With markets likely to remain rocky, we need not be in a hurry to put dry powder to work immediately. Investor sentiment is quite cheery once again, which is a reason for caution. Interest rates also remain a wild card, because another leg up in the 10-year rate would likely roil markets.

That said, our Federal Reserve is printing a boatload of money. The “M2” money supply is up a scorching 26% year-over-year. This cash is finding its way into speculations such as “meme stocks” and cryptocurrencies. Due to this flood of money, any pullback is likely to be modest and represent a buying opportunity.

The long-term trend of the broader market is pointing up. We should use any soft patches in the weeks and months ahead to put any remaining dry powder to work.

If you haven’t yet deployed most of your cash, doing so over the next three or four months is a good goal.

Business Development Companies As Rates Rise

Business development companies (BDCs) can thrive as rates rise. BDCs extend loans to small businesses and often their loans have a “floating rate” component included. So, the BDC tends to make more money as long-term rates rise.

I’m keeping an eye on BDCs as well as financials, REITs (real estate investment trusts), and floating-rate funds. As always, I’ll let you know when I see a nice buying opportunity.

Cohen & Steers Infrastructure Fund

Cohen and Steers Infrastructure Closed Fund (NYSE:UTF) is a great high-paying way to play infrastructure. UTF invests in “cash cow” infrastructure companies that own and operate utilities, airports, toll roads, railroads, and other physical framework.

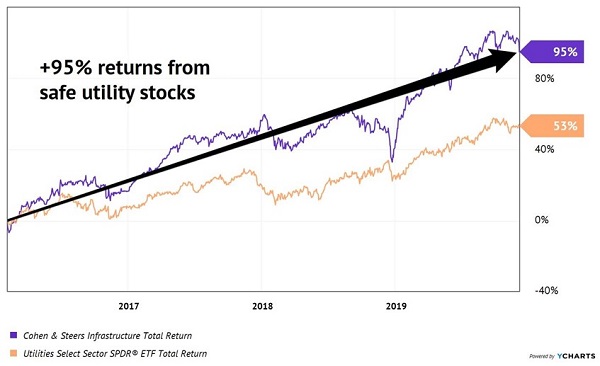

We often discuss how well-run CEFs often beat the pants off of pedestrian ETFs, and that’s exactly what UTF did to household utility ETF XLU:

Our Utility CEF Crushed its ETF “Competitor”

Since we re-added UTF to our CIR portfolio, its price has rallied, and the fund now trades at a premium to NAV. This is a great long-term holding, but there’s no reason for us to chase it. Let’s sit back, be patient and wait for a pullback to purchase more shares.

Real Estate

As the commercial real estate market gets back on its feet, we will monitor these high-paying landlords. Arbor Realty (NYSE:ABR) and Ladder Capital (NYSE:LADR)are the two strongest candidates at the moment.

That said, I do anticipate that commercial real estate will have headwinds for years. Many retail stores are toast, and how many people are actually going back to work in an office after this? Some, but probably not most.

The trend in commercial downsizing has only begun. So, while I love the management teams behind ABR and LADR, we’ll be watching the broader commercial market for cues when to buy.

What to consider when searching for dividends

The business engine. Always consider where the cash flow is coming from, first.

In other words, if the business is humming, the dividends will be there. And as the payout keeps chugging along, so will the stock price. A dividend will protect the stock from downside and, with growth, provide a sweet kicker of upside.

We are currently undergoing the greatest economic shift in American history, however. Some cash trains are being derailed while others are accelerating.

For some, is a once-in-a-lifetime wealth-building event. For others, it will wipe out decades of diligent saving and investing.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."