If any professional baseball player (particularly one in New York) puts up stats like that, he’s immediately booed and ridiculed.

But when it comes to a particular stock market indicator, it’s actually a reason to celebrate.

And guess what? It’s time to break out the bubbly!

No Batter! No Batter! Big Whiffer!

I can’t tell you how many readers routinely accuse me of being too optimistic. And I’ll readily admit that I’m a “glass half full” kind of guy.

Despite my predisposition, though, I always base my bullishness on cold, hard facts. So my optimism is always justified.

What’s more, when the data warrants a pessimistic stance, I have no problem embracing it. And we simply start sleuthing out attractive short-selling opportunities together.

Right now, however, there’s nothing to be bearish about. And I say that with conviction, because my “Bear Market Checklist” is a perfect 0-for-9.

Heck, not a single indicator on the list is even close to flashing a warning sign. We’ve got nothing but big whiffers!

Take a look…

~Bear Market Warning Sign #1: A Tightening Fed

When Fed Chairmen – and their merry band of bankers – start tightening monetary policy, it’s time to keep an eye on the exits.

Why?

Because they have a tendency to overdo it, thereby creating a much more challenging environment for businesses.

Or, as Richard Bernstein notes, “Historically, bull markets didn’t end when the Fed started to tighten. Rather, they ended after the Fed tightened too much.”

We’re in the clear now, though, since Ben Bernanke isn’t even contemplating an end to the quantitative easing efforts.

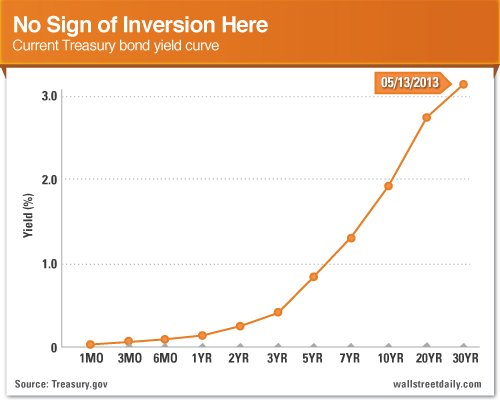

If you want something specific to track, look at the yield curve. That is, the difference in short-term and long-term government bond yields. When it inverts (i.e. – short-term yields rise above long-term yields), it’s a surefire indicator that the Fed has tightened too much.

As you can see, the current yield curve is nowhere near inverted.

~Bear Market Warning Sign #2: The Incredible, Disappearing Profit

By now, I’m sure you’re tired of hearing me say that stock prices ultimately follow earnings. But it’s true. So when corporate profitability starts taking a hit, it’s only a matter of time before stock prices head south, too.

Again, we’ve got nothing to worry about.

In the first quarter, S&P 500 companies reported a 3.2% increase in earnings. And analysts expect them to keep growing over the next three quarters, by 1.6%, 7.9% and 14.2%, respectively.

~Bear Market Warning Sign #3: A Recession is Coming! A Recession is Coming!

Economic activity tends to slow down long before corporate profits take a hit. So we need to be on the lookout for reliable signs of a looming recession.

Note the word “reliable.”

I say that because, at any given time, there are always a handful of analysts warning that a recession is coming.

Ignore the Chicken Littles – and their opinions. Instead, focus on the hard data, including the two most reliable recession indicators I shared with you in late March – Piger’s “Recession Probability Index” and the 2/10 Spread. (For the record, they aren’t flashing any warning signs.)

Besides, although the economy isn’t firing on all cylinders, it’s growing nonetheless. The latest estimates call for GDP growth of about 2% this year.

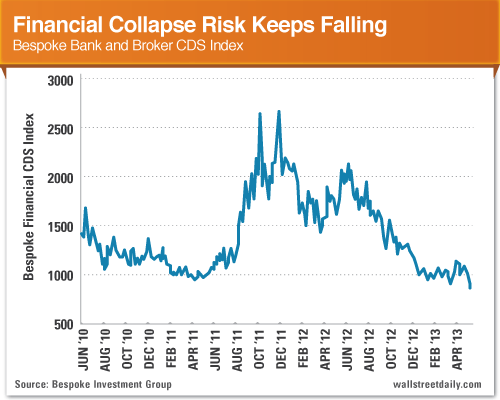

~Bear Market Warning Sign #4: A Spike in CDS Prices

With all the funny money being pumped into the market by the Federal Reserve, another banking crisis is the biggest threat to the stock market.

As I’ve shared before, there’s a simple and quick way to determine if we need to be fearful. All we need to do is consult the latest prices for credit default swaps (CDS) for banks and brokers.

CDS prices reflect the cost to insure against a default. So if banks are truly about to pull the stock market into the abyss, CDS prices should be rising rapidly.

Guess what? Right now, we have nothing to fear but fear itself.

Or, as Bespoke Investment Group says, “Our Bank and Broker CDS Index is now at its lowest level since April 15, 2010. Over the last week alone, financial-sector default risk is down 8.5%, and it’s down 50% over the last year.”

Stay tuned for tomorrow’s column, where I plan to share the remaining five indicators on our “Bear Market Checklist.”

In the meantime, pop a pill and relax. There’s no immediate danger threatening stocks.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Time To Sell Stocks? Consult This Bear Market Checklist First

Published 05/15/2013, 01:54 AM

Updated 05/14/2017, 06:45 AM

Time To Sell Stocks? Consult This Bear Market Checklist First

0-for-9.

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.