Consumer staples stocks have never been really exciting. For years they have been described as where your parents or grandparents sock away their money so that they can get dividend checks in their retirement. But a lot has changed. Nobody retires anymore. Nobody cares about dividends, only tech stocks, or is it Bitcoin, or cannabis this week. I have lost track.

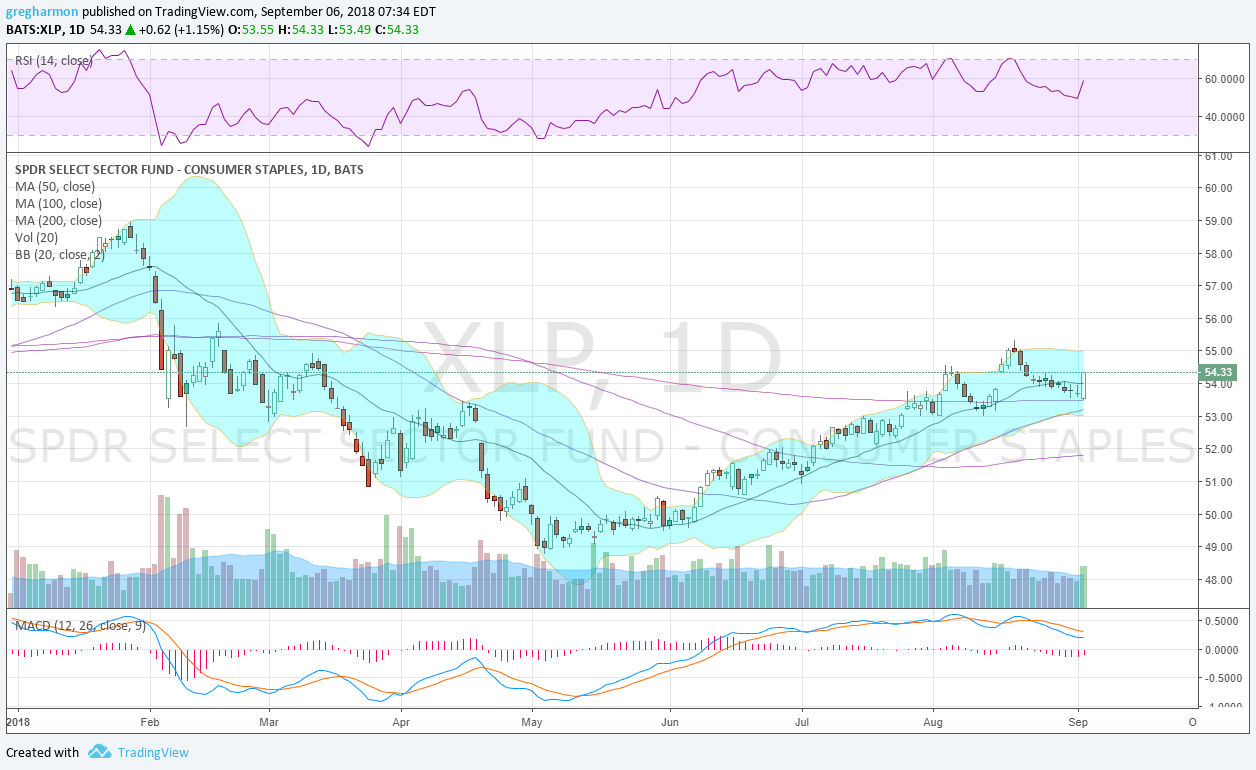

It is often when a sector is totally ignored that it is the best place to look for excitement. And by excitement I man positive price action. And Consumer Staples are exhibiting that right now. The fun actually started in May. That is when the sector made a bottom and started to roll higher. The chart below of the Consumer Staples ETF, $XLP, paints the picture.

Since the ETF crossed its 20 day SMA it has risen in a steady trend higher, with pullbacks to it as support. In mid-August the price broke below the 20 day SMA and continued lower. It found support on a retest of the 200 day SMA, closing the recent gap, and reversed. This pullback reset the MACD lower, but still positive. It also reset the RSI lower in the bullish zone.

And the RSI fell enough to trigger a Positive RSI Reversal. This is when the RSI makes a lower low while the price does not. And it gives a target on reversal to near 56. The bullish engulfing candle Wednesday also bodes well for continuation higher. Not sexy, but a strong steady uptrend.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.