In addition to waiting for the FOMC and the results of the Scottish Referendum, we will see the first results of the ECB's TLTRO this week. As a reminder, the purpose of the TLTRO program is intended to stimulate lending to eurozone households and non-financials:

In pursuing its price stability mandate, the Governing Council of the ECB has today announced measures to enhance the functioning of the monetary policy transmission mechanism by supporting lending to the real economy. In particular, the Governing Council has decided:

1. To conduct a series of targeted longer-term refinancing operations (TLTROs) aimed at improving bank lending to the euro area non-financial private sector, excluding loans to households for house purchase, over a window of two years.

2. To intensify preparatory work related to outright purchases of asset-backed securities (ABS).

This program should be beneficial to eurozone small and medium enterprises (SMEs). In that case, why are European small caps underperforming?

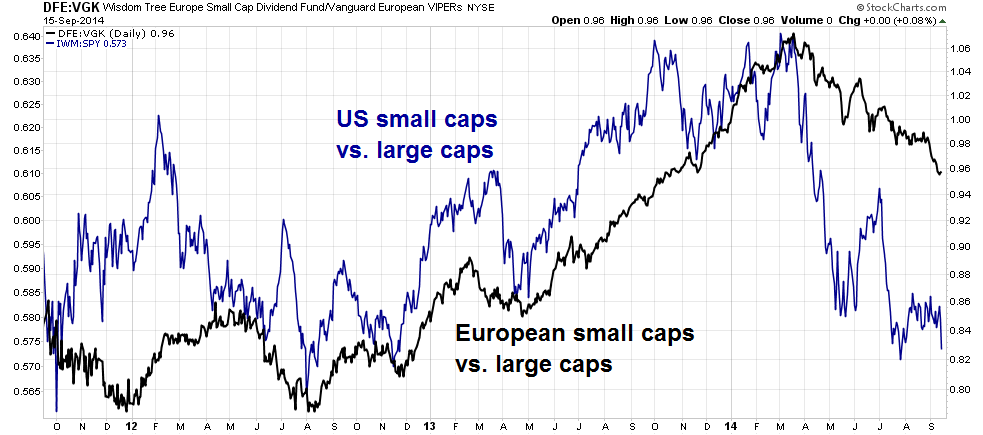

As the chart below shows, European small caps (via WisdomTree Europe SmallCap Dividend Fund (NYSE:DFE)) topped out against large caps (via Vanguard MSCI EU (ARCA:VGK)) - black line, in March and they have been rolling over ever since. This pattern of small cap underperformance is not unique to Europe, as US small caps have exhibited a similar pattern, albeit with a greater magnitude.

As the ECB implements TLTRO, is this an opportunity for European small caps to revive?

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.