In August, base metals experienced a breathtaking rally in prices.

For example, aluminum and copper increased by 8% and 9%, respectively. Bullish sentiment dominates the overall industrial metals market. A weaker dollar has also accompanied the uptrend in base metals (although the dollar has had less of an impact this year than it has historically).

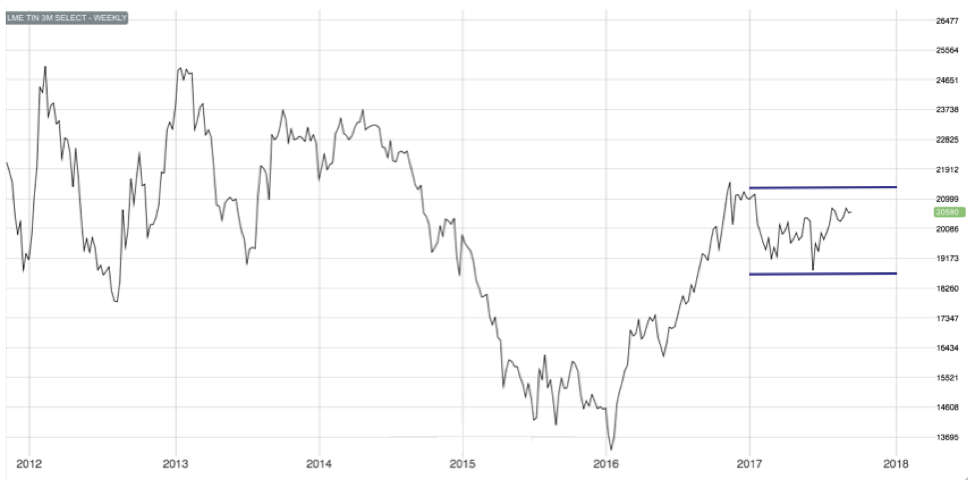

Why is Tin Trapped?

Contrary to other base metals, tin appears trapped in the $19,000-$21,000 range since the beginning of 2017.

While tin has seen less volatility than other base metals, such as copper, it refuses to give signs of moving either up or down. Tin seems to be trading sideways.

Source: MetalMiner analysis of FastMarkets

Looking at fundamentals, tin appears headed for a 22,000-ton deficit for 2017, according to the International Tin Research Institute (ITRI). This supply shortfall, in theory, should act as a price support to tin.

Trading volumes appear stable, too, and are not yet pointing toward any specific direction.

How Have Other Base Metals Traded So Far?

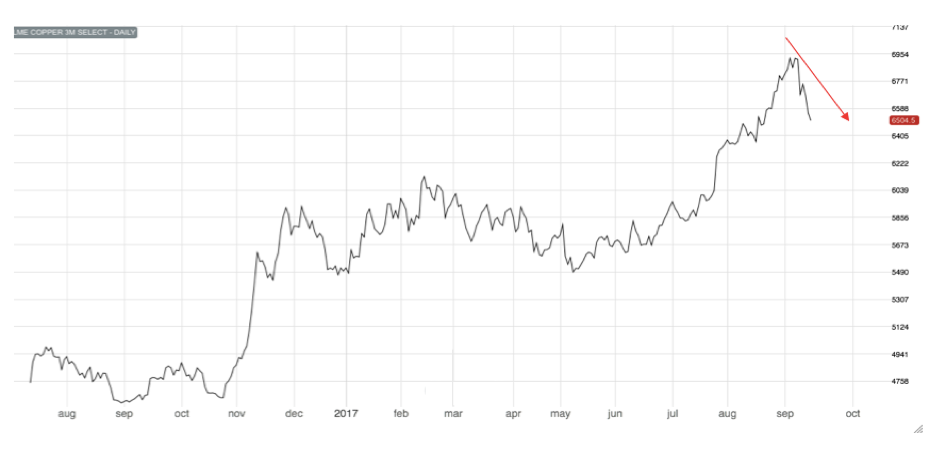

September has started with a general fall in base metal prices, with copper prices seeing the biggest decline.

Source: MetalMiner analysis of FastMarkets

Aluminum, nickel and zinc prices have also fallen since the beginning of this month. The current downtrend is a price pullback — a normal pattern we see after big price gains.

Buying organizations might want to analyze price movements and trading volumes to commit to purchases.

In bullish markets, like we have now, buying organizations can adapt their buying strategies to time purchases.