I noted Tuesday that I closed a Call Spread as part of a stock repair strategy. Many asked what that mean. My trade was on Twitter (NYSE:TWTR), a company that lost a ton of its value in 2016, falling from over $52 to a low in February, under $14.

Twitter has been a great tool for communication but the company has not been able to generate much revenue. This leads to many investors interested in the stock looking for a turn in the model to start accruing value. Unfortunately there have been a few false moves along the way that have trapped some investors.

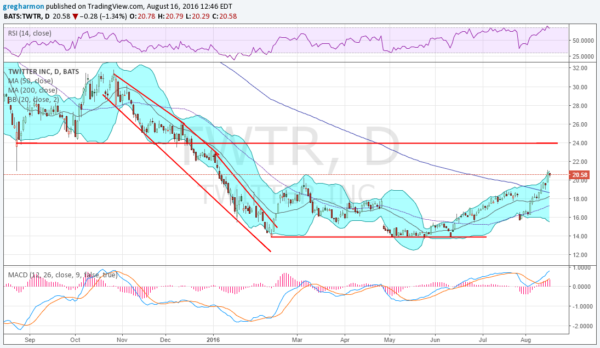

From the chart below you can see them as the peaks before the pullbacks on March 4, April 26 and July 26. Anyone who bought the stock then was underwater for a bit, but are now doing fine. It is those that either rode the stock lower from 52 or bought in somewhere along the way that are still in pain. But both sets of investors can benefit from a strategy called 'stock repair,' which is like an accelerator for stocks moving higher.

The strategy involves options and options spreads. Specifically, it is buying a Call Spread and then selling a Covered Call along side it so that there is no cash outlay. For Twitter you can see the turn up in the chart. And there is also a potential short-term resistance area around $24 where it has battled with sellers and buyers in August, September and December 2015.

A stock repair strategy for this stock now might be to add a September 21/23 Call Spread to gain value as the stock rises. There is large open interest in the September options at the 22 and 23 Strikes that could also help pull it higher and may then hold it there, a pin. Buying the September 21 Call and selling the September 23 Call, for the Call Spread, cost about 55 cents. By also selling a September 23 Covered Call for 55 cents, your total cost for the trade is zero, before commissions.

If the stock runs up to 23, the Call Spread is then worth $2. If the price stops there you keep the $2 and the stock now has a $2 lower basis. If it goes higher than $2 you will be called away on your stock, but with a net value of $25. Should you still want to own the stock, you can roll your Covered Calls out to October or later and to a higher strike.