It's no secret that President Donald Trump enjoys tweeting. In fact, some might say that he's built his political career on the micro-blogging platform.

One of the features that he seems to use quite often is the "block" button. Once blocked, users no longer have the option to respond to any of the president's tweets.

Yesterday however, a federal judge has ruled that it is unconstitutional for the president to do so, stating that the Twitter account of a public official is considered a public forum and as such it must remain available to everyone to express their point of view.

Though it's not clear whether the ruling means that Trump will now have to unblock everyone that he's already blocked, what is clear is that the President will have a few new followers on his timeline.

Today's Highlights

FOMC Wow

Trying to Stop the Wave

Why are the Cryptos Falling?

Please note: All data, figures & graphs are valid as of May 24th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

Yesterday afternoon, the FOMC released the minutes from their previous meeting. This type of event is usually rather uneventful as people are more concerned with the bottom line. However, this release did make a few headlines.

So now it seems Fed Chair Jerome Powell is weighing in on Trump's trade war. The announcement does seem to have reversed the direction of the US dollar as we can see here.

Zooming out a bit, it can be seen that this was the market highs and the pullback above is rather small in comparison, so no official change to the strong dollar trend just yet.

As well, the Fed expressed concern over a recent poll that revealed 40% of American's would not be able to cover an emergency expense of $400. A figure that may indicate the economy is not doing as well as many analysts would like to think.

TRY as they Might

The Central Bank of Turkey (TCMB) finally fought back yesterday.

We've been discussing the slide of the Turkish Lira a lot lately as people seem to lose confidence in President Erdogan and the Turkish economy.

Yesterday, the TCMB raised their main lending rate from 13.5% to 16.5% in an attempt to stop the slide. The market reaction was pronounced as the TRY gained almost 3000 pips in less than an hour.

However, the slide does seem to have continued this morning as the Lira has given back about half of those gains already.

(Remember: The chart is inverted so a downward movement indicates Lira strength and vice versa.)

Why Are Cryptos Falling?

People keep asking me this. Even though I disagree with the premise, it's still worth taking a good look.

First, it's important to note that the crypto asset class as a whole has risen 330% over the last year. This is a massive growth for any market and should not be taken for granted.

The price of bitcoin on May 24th 2017 was $2,250 and at the time many thought it was a bubble and the price was too high. Today we're seeing lows of $7,300, which isn't as strong as the $20,000 peak but certainly still in a strong upward trend despite the sizable pullback.

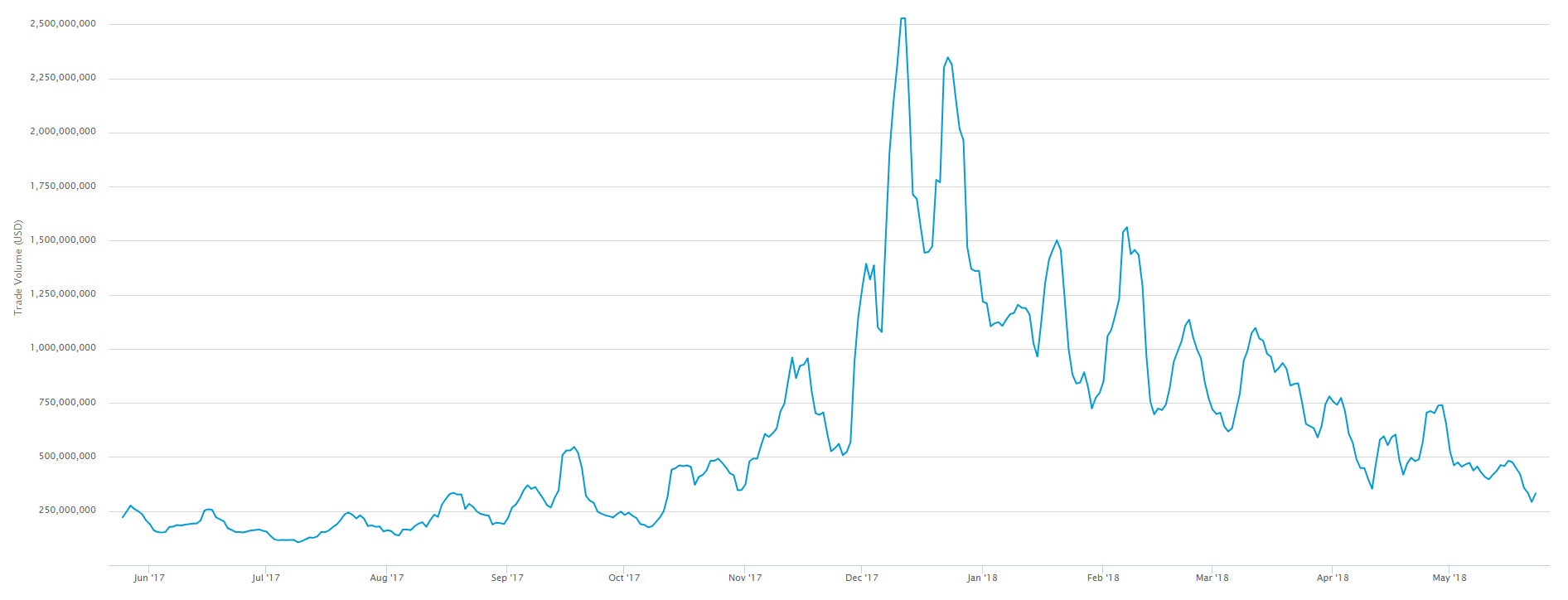

If we really want to dive into the market movements, we need to take a good look at volumes. Here we can see that the total volumes have been dropping steadily over the last 3 months.

A year ago, a total volume of $250 million was extremely high, but today it's considered really low. Especially when we consider that the December peak was above $250 billion.

Yesterday's sell-off, which took bitcoin below $7,700 happened on rather large volume, as did the continuation of that sell-off this morning.

This sharp sell-off coinciding with a volume spike is not great news for the price action. As we stated several times this week, the support level to be watching is around $7,100. Let's hope it holds.

Let's have an amazing day ahead!

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.