TIPS may tip Fed policy, as declining real yields indicate a weak economy and loose money.

Even investors who aren’t interested in the minus 0.91 yield on 10-Year Treasury Inflation Protected Securities are closely following TIPS these days, for clues about what the Federal Reserve has in store.

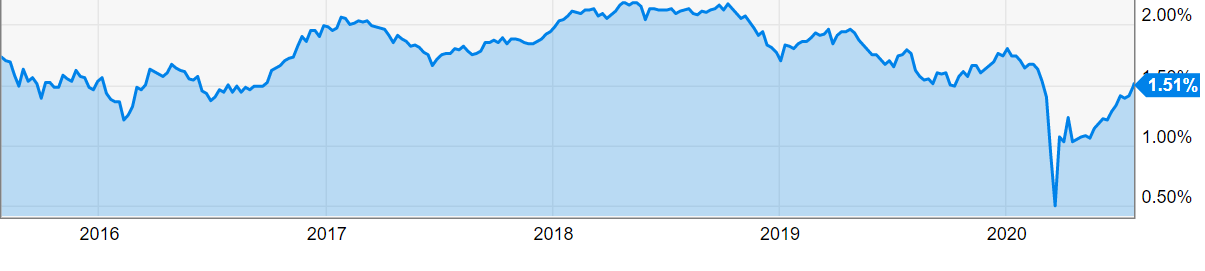

TIPS yields strip out inflation expectations from the nominal yield on Treasuries—currently about 0.60% on the 10-year—and the historically low rates, indicated in the chart above by the rising price of the security which moves inversely with yields, herald a weak economy and continued monetary accommodation from the Fed.

The yields on TIPS reflect pessimism about the chances of a quick economic rebound, amid a resurgence in COVID-19 infections. They also reflect the belief that the Fed will do more—although just what that means will be clearer after this week’s two-day meeting of the Federal Open Market Committee, even if the central bank just provides hints.

Breakeven Rate Rising; Geopolitical Uncertainty Whipsawing Yields

If investors judge that Fed Chair Jerome Powell is not sufficiently dovish in his remarks Wednesday, after the FOMC meeting, real yields may rise. But analysts are counting on Powell coming through and are advising clients to stay long in TIPS, as real yields decline further (and since prices move inversely to yields, that means rising prices).

One of the indicators in the interplay between nominal and real yields is the so-called breakeven rate, with the difference between the two yields pointing to the expected rate of inflation.

Courtesy YCharts

The breakeven rate on 10-year bonds jumped from 1.06% on May 1 to 1.51% last Friday, compared to the 11-year low of 0.50% in mid-March with the onset of the pandemic, according to calculations by the St. Louis Fed.

In the twisted logic of markets, this indicates investors are expecting higher inflation, because a weak economy will force the Fed to add more stimulus, which will then boost the economy.

A rise in the breakeven rate historically signals a brighter economic outlook. This in turn boosts equities, fueling the stock market rally.

One of the measures the Fed could adopt to stimulate the economy is to shift its bond purchases to the longer end of the Treasuries curve, as it moves from stabilizing markets to stimulating the economy, by pushing down long-term yields.

However, geopolitical uncertainty—particularly escalating tensions between China and the US—has already led to a decline in the yield on 30-year Treasuries to about 1.25%.

That was counterbalanced on Monday by news that biotech firm Moderna Therapeutics (NASDAQ:MRNA) is embarking on the biggest trial yet for a coronavirus vaccine, pushing up yields on both 10-year and 30-year Treasuries from Friday's lows. At the same time, dithering in Congress over further fiscal stimulus is flashing a caution signal for the economic recovery.

It will be up to Fed policymakers to sort through these ups and downs. The picture is so opaque that many analysts believe the Fed will try to sound dovish, but not actually adopt new measures, let alone introduce new tools like yield-curve control.

FOMC participants have been discussing the possibility of stabilizing some maturities at a certain yield, based on the model of Japan and Australia, which manage expectations in this manner. This would enable the Fed to cap long-term rates, even though short-term rates are nearly zero.

This type of bond purchase differs from those under quantitative easing, because the Fed would commit to maintaining a certain price regardless of how many bonds it must purchase, rather than committing to a certain volume of purchases.

The Fed is unlikely to adopt such a novel strategy from one day to the next. The most Powell is likely to do now is to update markets on the Fed discussion and perhaps tweak forward guidance.