Not the best week for stocks but the bull market remains intact and a little refresh is great.

Banks and biotech are acting fine along with many other sectors, with a nod to the miners late in the week.

Metals showed weakness this past week as we expected, but late in the week I noticed some miners showing bounces off support areas.

Mining stocks nearly always lead the metals and they are telling me metals area ready to bounce, at the very least.

Gold lost 2.05% this past week and is now below the 4 moving averages.

That is terrible news, that said, unless we remain under the 100 and 50 day moving averages at $1,212 for a few days, it’s not a big deal.

As I mentioned, miners showed some strength and Friday did print a Doji bar which will be confirmed with a higher close Monday.

Doji bars often signify a change in direction.

Seems like the $1,212 level will be a good entry for a swing trade.

Silver slid 4.05% this past week and did not show a Doji bar on Friday.

Still, miners are telling of strength to come so let’s see how Monday goes.

I’d consider $17.25 the buy area in silver with $18 the first support to keep an eye on.

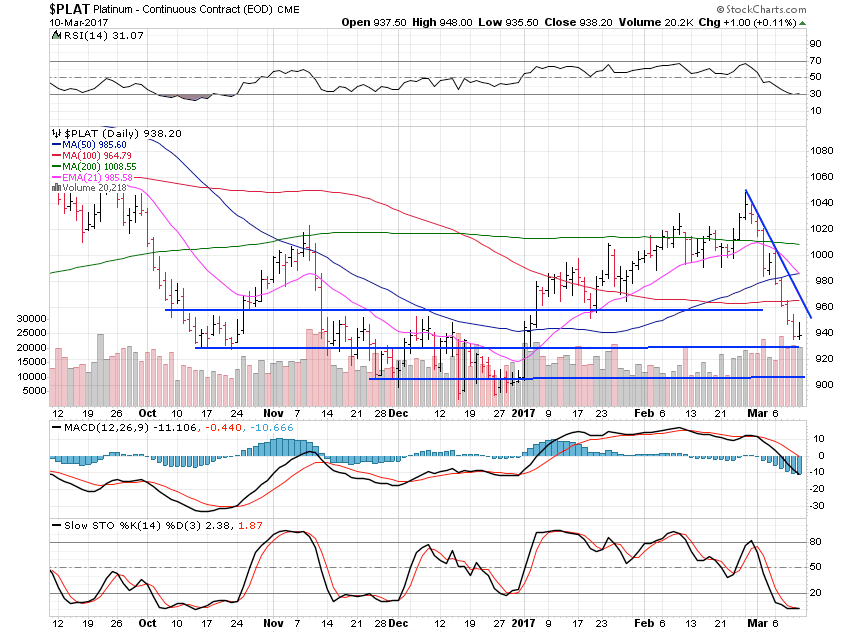

Platinum fell hard losing 5.62% this past week but will move higher shortly if the miners are correct.

I’d consider $960 the buy area if we do begin to move higher, or even below if gold and silver show strength.

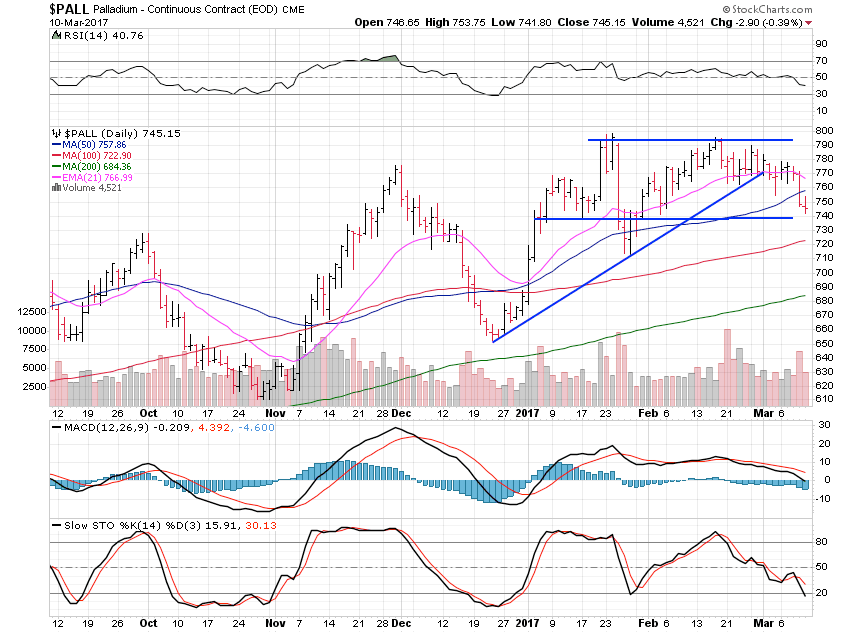

Palladium lost 2.94% but has a few things going for it.

This horizontal channel has $740 as the low end so it looks like a buy zone with the $790 area a profit taking level.

I don’t have a lot more to say on this very cold day.

Stocks continue to trend upwards while metals look to be taking the turn up.

Monday or Tuesday should tell us if the metals are indeed set to bounce.