Investing.com’s stocks of the week

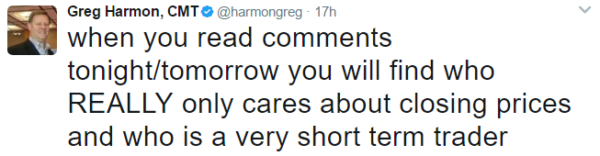

Wednesday saw a colossal collapse in the stock market after a great start. Or it was a non-event. Which one? Active traders have varied time frames and it's often hard to discern where they are focused. It's days like Wednesday that give insight into their true time frame. As the market was reversing intraday I tweeted the following:

With so much information coming at you, it is moments like yesterday that allow you to gather true insights. If you were freaking out between 1pm and 3pm, then you had better be an intraday trader. If you gained some concern after the market closed because of a potential failed breakout then you are acting like a swing trader. And if you never even noticed then you are more aligned with a position or long term trading strategy.

There are successful investors and traders in each of these time frames. I am not trying to make the point that one is better than the others. My point is that you need to make sure that your view of the market aligns with your trading and investing style. And that your filter on that information fire hose is doing the same, giving you information aligned with your time frame. What did you learn about your sources of information yesterday?