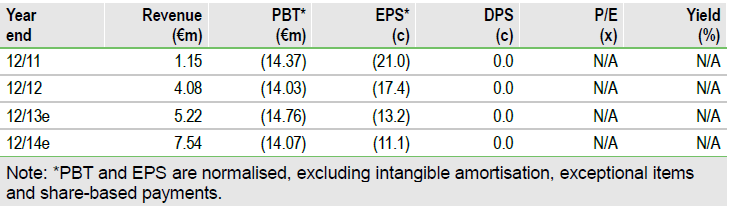

TiGenix is making solid progress in growing ChondroCelect sales for knee cartilage repair, with 2014 sales potentially in the €7.5-9m range. The July €6.5m funding provided cash into Q114, but management indicates a further €12m might be needed up to Q314. A deal on the Phase III Cx601 (cell therapy for fistulising Crohn’s disease) is anticipated with an upfront fee; non-dilutive funding is being actively explored. Phase IIa Cx611 data in April showed good responses in highly-refractory rheumatoid arthritis patients. The next Cx611 stage is in discussion but this is a massive opportunity.

Cash control

TiGenix has pruned core costs to invest in marketing to get extra Spanish and some UK sales. R&D (€6.7m) fell 9.6% as the Cx611 Phase IIa trial ended, but may rise in 2014 if further studies are initiated. Administration fell 20% to €2.5m. Cash operating expenses for FY13 (R&D, admin, sales) are expected to be €16m. Net cash outflow after financing is expected to be about €10m. Following the gross €6.5m funding in July 2013 at €0.25/share, TiGenix had €8.9m in cash. This is sufficient to last into H114 before any deals and non-dilutive funding.

Developing prospects

TiGenix has a solid position to develop. Sales may reach €5.2m in 2013 given the 55% H1 growth. The Spanish reimbursement for ChondroCelect in May is taking time to result in sales, but should generate increasing revenues over 2014; UK sales may strengthen in 2014. Total 2014 sales might be in the €7.5-9m range and this could move ChrondroCelect into cash neutrality by H214. Cx601 for fistulising Crohn’s disease is in partnering talks and a US deal is possible. This would enable a further trial for FDA approval. Cx611 produced excellent exploratory Phase IIa data in April. Further trials may confirm this and enable partnering, possibly for refractory Rheumatoid arthritis.

Valuation: €1.14/share before deals

Edison’s indicative value has been revised to €144m based on ChondroCelect breaking even in 2014 and the revised cost base. This equates to €1.14/share based on 126m shares post the July funding, using a multiple of 20-fold on 2020 risk-adjusted sales. However, there is a funding gap of perhaps €12m to Q314, depending on ChondroCelect sales. TiGenix could do deals and obtain non-dilutive finance, for example, on the facility or using soft loans. If Cx601 is successful in its Phase III, EU sales should develop from 2016.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

TiGenix Extends Knee Sales, Aims For Crohn’s Deal

Published 09/12/2013, 10:20 AM

Updated 07/09/2023, 06:31 AM

TiGenix Extends Knee Sales, Aims For Crohn’s Deal

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.