Recently, I was asked on CNBC Asia what I thought about fixed income at the present time.

My answer was that I thought having cash allocated to some is wise and that we were doing that as well.

Last year, I had the pleasure of meeting Nancy Davis from Quadratic Capital.

Their product IVOL ETF is “designed to hedge the risk of an increase in fixed income volatility and/or an increase in inflation expectations.

It also seeks to profit from a steepening of the yield curve, whether that occurs via rising long-term interest rates or falling short-term interest rates, which are historically associated with large equity market declines.”

My past Daily’s have covered the risk to the equities market and the potential for higher inflation or at the very least, stagflation.

I have also talked about “normalization” where Fed Funds rates and the rate of inflation are in alignment.

IVOL is an instrument meant to benefit from that normalization while at the same time offering some protection against inflation.

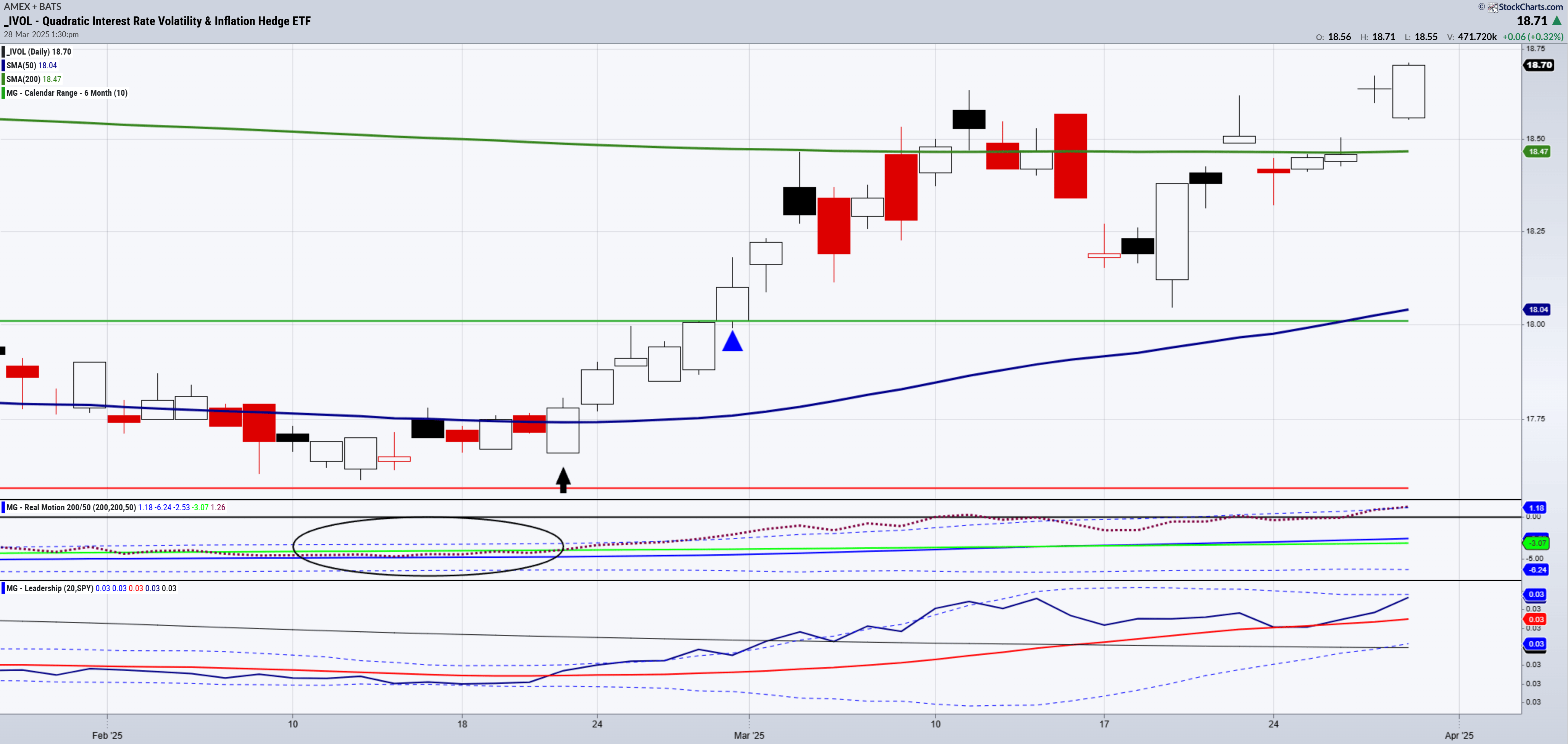

The chart is interesting and of course, the timeframes differ.

On the daily chart, a few standouts

- The new high close since October 2024.

- The outperformance to the benchmark.

- The accumulation phase with IVOL over the 200-DMA.

- The circle I drew on real motion shows the bullish divergence in momentum that happened in February, just as the price started to clear the 50-DMA.

No doubt the daily chart makes a bullish case.

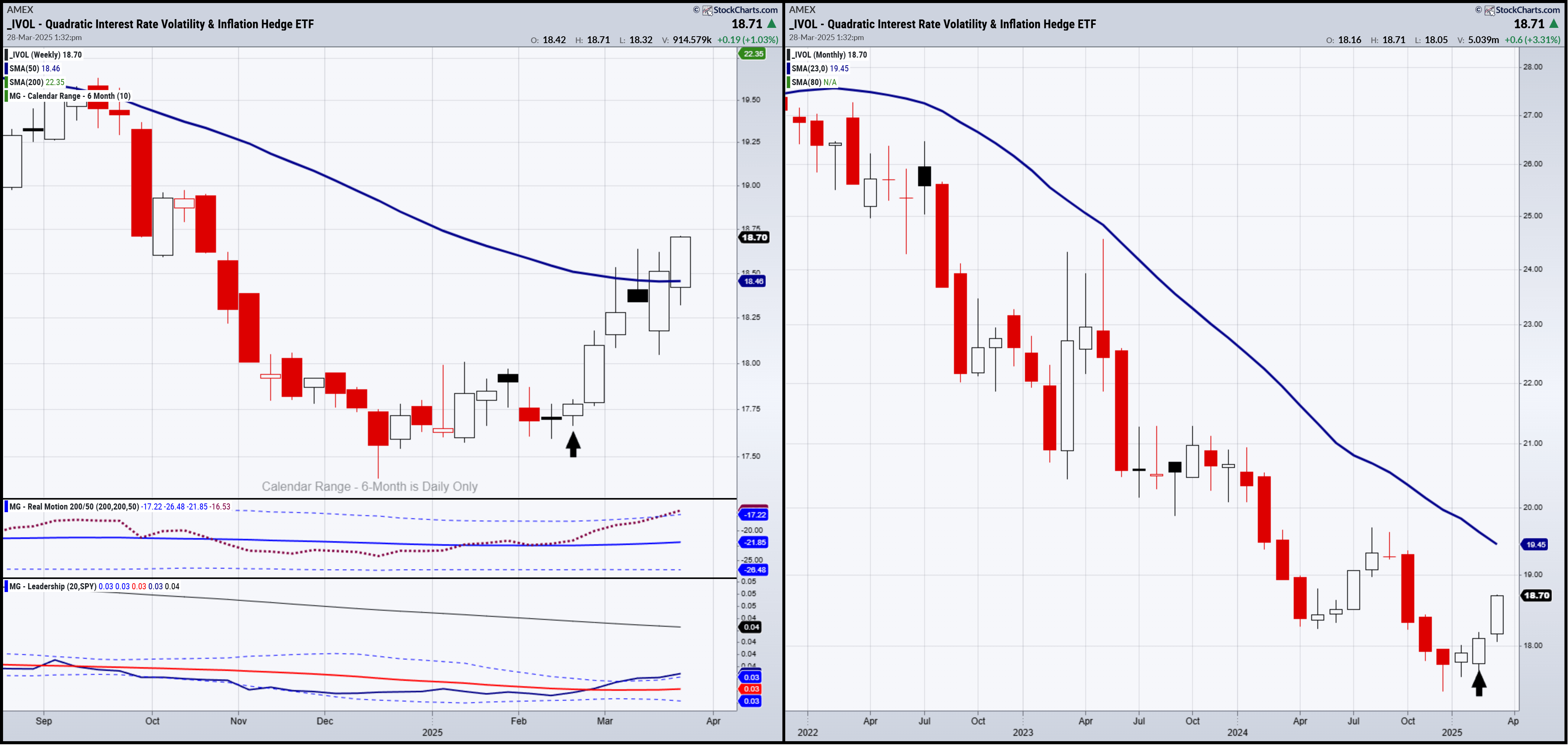

Looking at the weekly and monthly charts:

IVOL has cleared the 50-WMA for the second week in a row, thereby confirming the phase change to recuperation.

The last time this instrument traded above the key weekly moving average was in May 2023.

That’s significant.

On the monthly chart, IVOL remains under the 23-month moving average, which we like to use as an indicator for 2-year business cycles.

Therefore, in the short term, IVOL is rallying in response to a stagflationary environment. Basically, with the economy slightly contracting, equities falling and inflation sticky, it’s a good place to be.

Nonetheless, the jury is out on whether this is a more sustaining sea change.

Should IVOL clear that 23-month, we must wonder whether the economy is about to enter a deeper recession, or worse, hyperinflation.

ETF Summary

(Pivotal means short-term bullish above that level and bearish below)

- S&P 500 (SPY) Now we watch the lows from early March 549

- Russell 2000 (IWM) 200 pivotal

- Dow (DIA) First close under the 50-WMA since 2023

- Nasdaq (QQQ) 466.43 March low

- Regional banks (KRE) 55-60 the trading range to watch

- Semiconductors (SMH) 205 monthly support

- Transportation (IYT) 63 support to hold

- Biotechnology (IBB) 130 support

- Retail (XRT) 66.07 March support

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.