Crude oil prices have continued to appreciate again this week despite concerns over capacity constraints at the Cushing storage facility. Despite statistics released by the EIA,forecasting shale oil production to fall by 45,000 barrels to 4.98 million/bpd in May, markets continue to remain concerned by the increasing stockpile.

Crude oil inventory capacity remains a significant concern to traders and some analysts have suggested that Cushing, in particular, is nearing full storage capacity. Commodities research, released by Goldman Sachs), takes a different view and suggests that, although there is uncertainty over the total capacity constraints, the risk of running out of US crude storage is a low probability event. In fact, their analysis of the EIA data suggests, there likely remains enough crude capacity to support higher alternative production paths for some time.

Goldman’s modelling of U.S crude production has also highlighted their belief that April represents the peak month for domestic oil production and that May through August will see inventory figures decline. These forecasted falls, based on rig shutdowns and increasing refinery activity, will likely last until October when scheduled refinery down-times will impact the movement of crude through the supply chain. The modelling further points to US domestic production as increasing by 170kb/d through Q4, 2015, thereby continuing to grow inventories moving into 2016.

However, lackluster domestic demand and increased productivity within shale oil production is definitely impacting the U.S crude inventories and causing a significant domestic oil glut. Considering the levels of domestic crude production, many are now questioning the sense in restricting US crude exports solely to appease the domestic refining industry.

The US crude oil export constraint directly impinges upon the markets ability to clear the excess supply and also impacts US GDP in the range of 22b/year. Even in light of the recent US rig stand-downs, it is likely that 2016 will bring further over supply within the domestic industry, fueling the case for a review of the ban. Failure to address the future of crude export is only likely to lead to further supply imbalances leading in to 2016.

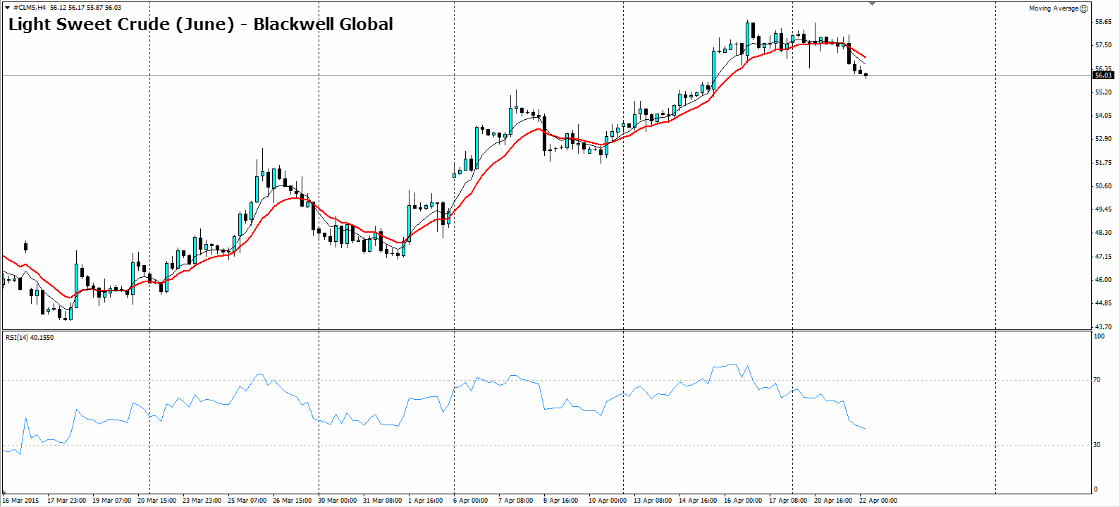

Our forecasting suggests that WTI crude in Q1 will be under pressure to move towards establishing a base at $48/bbl, in spite of the large reduction in capex and well shuttering occurring. This stands in contrast to Goldman’s original projections at WTI $65/bbl which is likely under risk.

Pressure from the private sector is also building for a review of the prohibition especially considering the export revenues that are foregone by the current ban. Senator Lisa Murkowski, of Alaska, has publicly stated her intent to introduce legislation to repeal the export restriction that has been in place since the oil crisis of the 70’s. Murkowski presents a credible advocate for the change considering her position as Chairperson of the U.S Senate Energy and Natural Resources Committee. Considering Thursday’s crude inventory figure is, yet again, likely to be positive, the pressure from advocates for change continues to grow.

Any subsequent legislative change or relief from the export constraint is likely to see light sweet crude prices heading higher as the market is able to clear the excess inventory. Such a move would also help to protect the domestic shale oil industry by allowing crude prices to stabilize, which are more in-line with shale producers cost structures.

Ultimately, rebalancing crude supply is a process which has a significant lead time and is complicated by restrictive legislation within the U.S domestic market. It begs the question, at what point does the U.S administration see the upside of ending a program that only benefits refineries and fails to support the fledgling shale oil market.