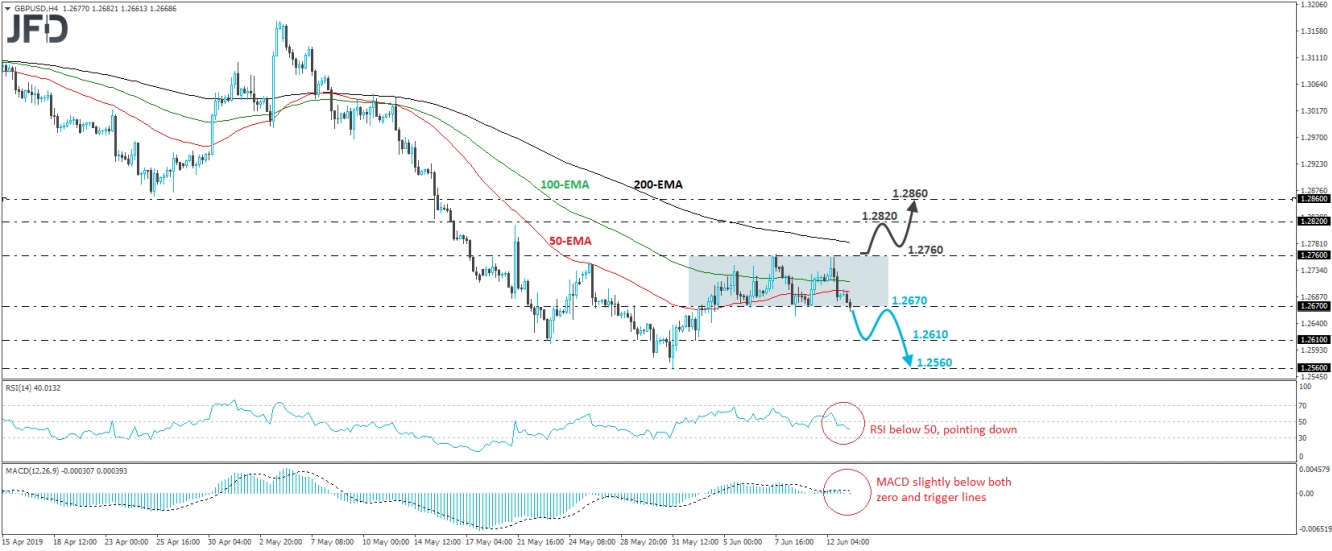

GBP/USD traded lower on Wednesday after it hit resistance near the 1.2760 barrier, which is fractionally below the high of June 7th. The slide continued today as well and at the time of writing the rate it’s trying to move pass the 1.2670 mark. The pair had been oscillating between those two barriers since June 4th, something that painted a flat short-term picture up until now, but a 4-hour close below 1.2670 might be a sign that the bears are taking more control.

If the bears manage to distance themselves from the 1.2670 hurdle, we may see them driving the battle towards the low of June 3rd, at around 1.2610. They could take a small break after hitting that zone, but any corrective bounce could stay short-lived below 1.2610, from where another negative leg may be initiated, perhaps aiming for another test near 1.2610. If at that time, the 1.2610 zone fails to halt the slide, then we could experience extensions towards the 1.2560 support, defined by the low of May 31st.

Taking a look at our short-term oscillators, we see that the RSI lies below 50, pointing down, while the MACD, already slightly below its trigger line, has just touched its toe below zero. These indicators detect negative momentum and support the case for the bears to take some more control, at least in the short run.

Alternatively, we would like to see a decisive recovery above 1.2760, the small range’s upper bound, before we start examining the bullish case. Such a move would confirm a forthcoming higher high on the 4-hour chart and may initially pave the way towards the 1.2820 area, slightly above the peak of May 21st and fractionally below the low of May 15th. Another break, above 1.2820, could extend the recovery towards the 1.2860 zone, marked near the inside swing low of April 25th.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.