It’s déjà vu all over again. With the PMs still ignoring technicals and fundamentals, their strength on Mar. 21 was akin to mining momentum. To explain, I wrote on Mar. 18:

The weak fundamental outlook that caused gold to underperform the S&P GSCI in early 2022 has only intensified since the Fed meeting. Despite that, momentum investors are following the trend and rallies in crude are sparking rallies in the metals.

To that point, with WTI rallying hard on Mar. 21, the PMs remained elevated despite the sharply deteriorating domestic fundamental environment. However, peak sentiment may have already materialized, with the last (likely) piece of the headline risk puzzle commencing on Mar. 21. To explain, I wrote on Mar. 9:

While picture-perfect scenarios have confronted the PMs in recent weeks, the optimistic headlines are likely near their peak. For example, with U.S. economic sanctions already priced in and only Europe left to consider a Russian import ban, we'll need WW3 to create more headline risk.

Moreover, with WW3 unlikely in my opinion, whispers of a European import ban made the rounds on Monday. As a result, the PMs’ news-based momentum may have received its final jolt.

Source: Reuters

Furthermore, as headline risk decelerates, the main drivers of the PMs’ performance should become more important. Likewise, with the PMs’ domestic fundamental outlooks hitting new 2022 lows on Mar. 21, the next few months should elicit sharp drawdowns.

To explain, inflation remains extremely problematic. In fact, while signs of deceleration were present in January, the Russia-Ukraine conflict has supercharged commodities’ fervor and put the Fed in a precarious situation. However, even as Fed officials pivot from no rate hikes to three rate hikes to seven rate hikes, investors are not listening. As a result, market participants are digging their own graves.

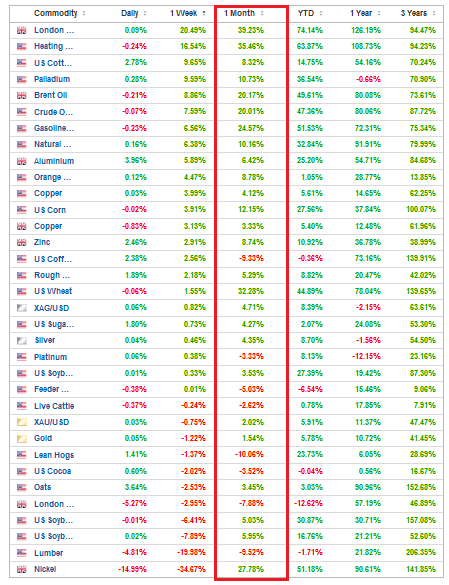

Source: Investing.com

The table above tracks the performance of various commodities over different periods. If you analyze the vertical red rectangle, you can see that most commodities have rallied over the last month. As a result, investors are ignoring Fed officials’ warnings, as rate hikes help slow economic growth, not accelerate it. Think about it:

- Rate hikes increase borrowing costs and decrease consumers’ disposable income, which reduces demand.

- Less demand results in less consumption and less economic activity.

- Less economic activity results in less demand for commodities.

- Lower commodity demand results in lower commodity prices.

- Lower commodity prices result in lower input prices.

- Lower input prices result in lower output prices (inflation).

Moreover, while officials understand this relationship and hope to achieve this outcome, investors are now fighting the Fed. As such, if (when) the wake-up call materializes, the PMs should suffer profoundly.

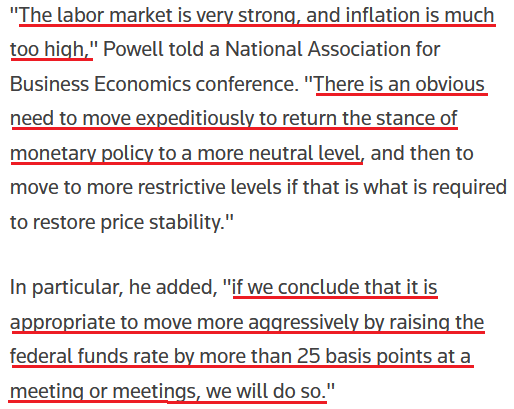

As evidence, Fed Chairman Jerome Powell dropped the hawkish hammer on Monday. When asked about inflation peaking this quarter and cooling in the second half of the year, he said:

"That story has already fallen apart. To the extent it continues to fall apart, my colleagues and I may well reach the conclusion we'll need to move more quickly and, if so, we'll do so."

To that point, Powell said that "there’s excess demand" and that "the economy is very strong and is well-positioned to handle tighter monetary policy." As a result, while investors seem to think that Powell’s bluffing, enlightenment will likely materialize over the next few months.

Source: Reuters

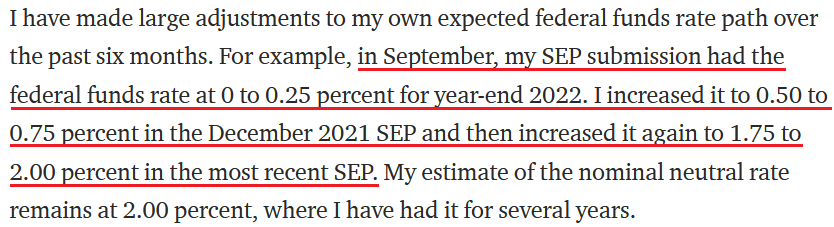

Thus, have you ever seen Powell more hawkish? In addition, notice how he said "at a meeting or meetings" when discussing the potential for "more than" 25 basis point rate hikes. As such, while Minneapolis Fed President Neel Kashkari (a major dove) had expected zero-to-one rate hikes in 2022 when submitting his projections in September, Powell let investors know that the Fed may double up "at a meeting or meetings." For context, this is what Kashkari wrote on Mar. 18:

Source: Neel Kashkari/Medium

From Bad To Worse

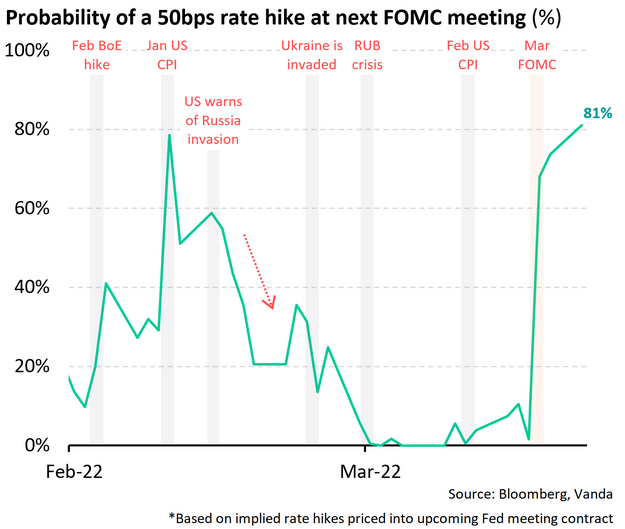

Furthermore, while some investors seem to think that the Fed will sit idly by and watch inflation rage, the futures market has priced in an 81% chance that the Fed will hike rates by 50 basis points on May 4.

The green line above tracks the market-implied probability of a 50 basis point rate hike on May 4. While the Russia-Ukraine conflict initially reduced the chance to zero, expectations have risen sharply recently. As a result, if commodity investors don’t listen to Powell and they keep bidding up prices, he’ll have no choice but to follow through with his hawkish threats.

To that point, I noted on Monday how the PMs are ignoring the materially shifting narrative. I wrote:

While the PMs have ridden the momentum of the Russia-Ukraine conflict, their medium-term fundamentals are worse now than they were in 2021. Back then, the Fed parroted the “transitory” narrative, and the PMs could take solace in their dovish pushback. However, the inflation outlook has worsened in the last few months, and commodities’ fervor is only accelerating the problem. Moreover, when doves like Kashkari turn hawkish, the game has changed. As a result, the PMs may learn this lesson the hard way over the medium term.

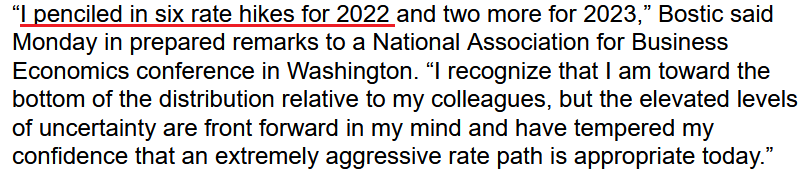

If that wasn’t enough, while Atlanta Fed President Raphael Bostic expects six rate hikes in 2022, his less-than-consensus view is still hawkish relative to where he was three months ago.

Source: Bloomberg

In addition, he added:

"I am comfortable with more aggressive movements if that is what the data and the evidence suggests is what is appropriate. So I’m not wedded to moving only 25 basis points. I’m not wedded to moving every other meeting. I am going to be very, very open in terms of my approach."

Thus, while the PMs seem to think that the Fed’s inflation fight won’t impact their medium-term prospects, the reality is that higher real interest rates are needed to reduce inflation. With commodity investors failing to comply, the merry-go-round of higher input prices leading to higher output prices will continue. As a result, the downside risk confronting the PMs is enormous at this point.

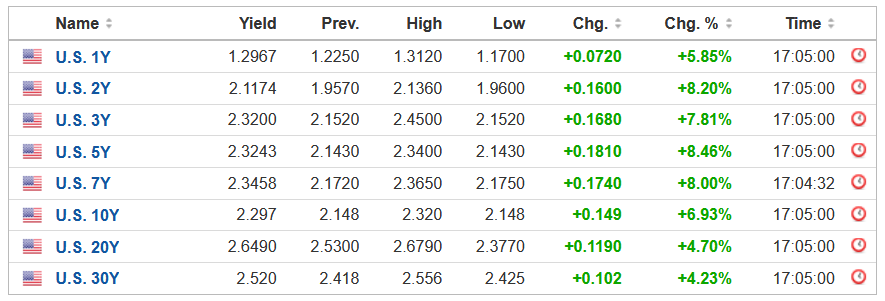

Finally, while the PMs and the general stock market covered their ears on Mar. 21, the bond market heard Powell’s message loud and clear. For example, the U.S. 10-year Treasury yield closed at a new 2022 high of ~2.30% on Mar. 21. Moreover, the entire U.S. yield curve rallied sharply. As such, since the PMs’ domestic fundamental outlooks have materially worsened during the Russia-Ukraine conflict, they’re likely to suffer profound declines when prices revert to their intrinsic values.

Source: Investing.com

The bottom line? While Europe's potential import ban helped underwrite another daily rally for crude and other commodities, the higher the prices, the more hawkish the Fed. Since investors don't realize that their short-term bullishness is actually medium-term bearish, epic drawdowns should materialize once sentiment shifts.

Remember, the Fed can only slow inflation by slowing the U.S. economy. That's why Powell keeps referencing a "soft landing" when describing the tradeoff between calming inflation and maintaining growth. However, with continued inflation of 8%+ likely to push the U.S. into recession, Powell knows that doing nothing is as bad as doing too much. As a result, investors should eventually learn that Powell's dovish days are over.

In conclusion, the PMs rallied on Mar. 21, as the Russia-Ukraine conflict still garners all of investors' attention. However, it's remarkable how much the PMs' domestic fundamental outlooks have deteriorated in recent weeks. With Fed officials more hawkish now than at any point in 2021, their fight with inflation is bullish for the USD Index and U.S. Treasury yields, not the PMs. As a result, don't be surprised if (when) a flash crash materializes.