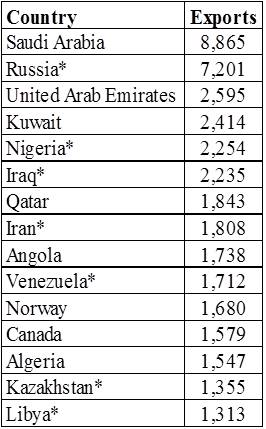

With civil/tribal/religious/ethnic/terrorist wars raging in many of the leading oil-export countries, isn't it just a matter of time before global oil exports are curtailed and prices spike? The table lists the leading oil exporters (thousand barrels per day). The countries with asterisks in the table below are the ones most likely to experience an oil cutback.

Source: US Energy Information Administration

Nigeria has been in the news recently because of abducted children. But the international search for the children has highlighted just how risky things are there. No children have been recovered as terrorist group Boko Harem seemingly continues to do whatever it wants.

Iraq? With ISIS causing havoc, who knows what will happen next. And Iraq is the fourth-leading oil exporter.

Russia, Iran and Kazakistan are worrisome not because local disruptions are likely but because they could use oil-supply reductions as a political bargaining tool.

Venezuela has been unstable since Hugo Chavez passed away and the economy is in tatters.

And then there's Libya. Yes, the new parliament just met, but a civil war is raging with countries pulling their embassy staffs.

Bottom Line

It takes just one of these situations to escalate for the world to suffer a significant supply reduction and an oil price spike.

In these circumstances, it would seem prudent to include some “oil” in your portfolio. Consider adding an ETF such as United States Oil Fund (NYSE:USO) or PowerShares db Oil Fund (NYSE:DBO).