The Canadian dollar has been going from strength to strength recently, but isn’t it time for the greenback to stage a comeback? Let’s examine the story the technicals tell...

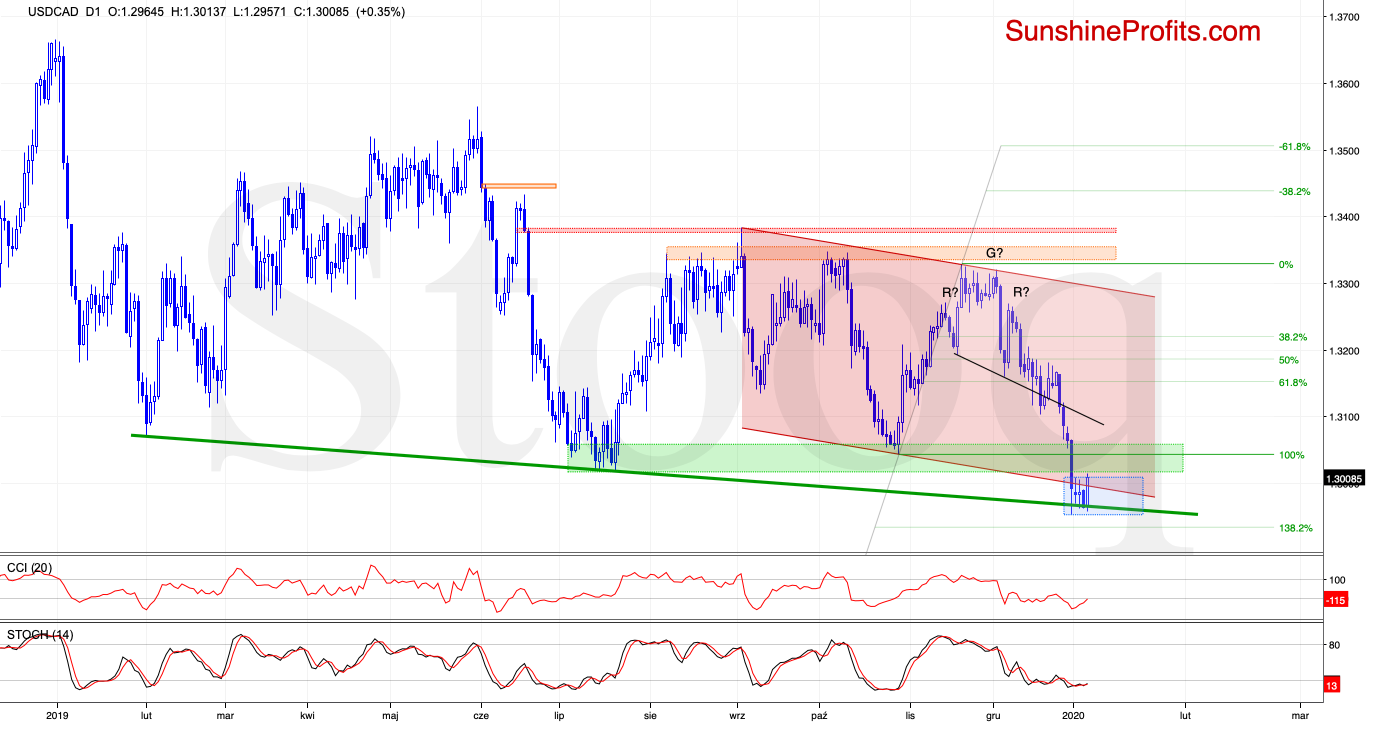

The first thing that catches the eye on the above chart, is the drop to the long-term green support line based on the previous lows.

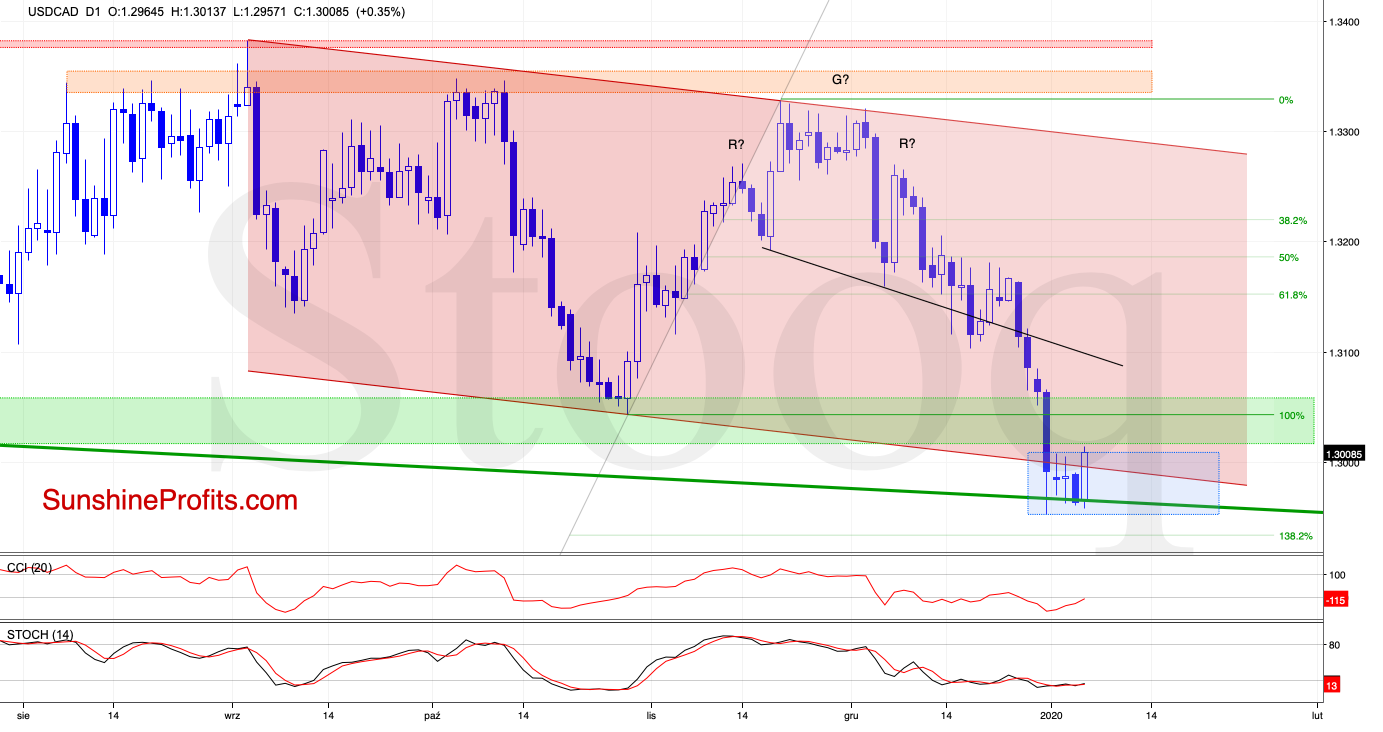

When we take a closer look at the chart below, we can see that although the exchange rate moved a bit below this support line, the bulls responded by pushing the pair higher, resulting in the invalidation of the earlier tiny breakdown.

Earlier yesterday, we noticed another move to the upside, which not only invalidated Monday’s drop below the green line, but also the earlier breakdown below the lower border of the declining red trend channel. Both of these invalidations are bullish signs.

Additionally, the current position of the daily indicators suggests that further improvement is just around the corner. Should this be the case and USD/CAD extends gains from here, the initial upside target will be the previously broken black line – that is the neck line of the head and shoulders formation.

Taking all the above into account, opening long positions is justified from the risk/reward perspective.