The Gold Miners ETF, (GDX), will likely attract some attention as it has a strong move higher Tuesday and closed the gap down from Friday. The Relative Strength Index (RSI) also turned back higher as well, a sign of a possible reversal. Longer term traders will see the downtrend for what it is and stay away, letting the traders that try to jump the signals take

a swing at it. But should they avoid it? To answer that take a look at the Gold ETF, (GLD). History says not so fast! It is showing a Heading and Shoulders Top with a price objective of at least 110.44. Kind of bearish, huh? This pattern could always fail, but until it does , by moving back over the top of the right shoulder at 128.44, it is in control. This is important for the miners as they price of Gold is a big input into their costs and revenue. But there is also a long standing relationship

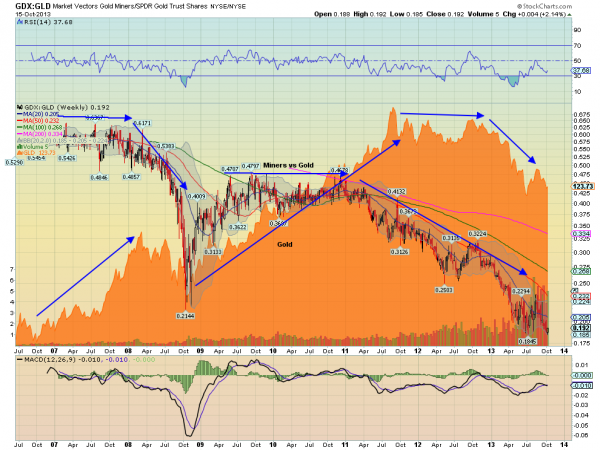

between the price of the Miners relative to Gold. The last chart below shows the ratio of the Gold Miner ETF to the Gold ETF plotted as candlesticks, with the area chart for the Gold ETF behind it. There are two key points to take away from this chart. First, as Gold rises so does the Miners ETF. The ratio line is level as Gold is rising. The second is that the Miners tend to fall before Gold starts to fall. The ratio is falling as Gold is level and then it catches up to the downside. Gold

and Miners move in lockstep on the way up and the Miners lead on the way down. So for confirmation to buy the miners look for the Head and Shoulders top for Gold to be negated. Otherwise you run the risk of that Head and Shoulders leaving you a headless Miner, as the clock runs into Halloween.