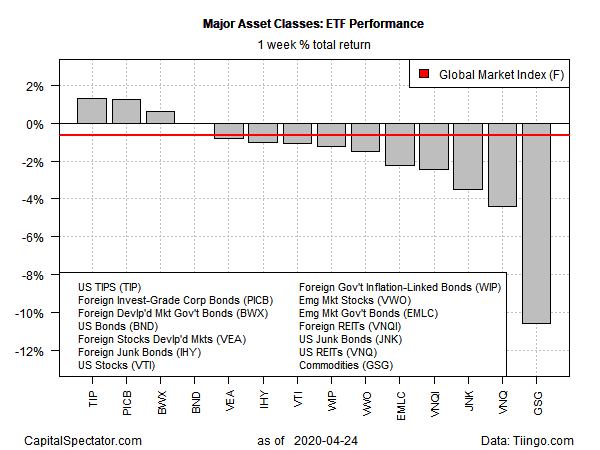

Despite a late-week rally in equity markets, risk-off sentiment dominated last week, leaving most major asset classes lower by the close of trading on Apr. 24, 2020. Inflation-indexed Treasuries bucked the trend, posting the best gain for the trading week, based on a set of exchange-traded funds.

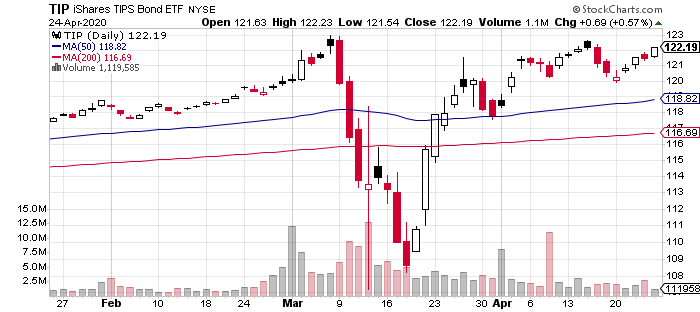

The iShares TIPS Bond ETF (NYSE:TIP) rose 1.3%, closing near a record high last week. The ETF’s current rally marks an impressive rebound after the sharp losses in March. In five of the past six weeks, TIP has posted increases.

The second-best performer last week was foreign corporate bonds. The Invesco International Corporate Bond ETF (NYSE:PICB) rallied 1.3%, fractionally behind TIP’s weekly rise. PICB’s increase marks the third straight weekly advance, lifting the fund to its highest close since Mar. 11.

Leading the losers

Meanwhile, broadly defined commodities continue to lead the losers by a wide margin. The iShares S&P GSCI Commodity-Indexed Trust (NYSE:GSG) plunged 10.6% last week, leaving the fund close to a record low for the ETF’s trading history.

Mostly lower prices in asset classes last week weighed on an ETF-based version of the Global Markets Index. This unmanaged benchmark that holds all the major asset classes (except cash) in market-value weights via ETFs fell 0.7%–the index’s first weekly decline in three weeks.

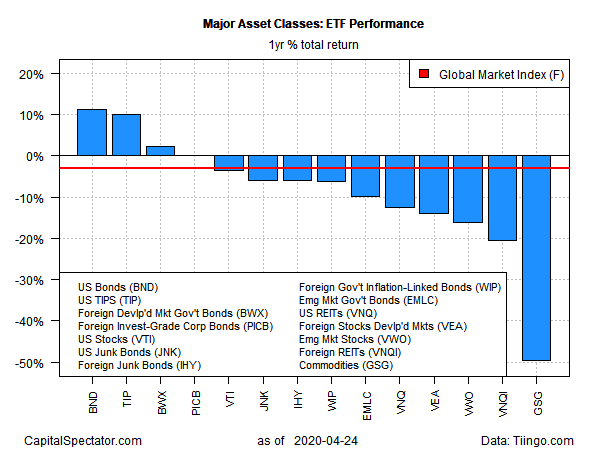

Bonds favored over one year

Looking at asset classes through a one-year lens continues to favor US bonds. US investment-grade debt is in the lead for the trailing 12-month return via Vanguard Total Bond Market Index Fund ETF Shares (NASDAQ:BND), which is up 11.2% vs. the year-ago level after factoring in distributions. TIP is a close second-place winner for one-year results, posting a 10.2% total return.

Red ink dominates the rest of the field. The deepest loss is still found in commodities, which lost a dramatic 48.5% for the past year via the aforementioned iShares GSCI Commodity Indexed Trust. The Global Markets Index remains under water, too, albeit with a mild 3.1% decline.

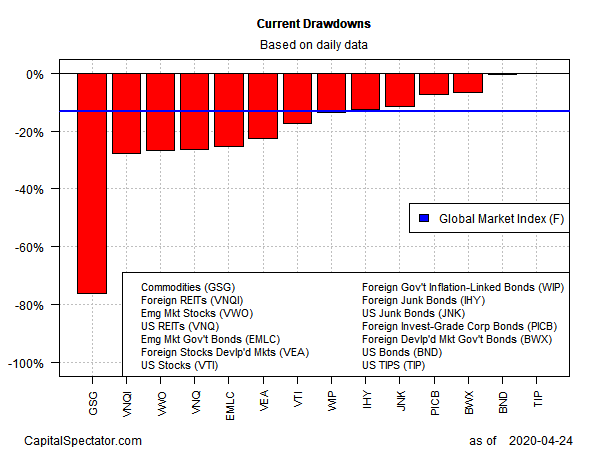

Ranking asset classes via current drawdown continues to show a wide range of results. US inflation-indexed Treasuries posted the smallest drawdown—close to zero at Friday’s close. By contrast, commodities (GSG) are still deep in the hole with a near-50% peak-to-trough decline—the deepest drawdown by far for the major asset classes.