It’s been almost five years since BMWG stock hit an all-time high of 123.75 euro a share. Five years for investors to wonder why they didn’t sell earlier. As of this writing, the stock trades near 75.40, down 39% from the March 2015 record.

On the bright side, the stock trades near 75.40, up 29.9% from the August 2019 bottom at 58.04. So depending on where you bought, you either have a big loss or a nice profit to show for it. But that doesn’t answer the most important question: is BMW stock a good bet at the current price?

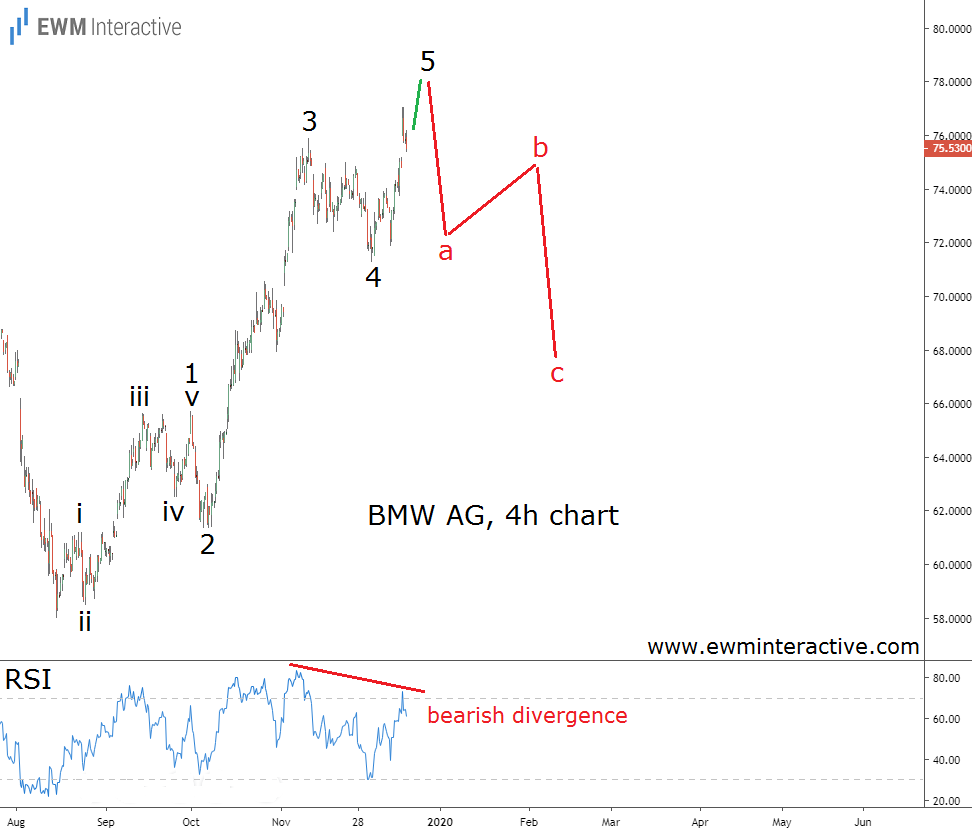

BMW’s 4-hour chart seems to be giving us a hint already. It reveals that the recovery from 58.04 to 77.06 so far is a textbook five-wave impulse. The pattern is labeled 1-2-3-4-5, where the sub-waves of wave 1 are also visible. From an Elliott Wave standpoint, unfortunately, this pattern means a three-wave correction can now be expected.

If this count is correct, we should prepare for a decline to the support area near 68 euro a share. The RSI indicator reinforces the short-term negative outlook by showing a bearish divergence between waves 3 and 5. In fact, even after this pullback we will be wary of buying.

BMW’s Financials Don’t Look Good Either

Despite its luxurious image, BMW is competing in a very capital-intensive industry. As a result, the company generates negative free cash flow every year, forcing it to take on mountains of debt to cover the deficits. At the end of September, BMW’s long-term debt stood at almost 74 billion euro. When both the fundamentals and Elliott Wave analysis suggest the bet isn’t worth it, we listen.