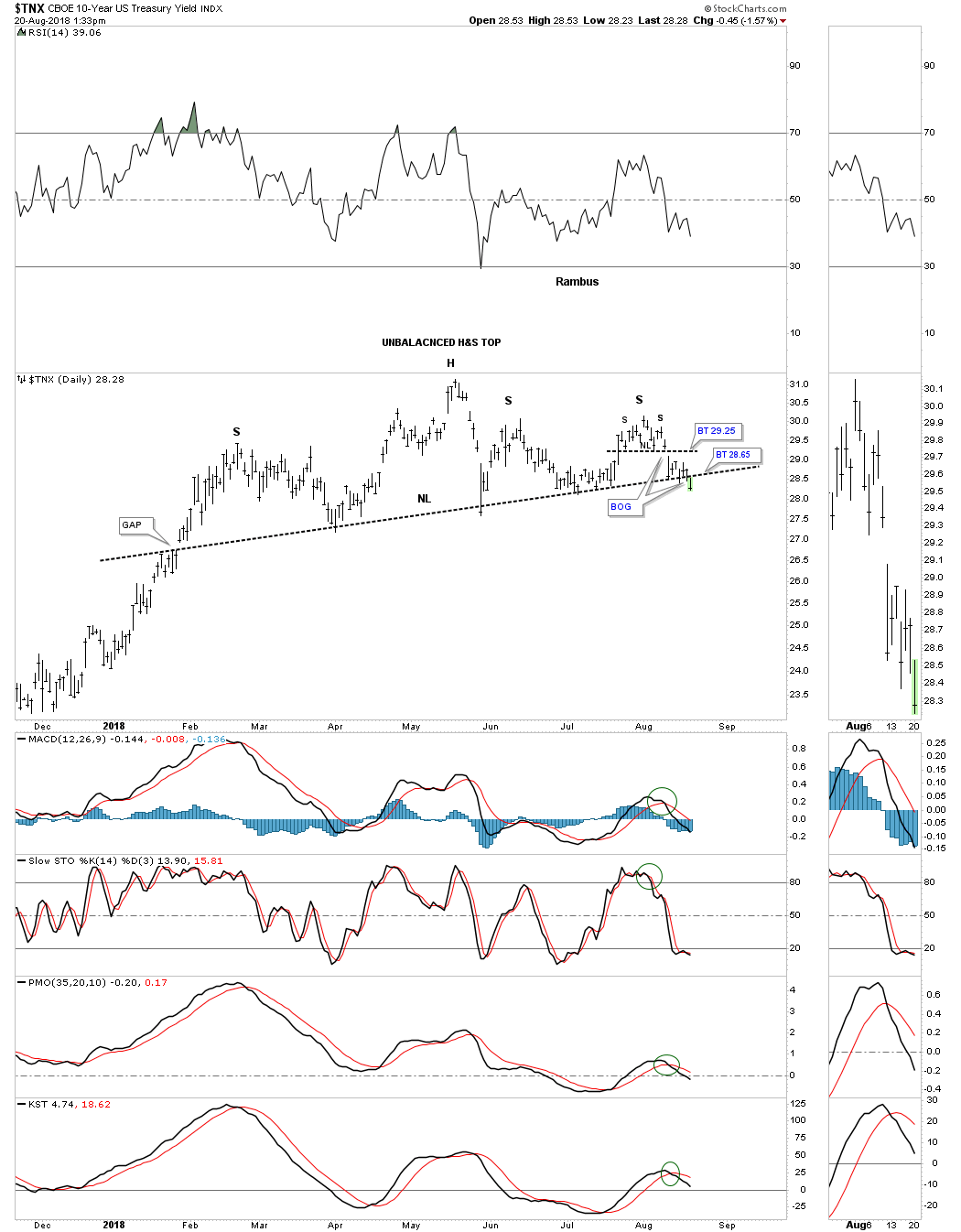

Yesterday, the 10-year Treasury yield finally broke below the neckline we’ve been following that started developing back in January of this year.

I’ve labeled the H&S top as an unbalanced H&S top as the price action formed a second right shoulder that was a small H&S top. A backtest to the neckline would now come into play around the 28.65 area.

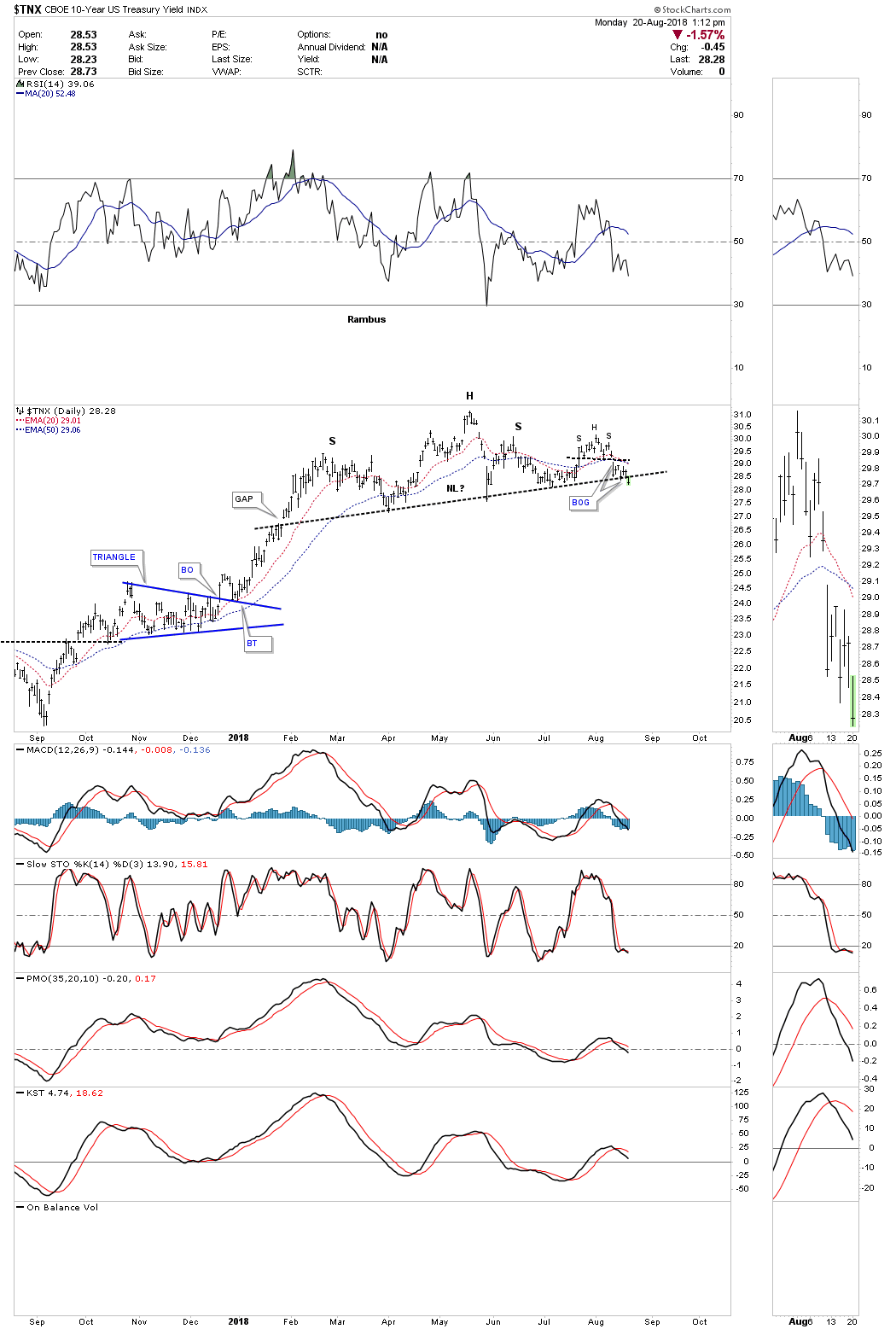

Here's a longer term daily chart:

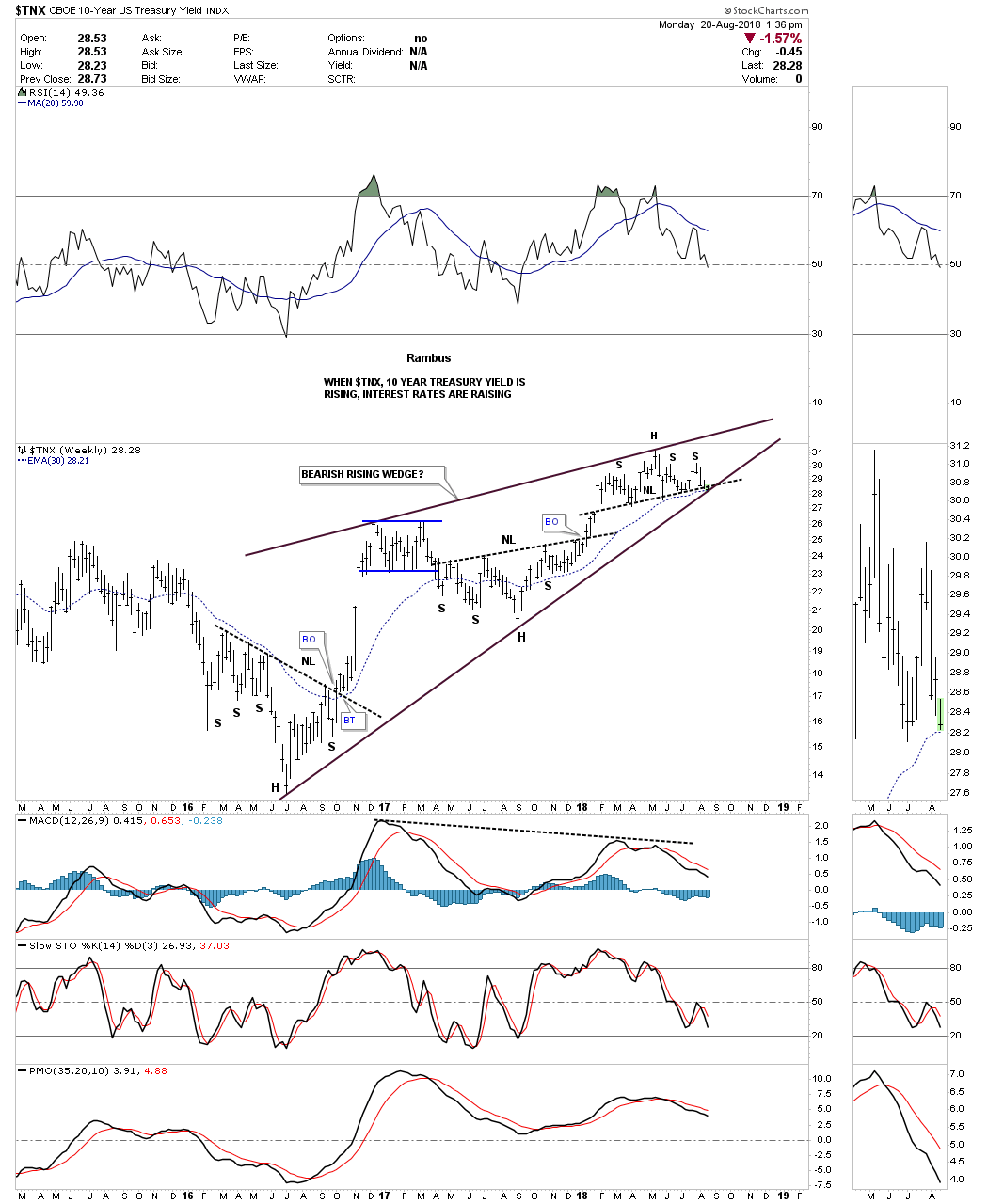

The weekly chart shows the TNX has been rising for the last two years, building out a possible bearish rising wedge with the H&S top forming at the top. That H&S top is strongly suggesting the bottom rail of the black rising wedge is going to give way to the downside. The curveball has almost reached home plate.

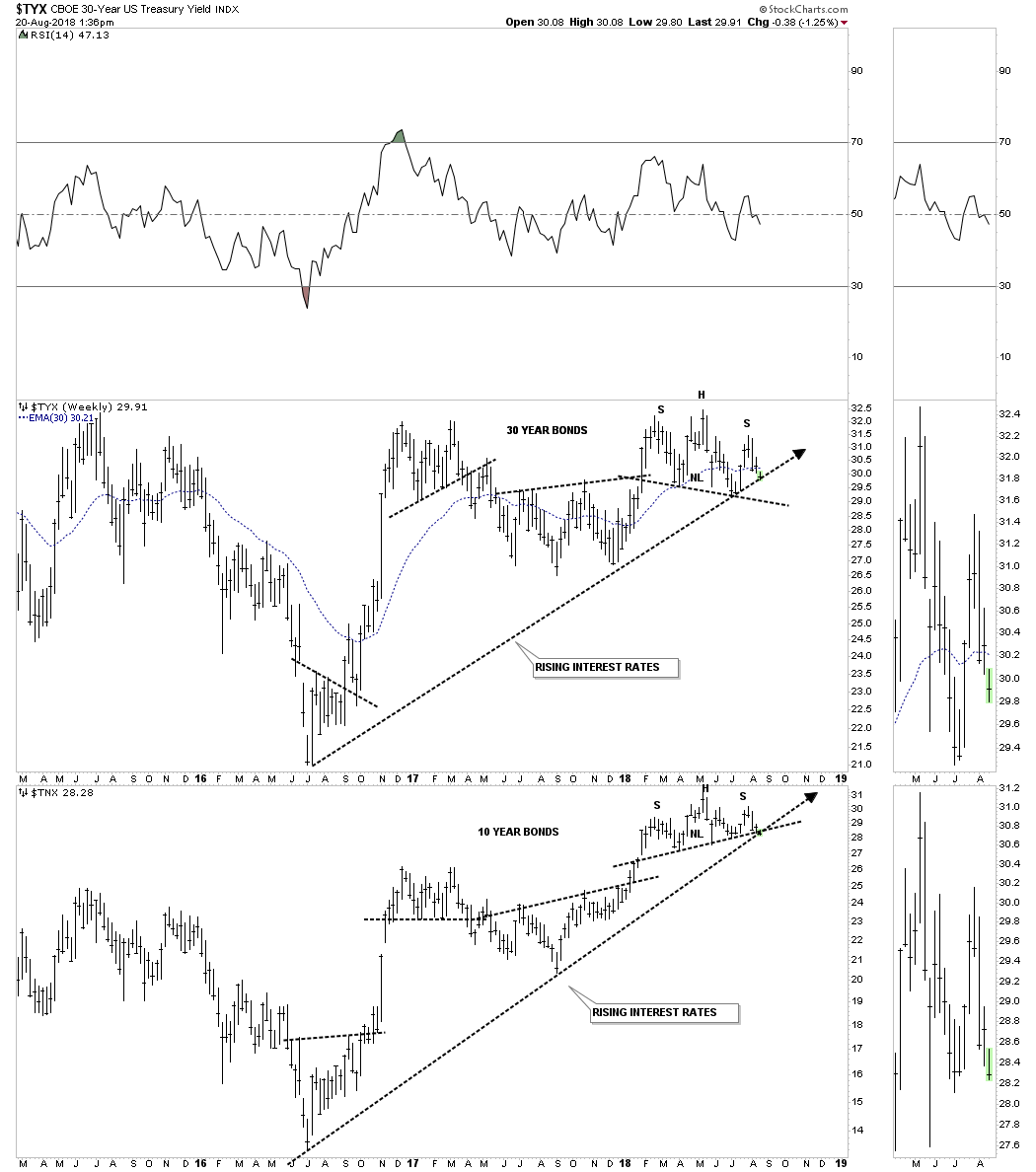

Below is a combo chart showing the TYX, 30-year Treasury bond on top and the TNX, 10-year bond, on the bottom.