For the man who knows the value of privacy, today and tomorrow will be very public.

Not to worry though, Mark has very likely spent the better part of the last week in intense sessions with his PR team rehearsing what he will say to the US Senate Committee and to the rest of the world.

What could be more interesting than anything Zuckerberg has to say is the tone and composition of the questions coming from lawmakers. Will this be inquisitive, or an inquisition?

The big data saga has reached the peak of its crescendo and the man who has become the face of it all is now center stage.

The stock markets have taken some much-needed liberties and the narrative has now switched back to... you guessed it...

. and here it is on the charts...

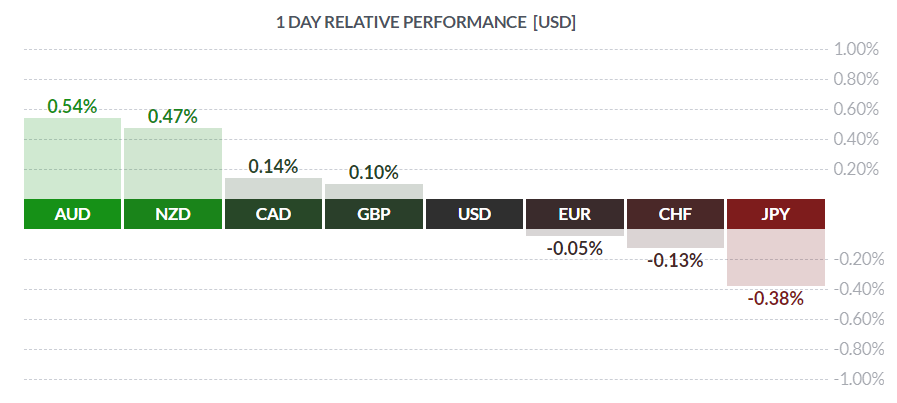

It's not just stocks either. Gold has come down, as have safe haven currencies.

The timing couldn't be better too. The rally kind of fell apart on Wall Street late in the afternoon, and just a few minutes before the closing bell a Trump-related headline ended the day on a rather sour note.

Also, no matter how the US spins the new trade war story, we're still expecting some sort of Trump announcement on Syria that could come through presently.

Meanwhile in Russia

Some more US sanctions on Russian oligarchs. This one is really shaking things up in the markets.

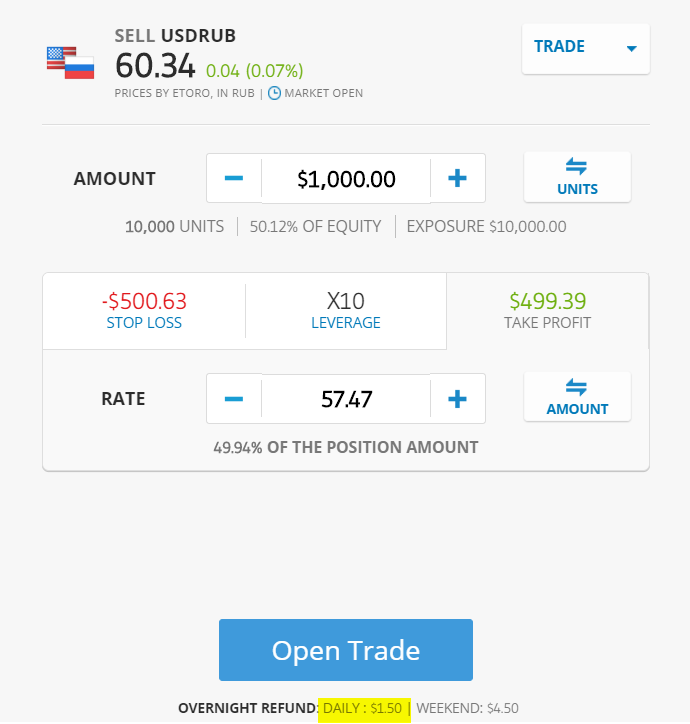

Nevermind the Russian stocks that are getting hammered, trading the Ruble can be a lot of fun. Even though the trading hours are limited, you get an excellent premium for holding the trade.

At the moment, a $1000 sell position on the USD/RUB with 10x leverage pays you $1.5 a day. As long as you can hold onto the position...

This is not trading advice. Trading with leverage can be risky.

Blockchain trading

Aside from the drama over the @bitcoin twitter account, there really hasn't been very much bad news for the crypto market.

Yesterday, just after I sent you guys the daily update, we saw a sharp sell-off (blue circle) but it really wasn't clear what caused it. For now, we have a nice tight range on Bitcoin between $6500 and $7500 per coin. For now, any movement between the yellow lines is probably not very significant.

Most likely just some whale dumping his stack. The Winklevoss twins are actually working on something that could help with that. In the next few days, they should have a channel for whales to unload off the books. Meaning, that the crypto can change hands from seller to buyer without affecting the price in real time.

Mind you, keeping transactions off-exchange doesn't impact the overall supply and demand of the market, but it may help sentiment by removing some of these sudden price spikes.

Another thing I found cool was another government use case for Ethereum, which so far is proving to be very useful.

The Ethereum blockchain is proving to be incredibly useful. You want uncontestable public data, this is the way to go.

Let's have an awesome day ahead!!

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.